Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Markets Expect The Fed To Do Something It Has Never Done Before

By Ye Xie, Bloomberg Markets Live commentator and analyst

Current market pricing is inconsistent with the notion that Jerome Powell will do whatever it takes to bring down inflation.

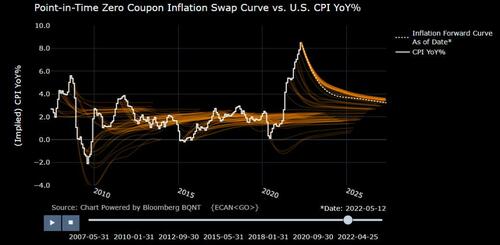

Bloomberg’s ECAN function allows you to see visually how investors expect the CPI to evolve in coming years, based on inflation swaps. The current pricing suggests that investors expect CPI to fall from the current above 8% to 5.86% by December, and to end 2023 at 4.09%. That is still way higher than the Fed’s projections.

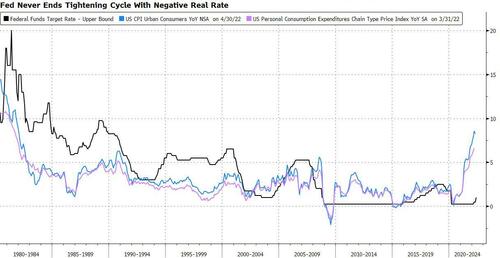

Meanwhile, traders expect the Fed funds rate to peak at a little under 3% next year and start declining in 2024. In other words, markets expect the Fed to end the cycle with a negative 1% real rate. In modern history, this has never happened before. The Fed has only stopped tightening when real rates moved to positive territory, as Bipan Rai at CIBC points out.

There are two explanations. One, this is mis-pricing. The expectation of the terminal rate is too low, or inflation expectations are too high. Alternatively, investors may believe that the 2% inflation target is a thing of the past. Inflation has permanently shifted higher, under the average targeting regime, as we enter the next down cycle, and the Fed will lift its inflation “target” from 2% to 3% or more…

Tyler Durden

Thu, 05/12/2022 – 15:40

Continue reading at ZeroHedge.com, Click Here.