Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Polymarket’s Trump-Bullish Whale Speaks Out: “Absolutely No Political Agenda”

While still guarding his anonymity, the mysterious man who’s bet more than $30 million on a Trump election victory via the Polymarket prediction marketplace has come forward to assert that his wagers aren’t intended to sway the election, but simply to profit from an outcome he’s highly confident in.

“My intent is just making money,” said the man who describes himself as a Frenchman and former US resident who was a trader for American banks. In an exclusive interview with the Wall Street Journal via Zoom, he used the pseudonym “Théo,” saying he wanted to remain anonymous out of a desire to conceal the extent of his assets from his children and friends. The Journal said he was “sport[ing] a short, neatly trimmed beard” and spoke English with a small accent.

Here’s how the Journal described the precipitation of the interview, and the paper’s process to ensure it wasn’t talking to an imposter:

Théo emailed the Journal after the publication of an Oct. 18 article about his wagers. To prove that he was behind the Polymarket wagers, the Journal asked him to place a bet on whether Taylor Swift would announce that she is pregnant in 2024—one of the many small, nonpolitical wagers available on the platform. Minutes later, Polymarket’s website showed that one of the four accounts, Theo4, had placed a small bet on Swift’s pregnancy.

In that original Oct. 18 article, the Journal gave some credit to the idea that the concentrated bets may represent some form of intentional narrative-control scheme meant to benefit Trump. Théo emailed the Journal to refute that theory, writing, “I have absolutely no political agenda.”

In his subsequent interview, Théo told the Journal he’s a veteran trader with a history of risking tens of millions of dollars when he discovers a high-confidence trade — and said that’s what he sees in the chance to wager on a Trump victory.

When news broke of the whale’s huge wagers on Trump, Polymarket engaged outside experts to scrutinize transactions in presidential election betting, an unnamed source told the Journal at the time. Last week, Polymarket said it had contacted the whale and confirmed it was a French citizen with an extensive financial services and trading background. “Based on the investigation, we understand that this individual is taking a directional position based on personal views of the election,” the firm said.

Théo said his conviction on a Trump victory rests on pollsters’ failure to capture the full extent of Trump’s support in both the 2016 and 2020 elections, and his belief that the “shy Trump voter effect” still endures in 2024. “I know a lot of Americans who would vote for Trump without telling you that,” he said, while also scoffing at the possibility that pollsters have improved their methodologies this time around.

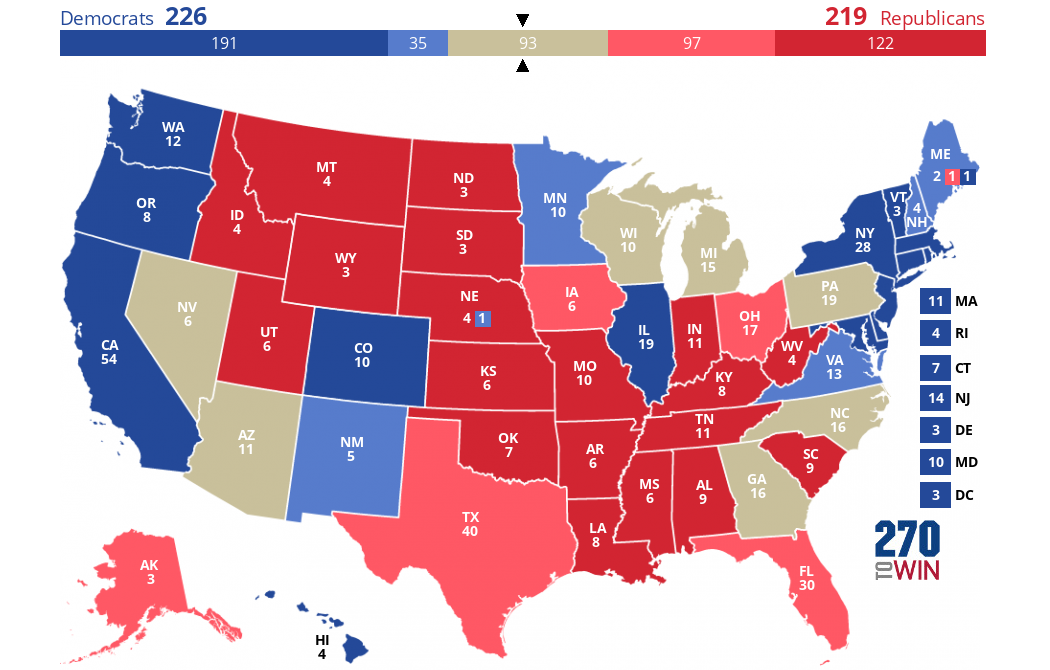

Having been previously accused of trying to shape the election, Théo dished out an accusation of his own, saying leftist major media outlets are setting America up for post-election social unrest by perpetuating a fiction that the race is a close one. Théo thinks Trump is poised to rout Harris, which is why he has more than $30 million on Trump reaching 270 electoral votes, with the potential to receive $80 million if he’s right. He says his $30 million on Trump represents most of his liquid assets.

Théo also has bets on a Trump popular-vote victory, along with bets on various swing-state wins. He also gave some insights into how he’s been trading:

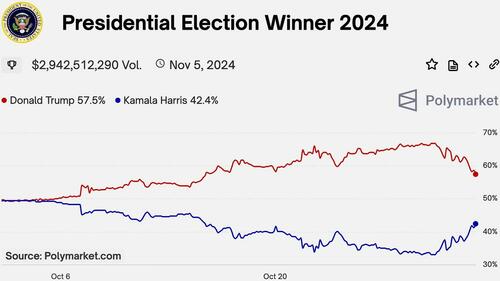

He started quietly in August by betting several million dollars on Trump, using an account with the username Fredi9999. At the time, Trump and Harris had roughly even chances on Polymarket.

Théo spread out his wagers over multiple days and weeks to avoid causing a price spike. Still, as his bets grew, Théo noticed other traders were backing away from quoting prices when Fredi9999 was buying. That made it harder for Théo to get attractive prices. He created the other three accounts in September and October to obscure his purchasing, Théo said.

Single-handedly accounting for 25% of the contracts on a Trump electoral college win and 40% of the bids on a popular vote victory, Théo would have a hard time pulling money off the table without pushing the value of his contracts down. Speaking of which, the electoral college version of a Trump win peaked on Wednesday at 76 cents (with a dollar payoff if Trump wins). However they’ve taken a big dive since — plunging to 57.5 cents as this is written in the wee hours of Saturday morning. You can check the current price here.

If you’re itching to buy the dip, note that Americans are officially barred from Polymarket. You can thank your all-powerful, all-knowing, Constitution-violating federal government for protecting you from yourself: The Commodity Futures Trading Commission fined the platform in 2022 for allegedly providing illegal trading services, prompting Polymarket to bar Americans going forward.

Tyler Durden

Sat, 11/02/2024 – 15:45

Continue reading at ZeroHedge.com, Click Here.