Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Netflix Stock Jumps After Beating Across The Board, Adding 5 Million New Subs

Lots of eyes into NFLX earnings tonight, not only because it is the first “tech” company reporting, but because its stock has underperformed as of late post a big run YTD.

According to Goldman, investors are looking for ~6mn subs in quarter, upside to FY FCF guide of ~6bn and then a revenue guide for 4Q that is inline-ish with the street (as a reminder, they don’t guide subs anymore). Goldman has NFLX at 8.5 on 1-10 positioning scale, which needless to say is quite long and the risk of disappointment is substantial. Overall, expectations are for a solid beat in quarter…

… And that’s precisely what Netflix delivered: here is what the company reported moments ago.

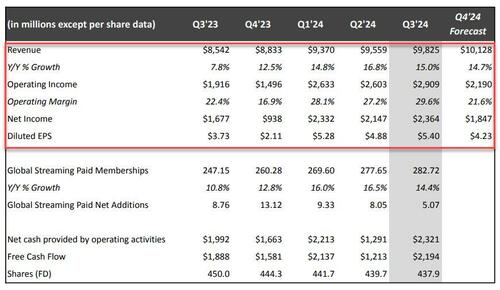

- Revenue $9.82 billion, up 15% y/y, and beating estimates of $9.78 billion

- EPS $5.40 vs. $3.73 y/y, beating estimates of $5.12, and included a $91M loss from F/X , related to the company’s Euro denominated debt remeasurement.

- Operating margin 29.6% vs. 22.4% y/y, beating estimates of 27.8%; the operating margin of 30% improved seven percentage points vs. the year ago quarter. This was above the previous guidance forecast “due to slightly higher revenue and the timing of spending.”

- Operating income $2.91 billion, +52% y/y, beating estimates $2.72 billion

- Free cash flow $2.19 billion, +16% y/y, beating estimates $1.73 billion

In short, Netflix eclipsed Wall Street’s expectations on every major financial metric despite a new programming slate constrained by last year’s strikes in Hollywood.

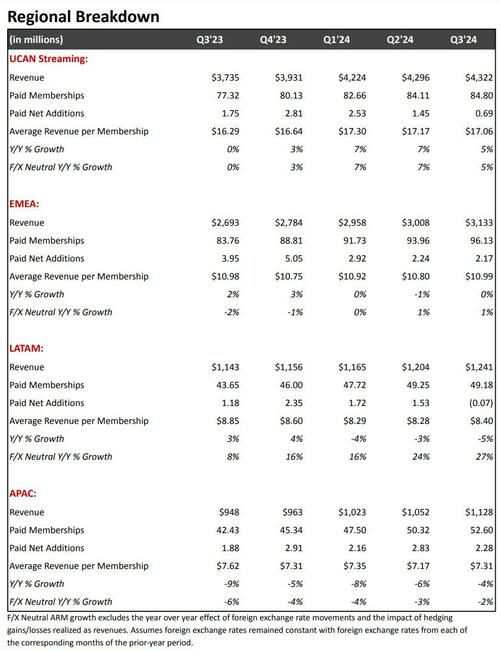

While the company clearly outperformed at the top and bottom line, there were some glitches at the subscriber level. Yes, NFLX added a greater than expected 5.07 million subs, and above the 4.5 million estimate, but this was thanks to EMEA and Asia-Pac; subs in US/Canada missed modestly while Latam subs actually declined, against expectations of a nearly 1 million increase.

- Streaming paid net change +5.07 million, down 42% y/y, but beating estimates of +4.52 million

- UCAN streaming paid net change +690,000, -61% y/y, missing estimates +696,658

- EMEA streaming paid net change +2.17 million, -45% y/y, beating estimates +1.44 million

- LATAM streaming paid net change -70,000 vs. +1.18 million y/y, missing estimate +975,270

- APAC streaming paid net change +2.28 million, +21% y/y, beating estimate +1.56 million

- Streaming paid memberships 282.72 million, +14% y/y, beating estimate 281.92 million

Here are some more details:

- UCAN, where subscriber growth missed, saw a 16% year over year increase in revenue, driven by 10% and 5% growth in average paid memberships and ARM, respectively.

- Revenue in EMEA grew 16% year over year, consistent with the increase in average paid memberships.

- Looking at APAX, Netflix said that it had a strong local content slate in Japan, Korea, Thailand and India in Q3. As a result, revenue growth rate in APAC (+19% year over year) led all regions.

- LATAM revenue rose 9% year over year, with a surprise decline of 0.1M in net subscribers which was due to recent price changes and a softer content slate. However, the company noted that “membership growth has rebounded nicely early in Q4’24.”

Q3’24 operating income increased 52% year over year to $2.9B, while operating margin of 30% improved seven percentage points vs. the year ago quarter. This was above our guidance forecast due to slightly higher revenue and the timing of spending.

Looking ahead to Q4, the company expects to generate $10.13 billion in revenue (above the median consensus of $10.05 billion), which would translate into $2.190 billion operating income, or a 21.6% profit margin, vs the 21.2% expected, and expects $4.23 in EPS, which is also above the 3.90 exp. While NFLX no longer provides subscriber guidance, it sees 4Q paid net additions higher than 3Q due to normal seasonality and a strong content slate. It notes that 2024 programming has been “patchier than normal due to last year’s strikes.”

The Company’s Q4 guidance implies that revenue will grow 15% year over year for the full year 2024, at the high end of the prior 14%-15% revenue growth expectation. Given the slightly higher revenue forecast, NFLX is now forecasting 2024 operating margin of 27% based on F/X rates as of 1/1/24 and on a reported basis, up from 26% previously. This would represent a six percentage point increase compared with the full year 2023.

Looking even further out, for 2025, NFLX forecasts revenue of $43B-$44B, which would represent growth of 11%-13% off of the company’s 2024 revenue guidance of $38.9B, and is in line with consensus estimates of $43.4 billion: NFLX expects “revenue growth to be driven by a healthy increase in paid memberships and ARM. We’re targeting a 2025 operating margin of 28% (also based on F/X rates as of 9/30) vs. our forecast for 27% in 2024; after delivering outsized margin improvement in 2024, we want to balance near term margin growth with investing appropriately in our business. We still see plenty of room to increase our margins over the long term.” Consensus saw a 27.9% operating margin.

While it is no longer a closely watched metric, NFLX net cash generated by operating activities in Q3 was $2.3B vs. $2.0B in the prior year period. Free cash flow (FCF) totaled $2.2B compared with $1.9B in last year’s Q3. For the full year, NFLX expects FCF of $6.0B-$6.5B, up from approximately $6B due to the higher operating income forecast.

Finally, during Q3, NFLX repurchased 2.6M shares for $1.7B, and has $3.1B remaining under its existing authorization. The company also raised $1.8B in its first investment grade bond deal during Q3. As a result, total debt increased to $16B from $14B in Q2, but net debt decreased from $7.4B in Q2 to $6.8B at the end of Q3. Proceeds from the bond offering will be used to pay down $1.8B in bonds that mature over the next 12 months.

While Netflix acknowledges its recently launched advertising business is progressing slowly, management said in the letter to shareholders that it has grand ambitions for the next couple of years. The company is building its own advertising technology and has struck several deals to sell its advertising-supported service alongside other streaming services.

“We have much more work to do improving our offering for advertisers, which will be a priority over the next few years,” the company wrote.

Netflix has also started to invested in live programming as one way to increase the amount of inventory it has to sell advertisers. As Bloomberg notes, it will offer a live boxing match next month, followed by two National Football League games on Christmas Day. Starting next year, Netflix will offer customers three hours of live wrestling every week.

Though two Hollywood labor stoppages last year delayed Netflix’s slate of programming for much of this year, the company still scored big hits with The Perfect Couple, a new season of Emily in Paris and a series on the infamous murderers, the Menendez brothers, from producer Ryan Murphy, as well as the movies Rebel Ridge and The Union. The company said it has a particularly strong slate in the fourth quarter, including the return of Squid Game, its most-watched series ever.

Shares of Netflix have more than quadrupled since May 2022, when a slowdown in the company’s growth led to a major sell-off and spooked investors about the entertainment business. Since then, the company has added more than 60 million customers thanks to a crackdown on password sharing and the introduction of a lower-priced subscription with advertising.

That said, most analysts believe the boost from the password crackdown is temporary, and that Netflix will soon need to find another way to grow. The company has yet to see material financial returns from its investment in advertising or video games, and some on Wall Street now worry the stock is overvalued.

The market reaction was initially disappointed pushing the stock briefly lower, before eventually rebounding strongly and rising as much as 4% after hours, not too far from its all time high hit one week ago at $736.

Tyler Durden

Thu, 10/17/2024 – 16:30

Continue reading at ZeroHedge.com, Click Here.