Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Goldman Issues Grim Outlook For AutoZone Citing “Significant Exposure” To Struggling Working-Poor Consumers

Continuing the theme of low-income consumers being financially under pressure, Goldman analysts told clients this AM that their decision to downgrade auto parts retailer AutoZone from “Buy” to “Sell” was primarily based on the challenging macroeconomic environment for consumers.

Goldman’s Kate McShane led a team of analysts who said AZO will likely see muted growth over the next few quarters. She noted that the auto parts retailer’s customer base is highly exposed to working-poor consumers, which elevated inflation and high interest rates could crimp spending from this group and impact sales through winter into early ’25.

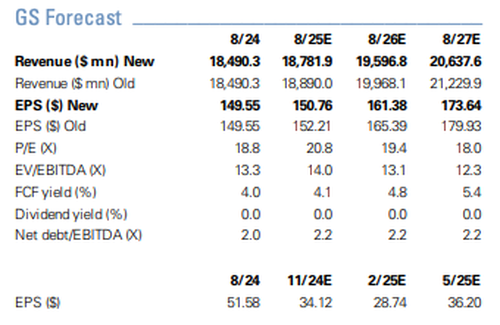

“We are lowering our FY25 estimate to $150.76 (from $152.21), largely reflecting our outlook for muted growth in the next few quarters. We are also lowering our FY26 EPS estimate to $161.38 (from $165.39) and lowering our FY27 EPS estimate to $173.64 (from $179.93) due to a lower base from our lower estimates in FY25.”

McShane explained her rationale to clients about why she downgraded AZO to “Sell” from “Buy”:

-

The lower income consumer, to which AZO has significant exposure, will likely remain under pressure into 2025.

-

As cars become more affordable, we see increased risk of a lower amount of repairs.

-

Per HundredX, AZO’s NPS and NPI scores have been on the decline, with AZO’s NPI score approaching a 3-year low.

-

We see increased risk for higher interest expense and/or reduced share repurchases with 2025 notes coming due.

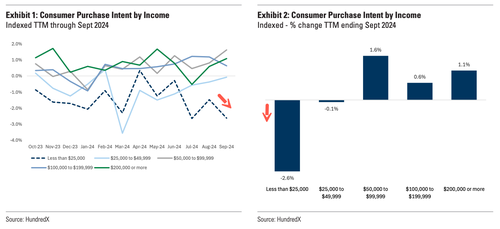

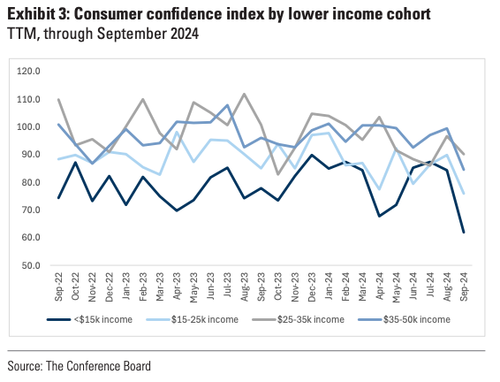

She provided a whole page in the note about waning sentiment among working-poor consumers. She continued to point out AZO’s large exposure to this income bracket.

“While GS’s Discretionary Cash Flow model points to growth for the lower income consumer in FY25, we note recent sentiment for the lowest income consumer continues to be under pressure, which is AZO’s core customer, especially in DIY,” the analyst said.

Her outlook on the company is a ‘muted’ one…

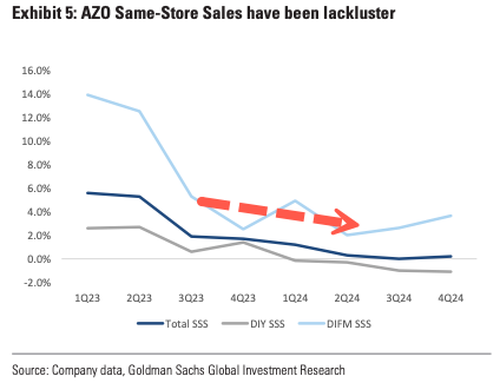

We note that AZO growth has been muted over the last several quarters, even once the company cycled through harder compares. While inflation has been less of a tailwind to same-store sales versus the last few years, unit growth has remained under pressure, with a lower income consumer deferring purchases in DIY and not buying discretionary products which compose around 18% of AZO sales. The company has also highlighted challenges in their commercial business as they manage through growing pains of a larger commercial business and need to further build out their supply chain with hubs and megahubs. We note the company opened 8 hubs and 11 megahubs in FY24, which is around half of what they did in FY23. They will open more in FY25, however the opening cadence of these locations will be 2H loaded.

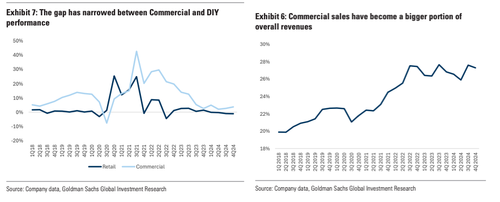

We note prior stronger performance historically came as AZO’s domestic commercial program increased as a % of total auto part sales (+500 bps to 27% of total auto part sales in FY24 from 22% in FY19) which drove expansion in our estimated same-store sales gap between commercial and retail; however, these gaps have since narrowed.

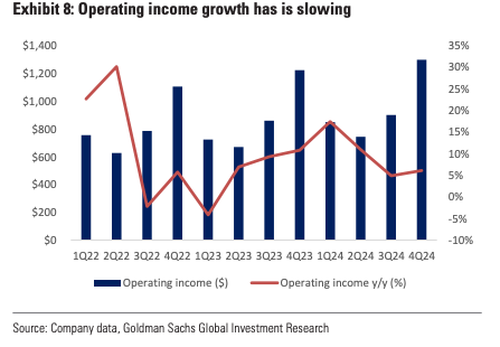

With top line pressured and SG&A dollar spend higher as the company invests in IT spend and payroll, operating income growth has also slowed.

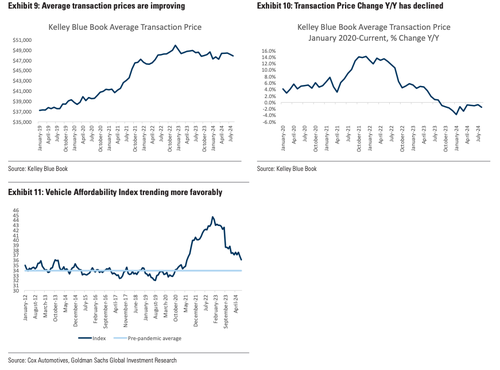

She said improving auto affordability (lower rates and sliding car prices) could “temper repairs” and will only translate into less demand for AutoZone’s products.

We think there is still some level of pent-up demand for new vehicles that will become increasingly unlocked as affordability improves, which would likely remove some degree of aftermarket demand if existing vehicles are scrapped.

Given this, the analyst said AZO’s valuation “remains above historical absolute levels despite slower growth and the increased risk to the bottom line.”

Her new price target for the stock is $2,917, with a -7 % downside.

The biggest takeaway is that low-income consumer stress only worsens into the latter parts of the year and will likely worsen into early 2025. We cited a Goldman note on Friday that showed rich and poor consumers were undergoing ‘trade-down trends.’

Tyler Durden

Mon, 10/14/2024 – 14:55

Continue reading at ZeroHedge.com, Click Here.