Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Dollar Dumped To 4-Mo Lows, Bitcoin & Big-Caps Pumped Ahead Of CPI Tsunami

Cooler than expected headline and core PPI (dovish for monetary policy hopefuls) trumped the margin-compression (bearish for corporate profitability and therefore stocks) aspect of the producer prices data this morning exaggerating a weak-dollar/BTFD stocks trend that emerged overnight.

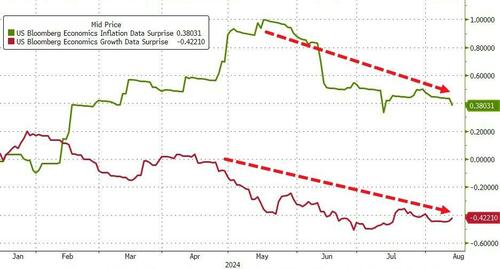

The ‘cool’ PPI knocked the ‘inflation-surprise’-macro-index down to its lowest since February… but at the same time ‘growth-surprise’ data has also stagnated significantly…

Source: Bloomberg

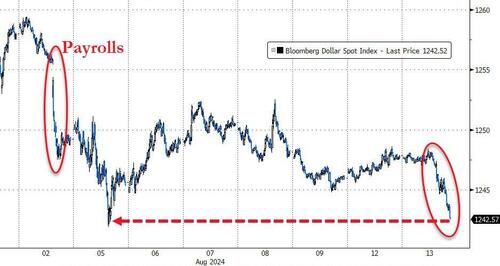

But, it was the dollar index that stood out today, tanking to post-payrolls plunge lows…

Source: Bloomberg

… dumped to its lowest in four months, breaking below its 200DMA…

Source: Bloomberg

Interestingly, as the dollar tanked, it was a buy-all-the-things day with bonds (prices) up, stocks up, and crypto up; but of particular note was weakness in oil (well, Iran hasn’t blown anything to shit today), and gold (flat – at record highs – as WW3 appears to be postponed… for now).

Nasdaq was the biggest winner on the day (surging 2.5%), but all the majors were up strong today…

Seems like we could have seen this one coming…

Goldman Sees Surge In Stock Buyback Orders As Volatility Fades https://t.co/sOXXasrUwr

— zerohedge (@zerohedge) August 12, 2024

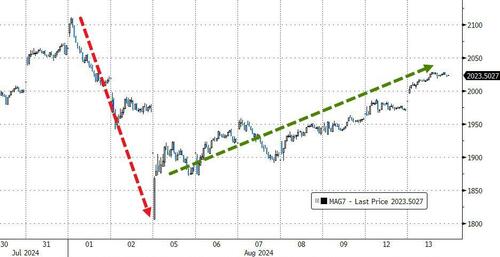

Mag7 stocks continued to roar back to life…

Source: Bloomberg

…and ‘most shorted’ stocks were squeezed hard, having now erased exactly 50% of their plunge from last week…

Source: Bloomberg

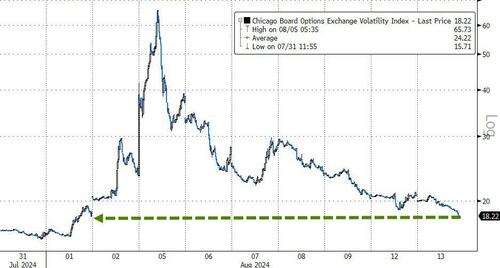

VIX was sold once again, back down to an 18 handle (and the levels before the payrolls panic)…

Source: Bloomberg

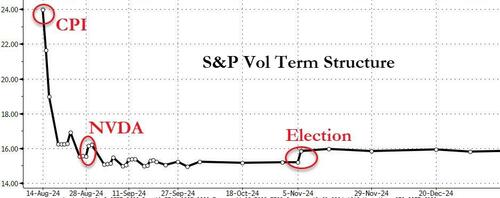

But shorter-dated vol is aggressively bid into tomorrow’s CPI and NVDA’s earnings

Source: Bloomberg

Treasury yields tumbled on the day, extending lower after the cool PPI. The Short-end outperformed (2Y -8bps, 30Y -4bps)…

Source: Bloomberg

The 2y Yield broke back below 4.00%…

Source: Bloomberg

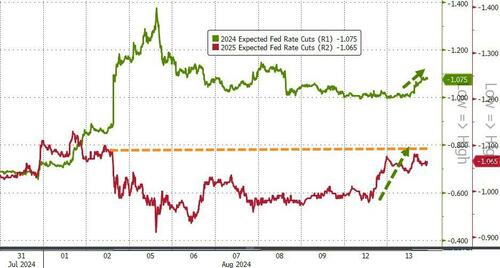

Rate-cut expectations jumped around 10bps on the day, mainly focused on the 2024 shift…

Source: Bloomberg

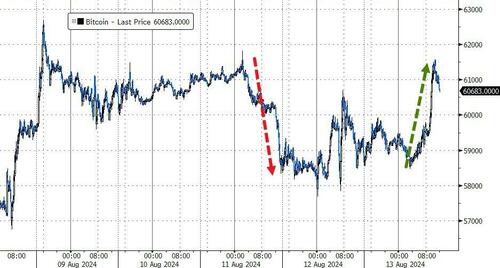

Bitcoin surged back to $61,500, erasing all of the weakness from Sunday…

Source: Bloomberg

Crude oil prices dipped after WTI double-topped at $80…

Source: Bloomberg

Gold was relatively flat today, holding at record highs…

Source: Bloomberg

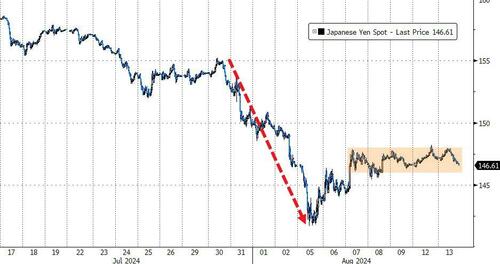

Finally, for context, today’s tumble in the dollar was NOT driven by a resumption of the yen-carry trade…

Source: Bloomberg

…of course tomorrow’s CPI print will decide which way yen breaks out.

Tyler Durden

Tue, 08/13/2024 – 16:00

Continue reading at ZeroHedge.com, Click Here.