Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Nasdaq Pukes To Worst Day Versus Small Caps In 22 Years, Gold Soars Near Record High After Soft CPI

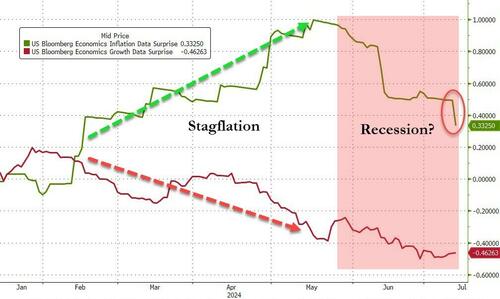

Misses across the board today in CPI left US macro surprise data languishing in ‘not so soft landing’ territory…

Source: Bloomberg

…as inflation and growth factors have are now tumbling in a ‘recession-y’ kinda way…

Source: Bloomberg

…all of which prompted a surge in rate-cut hopes, with 2024 expectations at their highest since April (61bps) as 2025 is now pricing in four full rate-cuts…

Source: Bloomberg

Which sent gold higher, the dollar lower and Treasury yields plunging (led by the short-end)…

Source: Bloomberg

… BUT the picture was very different in equity market land…

Source: Bloomberg

…where Nasdaq was monkeyhammered while Small Caps surged. The Dow clung to unchanged as the S&P ended off around 1% weighed down by Tech obviously…

That RTY/NDX spread was over 600bps at its peak today. By the close it was the biggest relative outperformance of the Russell 2000 over Nasdaq 100 since 2002…

Source: Bloomberg

…and oddly, breadth was crazy positive despite the ugliness as the reverse MAG7 trade struck hard…

388 members of the S&P currently trading up on the day vs 111 in the red (top 5 breadth day of the year).

TSLA tumbled on robotaxi-delays talk…

NVDA stalled at its previous record close and dropped over 5%…

However, as Goldman’s traders noted, as big as today’s moves are, they hardly register on long-term charts…

Source: Bloomberg

But, the NDX/RTY pair does remain at a key support level for now…

Source: Bloomberg

Finally, before we leave stocks, volumes on Goldman’s trading desk were tracking higher +27% vs the 20dma and index trading leading the way w/ ETF’s capturing 31% of the overall tape.

Both LOs and HFs much better for sale.

-

LO supply concentrated in mainly Tech + Hcare, vs buying Discretionary names and macro products.

-

HF’s sellers of every sector expect Indust. and Cons Discretionary (covers) with supply most concentrated across Tech.

There was plenty of activity in other asset classes too…

The dollar was clubbed like a baby seal on the dovishness back to pre-June Payrolls lows…

Source: Bloomberg

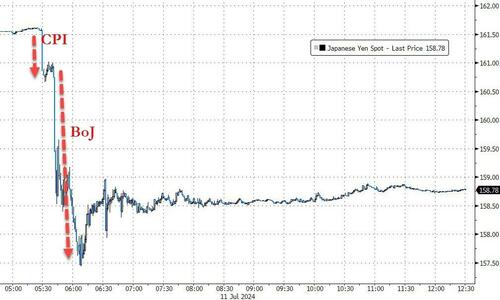

..helped lower by alleged BOJ intervention to strengthen the yen…

Source: Bloomberg

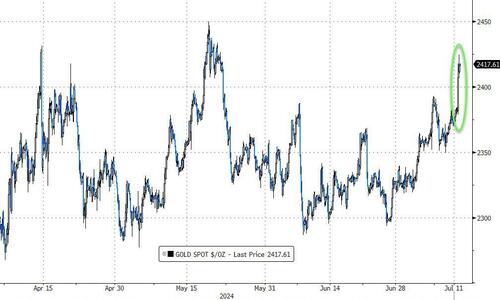

Gold soared back near record highs with spot prices topping $2400 once again…

Source: Bloomberg

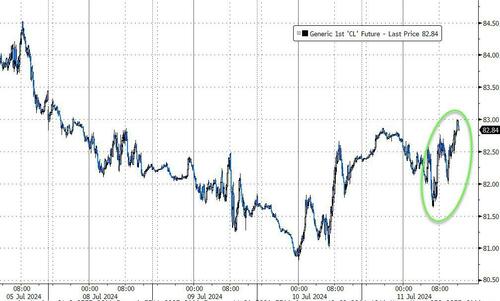

Crude prices managed gains too with WTI back up to $83…

Source: Bloomberg

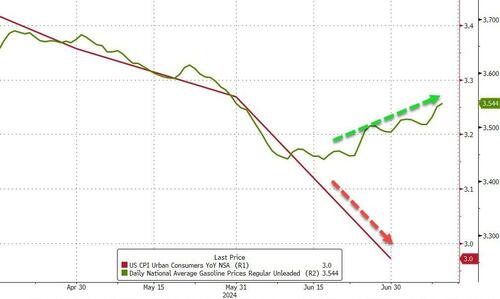

And Powell and Biden better hope that oil prices (and thus gas prices) start coming down soon or today’s CPI may be overwhelmed…

Source: Bloomberg

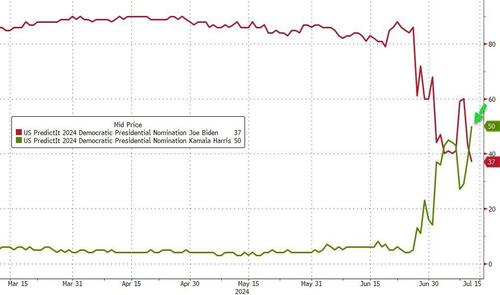

Still if you think you had a turbulent day, give a thought for President Biden who is now behind none other than Kamala Harris in the betting for who will get the Democratic Party nod…

Source: Bloomberg

Time to get back on your knees, Joe!

Tyler Durden

Thu, 07/11/2024 – 16:00

Continue reading at ZeroHedge.com, Click Here.