Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Coal Prices Halved As Beijing Central Planners Step Up Interventions

Having soared to record highs just weeks ago, Chinese coal futures extended their declines on Friday, down more than 50% in a little over a week as Beijing unleashed its latest verbal crackdown as saying prices have further to fall, an attempt to ease the energy crunch, according to Bloomberg.

Thermal coal futures on Zhengzhou Commodity Exchange dropped 7.5% Friday to 973 yuan ($152) a ton, the lowest since early September.

China’s top economic planning body, the National Development and Reform Commission (NDRC), announced on its official WeChat account Friday that production costs for coal miners are much lower than current spot prices for the fuel, suggesting coal prices have more room to fall. NDRC cited initial results from a survey of top firms in all producing regions.

China’s ruthless authoritarians revealed a plan earlier this week to impose limits on the price miners sell thermal coal as they seek to ease a power crunch that’s prompted electricity rationing in more than half of the country’s provinces. China has also urged miners to deliver about 100 million tons of the fuel by the end of the year to help meet winter demand.

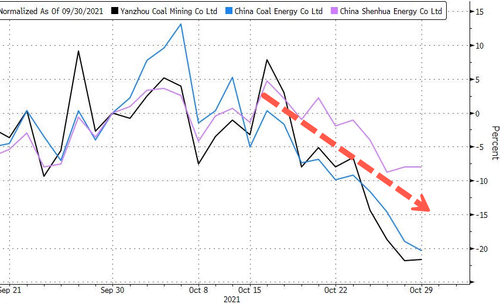

China’s coal mining stocks have plunged on Beijing’s interventions.

The energy crisis that’s engulfed the world’s second-largest economy started in part due to surging coal prices, which caused almost all coal-fired power plants in the country to run at losses. What made it worse was when Beijing told energy firms to “secure supplies at any price” less than a month ago. Zhengzhou’s coal futures rose to a record above 1,980 yuan ($309) a ton earlier this month, while spot prices soared higher.

And since this is China, where the government intervenes in every market, the surges in both futures and physical coal markets triggered immediate intervention by the country’s central government. Action by authorities to curb those gains and help miners boost supply has had an impact, with futures tumbling by more than half since Oct. 19.

There’s only so much intervention Beijing can accomplish if supply is not immediately brought online because the China Meteorological Administration warned earlier this week that a La Nina weather pattern has already ushered in the first round of cold weather, increasing power demand.

Tyler Durden

Fri, 10/29/2021 – 13:55

Continue reading at ZeroHedge.com, Click Here.