Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

The Era of Bitcoin ETFs has Arrived After a Decade of Delays

Bitcoin holders are a testament to the human capacity to achieve the unachievable if you truly believe it. In this edition, we’ll dive into Grayscale’s spot bitcoin ETF application, BTC/USD levels of interest, price targets, funding rates, and whether alt season will ever return again.

Let’s dig in.

Grayscale confirms an Application to File for a Spot Bitcoin ETF

The largest investment fund operator has confirmed that Grayscale will file for the fund to be converted into an ETF as soon as there is regulatory clarity from the SEC. Once the SEC provided verifiable evidence of the regulator’s comfort with the Bitcoin market — in the form of a futures ETF — this would form the basis to file for the process to take place.

Unlike the recent ETF filings tracking futures derivatives, Grayscale would aim at an ETF that is physically backed, also known as a spot ETF. This would be a superior financial product for retail investors for several key reasons.

Check out the full article here!

Technically speaking

As Bitcoin crests new horizons, I’d like to take this opportunity to thank each and every one of you for your readership. Whether you are a long-term holder that has been through this experience with me for the last two years or a new subscriber, I am sure you will continue to find something valuable in the next paragraphs. Thanks again. Your support is truly appreciated.

$67,000 for One Bitcoin

Last week recorded the highest weekly close ever, which has disproven bearish narratives that have been calling for new lows since the bottom around $29,000. Bitcoin has risen 120% since then. Today, Bitcoin just crested $67,000. If this projection is to hold true, then the crypto could finally consolidate around these levels, potentially providing a window of opportunity for altcoins to catch up.

Notably, the ProShares futures-based ETF launch was a success, and did not end up being a ‘sell the news’ event. Still, it’s my view that any meaningful pull back is a buying opportunity.

The levels of interest to bid a pull-back are $55,800 and 56,800, respectively, at the time of writing. The higher the parabola, the higher the floor price where buyers will show up. This area offers sufficient confluence for investors to position for new highs, even though there’s no guarantee prices will retreat in the immediate short term.

Contextualising upside targets

In terms of long-term spot profit-taking, my view is that the market cycle top will be above $100,000 for bitcoin — the rest is just noise. Levered positions are another matter entirely, though, as one must take funding fees, open interest, and other metrics into account.

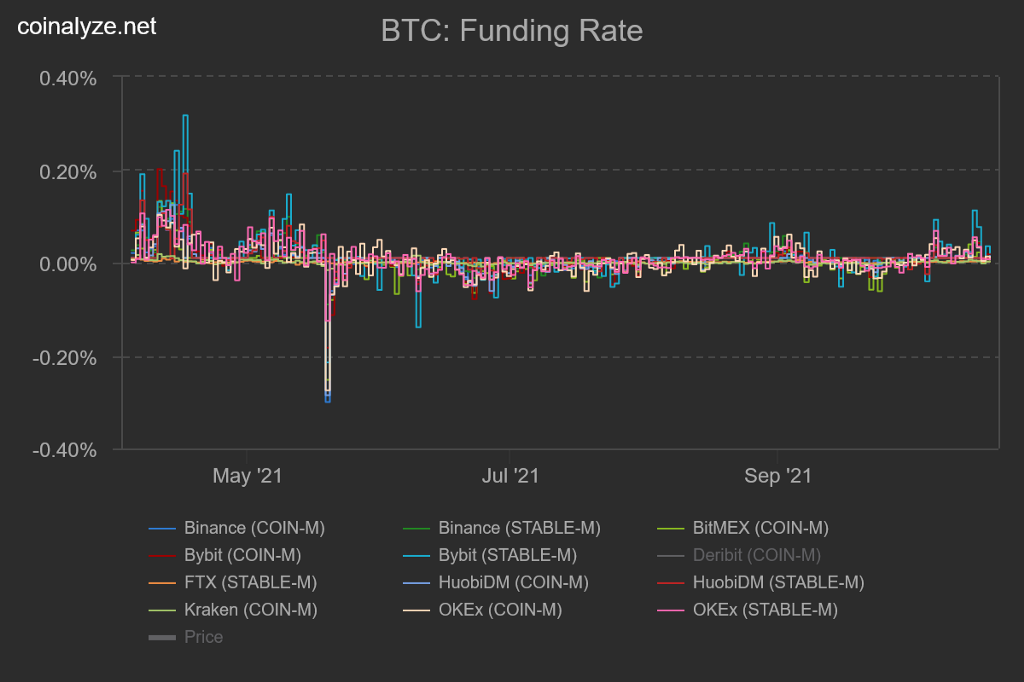

Across key exchanges, funding rates remain tolerable (<0.20%) when compared to the last time BTC/USD exchanged hands at these prices. No glaring red flags for now.

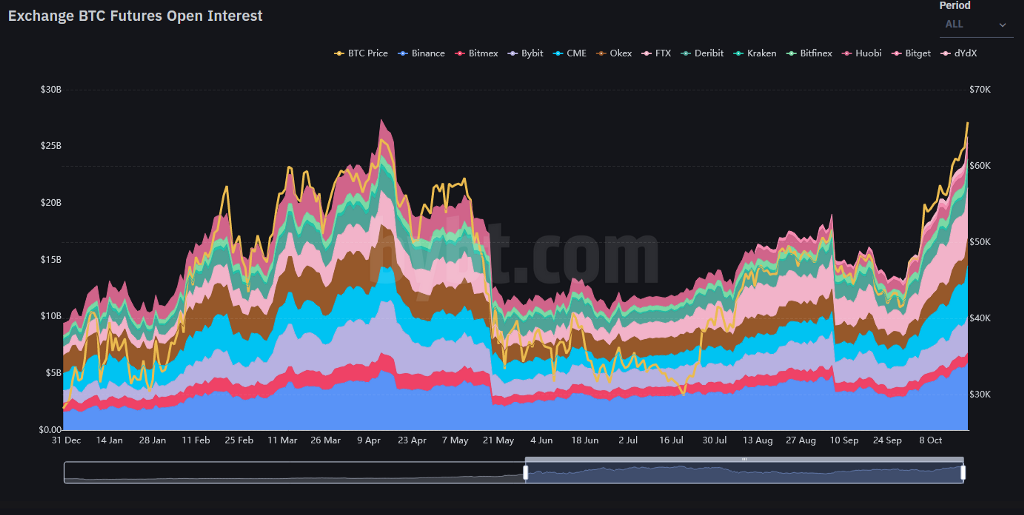

At the same time, open interest is taking off, which is to say that market participants are increasing exposure at a rapid pace — emboldened by the first Bitcoin ETF launch no-doubt. However, unlike when funding rates increase, these participants are executing limit orders rather than market orders on average, suggesting a more tempered approach (for now). This is good and suggests that many, like Peter Schiff, are still in disbelief.

Open interest has soared to $25.86 billion, according to data from Bybt, as opposed to the $27.4 billion in April. In the event that another liquidation cascade eventually befalls the market (highly likely), the coin-margined contracts (collateralised by cryptos instead of stablecoins) will be wiped out first and are a welcomed signal to continue higher. The riskiest trades are the first ones to be taken out.

Will Alt season return?

As we’ve often discussed, altcoin season will most likely be back once BTC/USD forms a trading range. BTC.D at or around 50% is an area to anticipate increased capital rotation (this signal is inversely correlated with ETH/BTC). As discussed on Twitter, the initial signal is typically a bottom formation on the ETH/BTC chart. Support zones denoted here.

The Big Picture

Take these levels and this analysis with a grain of salt, and bear in mind that nobody can tell the future. You are personally responsible for your decisions, and if you cannot accept that, you shouldn’t be in capital markets. Many altcoins will go to zero on a long enough time horizon and what was true yesterday isn’t necessarily true today. Still, we’ll navigate these waters as best we can and take our dopamine levels to all-time highs if the market wishes it so.

Jokes aside, it’s worth keeping in mind that this scenario is possible for two reasons: (1) technology and (2) the reckless policies of the Federal Reserve. Nowadays, everyone has access to the same moral hazards that warped the pricing of all markets in the first place. This is why owning Bitcoin (and Litecoin, in my view) is so paramount. These cryptocurrencies, Bitcoin more so than Litecoin due to mass adoption, are anchors of absolute scarcity that do not change.

That’s value.

Catch you later.

p.s. This is my opinion. You can have your own opinion.

Join the Telegram channel for live updates & setups!

Follow me on Twitter & Gab and my social portals below.

Read More: Grayscale Confirms an Application to File Bitcoin Spot ETF

You can also support me in Bitcoin!

BTC address: 3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Best regards,

Christopher Attard

Founder of Chris on Crypto

Contributor to www.cityam.com

Connect directly on: Telegram

Originally published at https://mailchi.mp.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

The Era of Bitcoin ETFs has Arrived After a Decade of Delays was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.