Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bitcoin & Bullion Bounce As Bonds Signal Fed Faux-Pas Imminent

Policy makers have “generally navigated the economic side of the COVID crisis decently well,” though they seem to have fallen “behind the curve in the last six months, or so,” Rieder said in a Wednesday note.

“It would be greatly disappointing to see the central bank not only not `stick the landing’ but in fact stumble in a way that injures the recovery.”

Well, judging by today’s CPI print, FOMC Minutes, and bond, bullion, and bitcoin market action, they are well on their way to more than a stumble.

A fifth straight month of high consumer price inflation suggests this is anything but transitory and traders are starting to bet that The Fed will have to act sooner rather than later.

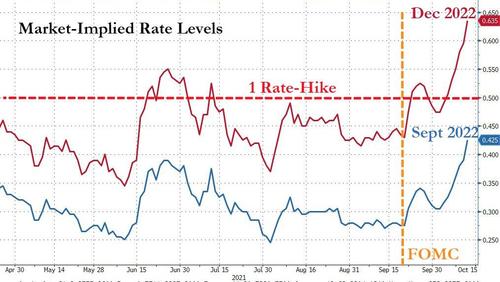

The market is now pricing in a 90% chance of a Sept 2022 rate-hike (and a July 2022 end to the taper), followed by another hike becoming more priced-in for Dec 2022…

Source: Bloomberg

On the week (with Monday being a holiday), 30Y Yields are down around 12bps (helped by a well-bid auction today) while 2Y yields are up around 5bps…

Source: Bloomberg

As the yield curve begins to price in a massive policy error by The Fed (more aggressive rate-hikes not ending well)…

Source: Bloomberg

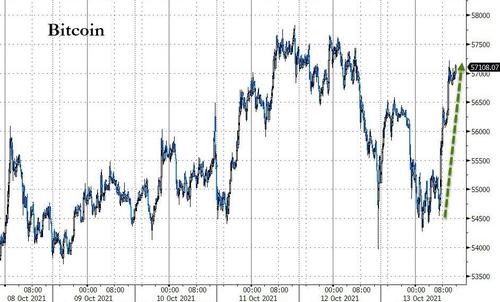

The inflation fears showed up in crypto with bitcoin surging back above $57k…

Source: Bloomberg

And gold spiking up to $1800…

Testing and breaking several key technical levels…

Source: Bloomberg

As fears of a policy error and flip-flop back to more easing sent the dollar down hard for the day – its worst day since August…

Source: Bloomberg

Oil prices were flatish for a change…

Stocks were mixed on the day with Nasdaq the best performer and The Dow the biggest laggard. Things were going so well into the open and then everything puked which reflexively brought in the dip-buyers…

The S&P 500 algos managed to push it back to the 100DMA (again)…

Utes led the S&P sectors today while Financials lagged (after JPM’s results)…

Source: Bloomberg

Meanwhile, TSLA is in melt-up mode again…

But, The SMART Money ain’t buying it…

Source: Bloomberg

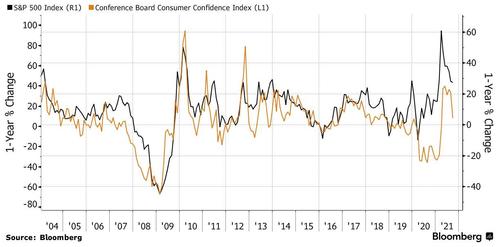

Finally, U.S. households lack the kind of confidence that usually goes along with higher stock prices, according to Morgan Stanley Wealth Management. The firm drew the conclusion in a report Monday after comparing 12-month changes in the Conference Board’s consumer confidence index and the S&P 500 Index.

“If consumer sentiment doesn’t quickly improve, it could be a signal of market weakness” as people choose to spend less and save more, the firm wrote.

Tyler Durden

Wed, 10/13/2021 – 16:00

Continue reading at ZeroHedge.com, Click Here.