Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Argentina’s Crypto Revolution

When you think about Argentina, you would probably think of economic instability, inflation, or even some guy called Lionel Messi. But you would never imagine that Argentina may be following in the footsteps of El Salvador in becoming a growing crypto hub for Miners. But why does Argentina do this, and why is the country slowly growing to be a crypto hub for Miners and Investors?

Why is Argentina a Crypto hub for Miners?

Miners in Argentina are benefitting from the cheap subsidized electricity rates and despite Argentina being a net importer of gas, consumer electricity bills are only about 2% to 3% of an average monthly income which is incentives provided to attract Miners into the country.

“Even after Bitcoin’s price correction, the cost of electricity for anyone mining from their house is still a fraction of the total revenue generated,” said Nicolas Bourbon, who experienced mining digital currencies from Buenos Aires.

Bitfarms is a publicly-traded bitcoin mining company that announced it is expanding its operations in Argentina from 60 megawatts to 210, “sufficient to support approximately 55,000 new-generation miners, which could generate approximately US$650 million in revenue.” This will, in turn, decrease the breakeven cost of mining which is $7500 in Canada and only $4125 in Argentina. With Electricity taking up to 75% of the mining cost, there is no stopping Argentina from becoming a South American Crypto powerhouse.

What is the benefit Cryptocurrency brings to the country?

Argentina’s economy is the prime breeding ground for the crypto world. Cryptocurrency is seen as a way for locals to hedge against cyclical economic crises, including repeated currency devaluations, defaults, hyperinflation, and now, a three-year recession made worse by the pandemic.

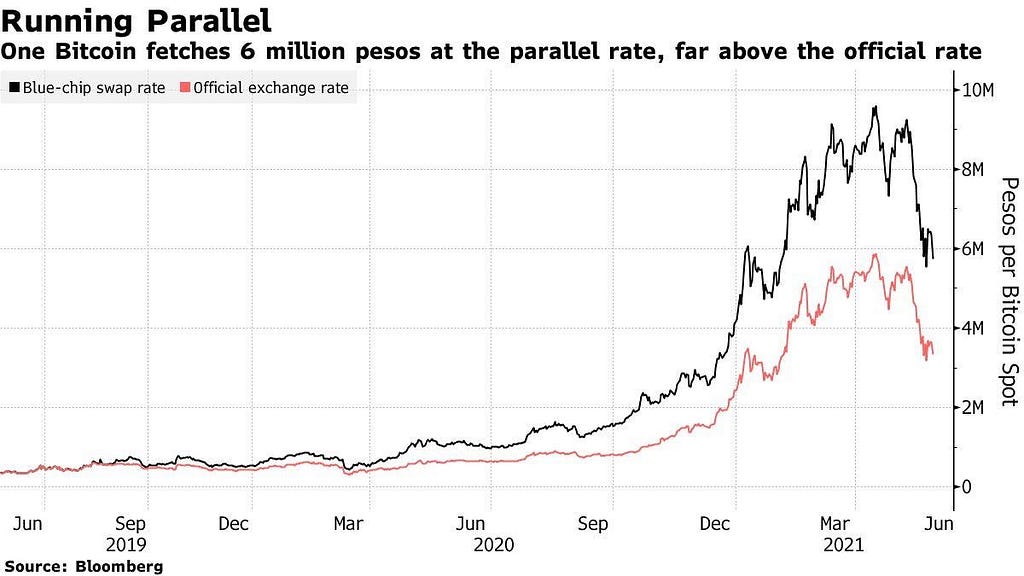

The return of foreign-exchange controls in recent years also have given Argentines, who are banned from buying dollars, even more incentives to mine digital tokens, as surging demand for non-peso assets has sent the value of Bitcoin skyrocketing to almost 5.9 million pesos in unofficial markets as of May 30th, 2021, versus about 3.4 million pesos at the official rate. Cryptocurrency is also being used to convert pesos into dollars, circumventing government restrictions through peer-to-peer transactions, with said transactions rising from under US$200,000 in late 2019 to US$600,000 last year.

Cryptocurrency has been growing under the radar in Argentina, but it is one of the hopes the locals can see as a way to sustain during these trying times. But Bitcoin and other Crypto assets are more interesting from a financial standpoint for investors who can bring in investments to help save Argentina’s economy, they’ve also created a massive hype that has brought along with it creativity and innovation. With the recently proposed bill that allows workers to be paid in Cryptocurrency, Argentina has, once again, a very real opportunity to be at the forefront of the Crypto World.

We in Nagaya Technologies surely believe that Cryptocurrency could create opportunities that can be globally felt through all people. This has led us to create the first Hybrid Crypto Asset in the world called Nagaya coin.

To know more about Nagaya Technologies and our Nagaya coin, you can find out more at www.nagaya.io

Or you can talk to us at t.me/nagayaofficial

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Argentina’s Crypto Revolution was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.