Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Wall Street’s Biggest Bear Capitulates, Reluctantly Hikes His S&P Price Target

First it was Goldman capitulating on its near-term tactical bearish outlook (as discussed yesterday), now it’s Morgan Stanley’s turn.

One month after Morgan Stanley’s chief equity strategist Michael Wilson emerged as Wall Street’s biggest bear, warning that “rolling corrections” across various asset classes could push the market down as much as 20%, Wilson this morning reluctantly joined the bullish bandwagon writing that “on the back of another exceptionally strong earnings season, we mark our forecasts to market and raise our earnings forecasts despite our leading indicators suggesting upward momentum to earnings revisions stalls. Our price targets generally stay the same (YE21 to 4,000 from 3,900 and June 2022 remains at 4,225) as we lower target multiples due to rising interest rates and stable equity risk premiums.”

But while Wilson may have capitulated on his steadfast bearishness which kept his price target at 3,900 even as most of his peers hiked well into the 4000s to keep up with actual prices, he remains adamant on his mid-cycle thesis, noting that “this ongoing de-rating is central to our mid-cycle transition thesis.” As a result, he is also raising his bull case and lowering his bear to “reflect greater uncertainty over the durability of the current pace of earnings growth, record leverage among equity owners, and expected tapering by the Fed.”

Wilson then shifts gears and lays out the details behind his reversal, noting that after the record 2Q earnings season, “we mark our earnings forecasts, multiple assumptions, and price targets to market with upward revisions similar to those seen among bottom up consensus (Exhibit 1).”

Translation: we are getting lots of pushback from clients who are getting angry at our bearishness. To appease these clients, Wilson then goalseeks his new targets, writing that strong top line beats has led to optimistic flow through to profitability with consensus 2021 net margins up 50 bps followed by an additional 10 bps in 2022.

As a result, the Morgan Stanley strategist adjusts his earnings forecast as follows:

- 2021: We move our numbers to $205 from $189 (current consensus is $201). The bulk of the change is driven by a mark to market on exceptional 1H21 results. Our forecast assumes that beats in 2H21 normalize to the low end of their historical range (4%) driven largely by top line with stabilizing margins.

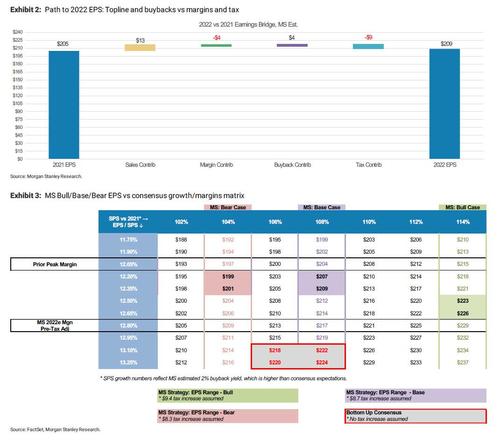

- 2022: We move our numbers to $209 from $200 (current consensus is $219). An important caveat is that our forecast includes a 4% (~$9) headwind from higher taxes while consensus does not. Our forecast assumes ~6% revenue growth based on a regression of our house GDP forecast against prior sales growth, though we take the low end of the standard error band given our strong belief that the composition of public markets is more heavily tilted to firms that saw demand pull forward or overconsumption of goods relative to the broader economy. We further assumed modest degradation of incremental margins as costs return while top line decelerates such that our 2022e margin is 12.8% (80 bps above prior cycle peaks) vs consensus 13.2%. Our 2% buyback yield also boosts earnings assumptions. Exhibit 2 shows our bridge between 2021 and 2022 earnings while Exhibit 3 shows a sensitivity matrix with our bull/base/bear cases vs consensus.

- 2023: We follow our usual practice for out-year forecasts of using low double digit growth for y/y EPS (12%). Our prior work has shown that consensus usually holds this view on out-year growth until more precise/focused estimates develop closer in time to the forecasted year. In this instance, our growth assumption is actually optimistic relative to consensus but we stick with this optimistic forecast to reinforce the point that index level upside is hard to come by even with fairly aggressive earnings assumptions.

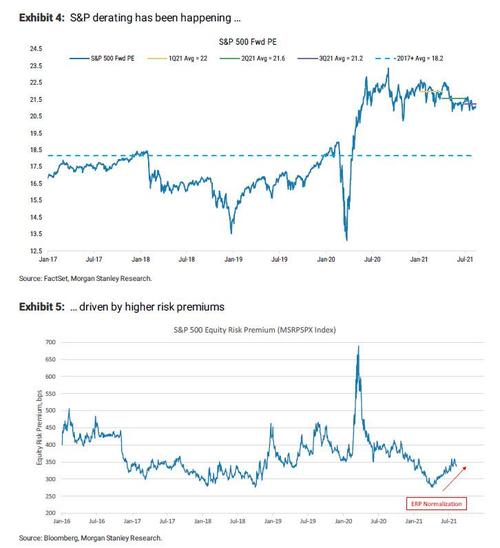

Yet while Wilson reluctantly hiked his price targets on the back of higher earnings expectations, at the same time he trimmed his multiple assumptions to offset higher earnings forecasts, and now expects 19x from 20x forward PE “as we see greater evidence of our mid-cycle derating call playing out.” Some more details on his Fwd PE views, where the first trace of residual bearishness emerges as he warns that “over that time frame an overshoot lower is very much still in play given extended positioning and leverage.“

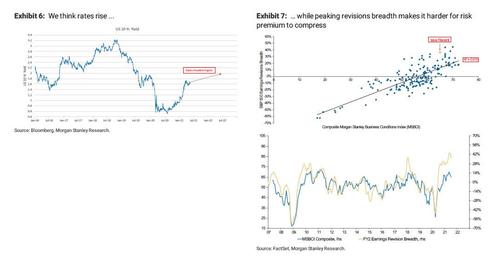

The peak for the S&P’s forward PE this year was around 22.7x in January, it averaged ~22x in 1Q21, 21.6x in 2Q22, and 21.2x QTD. Our framework on valuation relies on forecasting two component parts – 10 year Treasury yields and equity risk premium (Exhibit 4). For rates we follow our house forecasts and assume the US 10Y hits 1.8% by YE and 2% by the end of 2Q22. The derating in equity multiples has come despite rates falling as the equity risk premium has normalized off of euphoric lows seen earlier in the year (Exhibit 5).

With the absolute level of economic growth still strong, we’re comfortable embedding an ERP near current levels (in the lower third of the post-GFC range of 300 – 475 bps) in our forecasts through YE but think it will be hard for risk premiums to compress again until after we pass peaking earnings revisions (where our leading MSBCI indicator indicates a substantial turn lower – Exhibit 7), tapering, and higher taxes. On net, we’re assuming ~19x forward PE both at year end and through 2Q22, but with slightly different mixes of rates and ERP (Exhibit 6). Over that time frame an overshoot lower is very much still in play given extended positioning and leverage.

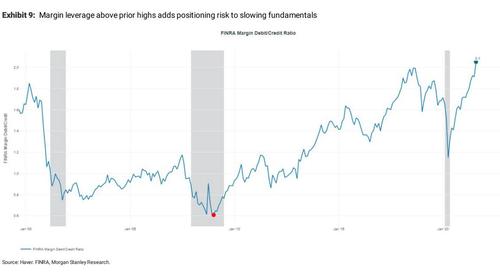

Wilson’s residual bearishness could also be detected in his discussion of positioning risk, where he notes that FINRA broker-dealer margin balances relative to credit balances are now past the prior highs of the TMTbubble and 3Q18 (Exhibit 9). As Wilson cautions, “History is clear that once this leverage ratio starts to turn, derisking flows through to price quickly.”

Putting it all together, while Wilson does “modestly” raise his S&P price target – as numerous taps on the shoulder make his persistent bearishness untenable – he concludes that he is “still cautious on price returns for equities at the Index level.”

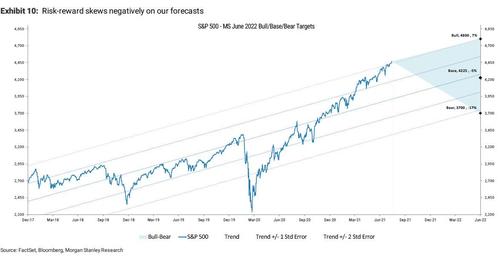

To summarize, the man we recently dubber the “most bearish analyst on Wall Street” notes that “with today’s changes we modestly raise our YE price target to 4,000 from 3,900 and keep our June 2022 target stable at 4,225. Our June 2022 bull case rises to 4,800 from 4,450 driven by strong top line and flow through assumptions and higher rates that are offset by equity risk premium overshooting to the low end of the post-GFC range.”

However, even he concedes that this upgrade was done in protest and he views this “as a particularly optimistic set of assumptions” and his June 2022 bear case actually falls modestly to 3,700 from 3,800 – widening his bull-bear range “to reflect risks of growth shortfalls due to payback on demand and a looming fiscal cliff in 1Q22, higher equity risk premiums, taxes, and broad based leverage that creates a positioning tailwind should price momentum turn.”

The punchline: “on net, the risk reward skew looks poor to us at the index level” which should tell Wilson’s clients all they need to know about his views on what happens next.

Tyler Durden

Mon, 08/16/2021 – 14:05

Continue reading at ZeroHedge.com, Click Here.