Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Mining Affects the Price and Value of Bitcoin. How?

Bitcoin has been leading the market for the last 3 weeks. Rising from $32k, the coin was up by 53.5%, trading above $46,700 at the time of press. This is largely believed to have happened due to investors pushing up the market with their investments.

However, a big contributor to this rise, is also the miners, as after a long period of time they are back on the network, taking charge. Moving forward, this is how miners continue to affect Bitcoin’s price and value.

Has miner capitulation ended

As a matter of fact, yes, miner capitulation is coming to an end. China’s ban on mining which led to miners’ exodus to different parts of the world, had caused a severe upheaval in the market. But now that effect is wearing off as well.

Bitcoin Hash Ribbon, which portrays the possibility of Bitcoin reaching the bottom, when miners capitulate, touched the lowest levels back in June. This was the same time when major dips began and brought BTC down by 47%.

The dark red zones show the worst of this capitulation, which was last seen around the same time last year. This phenomenon occurs when the 30-day moving average (MA) crosses below the 60-day MA. However, at the time of this report, the same 30-DMA has crossed above the 60-DMA, after 80 days. This marks a subsiding sell pressure in the market.

What miner earnings look like

Miners have been making tons of profits in the last few weeks. As BTC’s prices started going up, miners’ holdings became significantly profitable. Since miners had already been accumulating for almost 3 months, they have amassed a significant amount of Bitcoin.

And with the selling pressure coming down, it becomes very clear that miners have no intention of selling either. Thus with time, their holdings will only become more profitable.

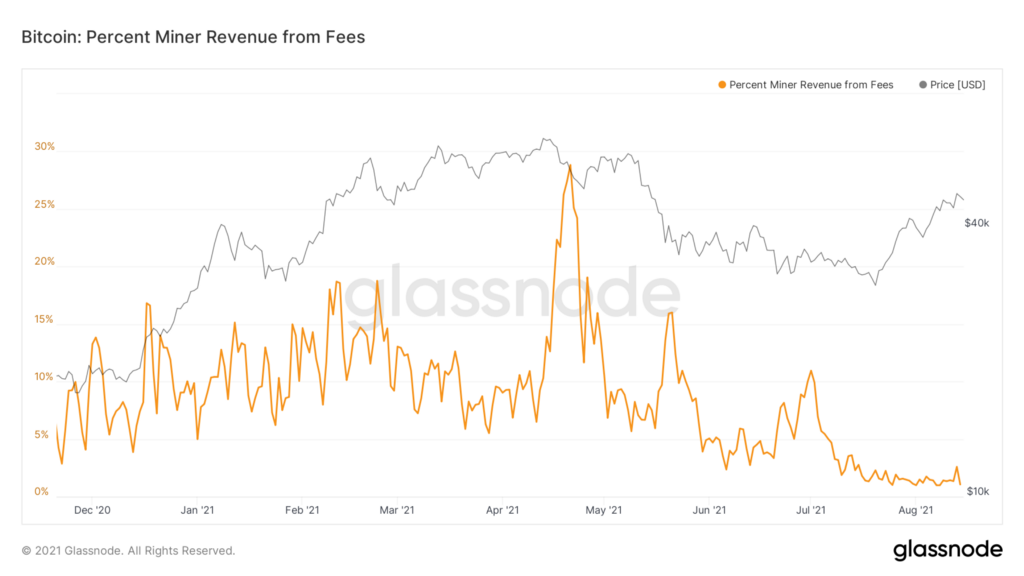

Additionally, miner revenues were at a 3-month high. The last time these levels were observed, was back in May. However, revenues from fees continue to be low. At press time, the metric touched a 13-month low. This signifies that investor participation is yet to catch up with increased miner activity.

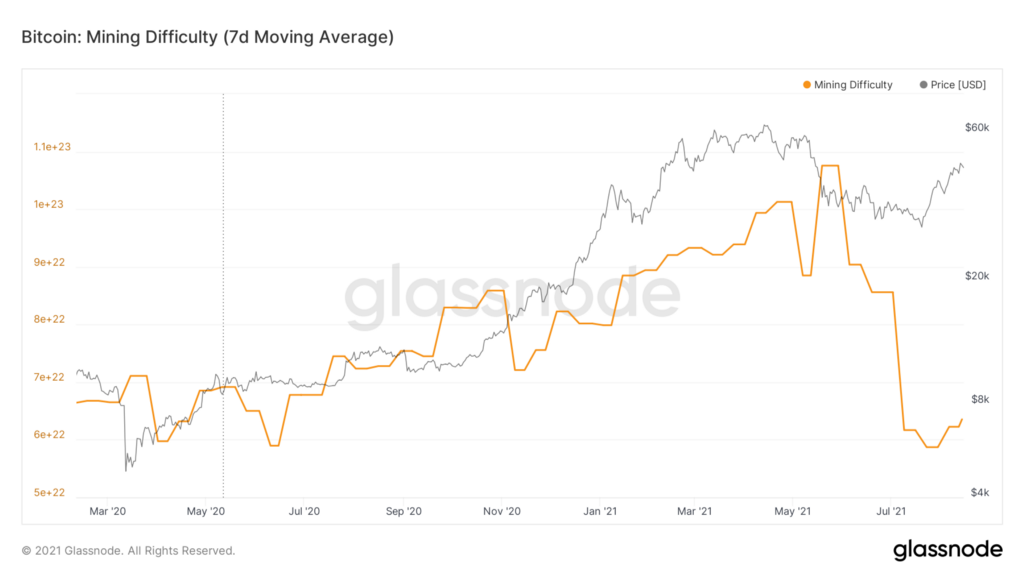

This increased activity is verified by the recovering hash rate, which improved significantly. As it continues to rise, it will also push the recovery of network difficulty, which was at a year low for almost 3 weeks. These are signs that the Chinese miners are now settling and restarting their operations. With this, not only will the network get stronger, but the overall market will benefit as well.

Invest in crypto mining on BBCStaticMiner. Earn daily through shared profits from returns of mining pools.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Mining Affects the Price and Value of Bitcoin. How? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.