Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Consumer Credit Misses Badly As Americans Unexpectedly Pay Down Credit Card Debt In October

Tyler Durden

Mon, 12/07/2020 – 15:18

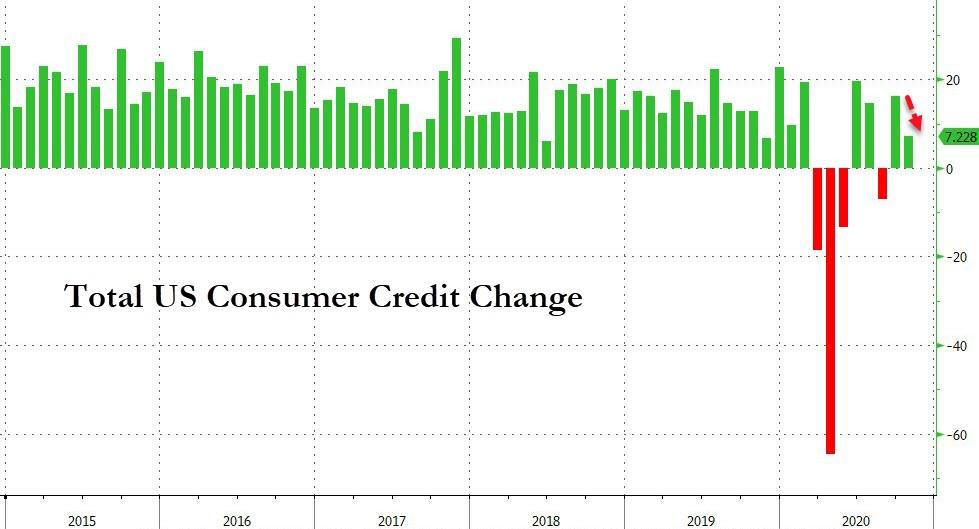

After several months of solid growth (with the exception of a sharp drop in August), in October consumer credit grew far less than expected, rising just $7.2BN, half the Sept $15BN increase…

… and badly missing expectations of a $16.1BN increase.

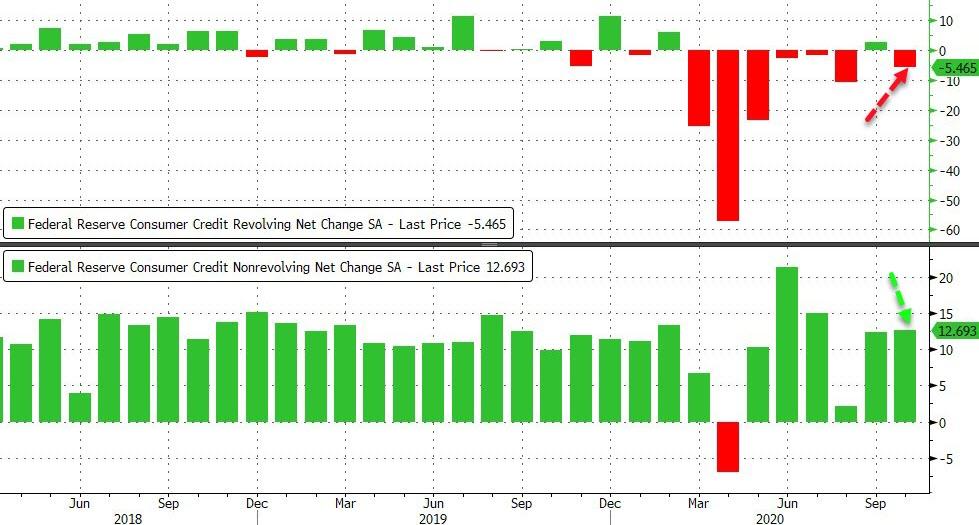

While revolving credit continued its smooth, virtually unchallenged melt up, rising by $12.7BN in October, it was another unexpected decline in credit card debt which shrank by $5.5BN that led to the weak October print.

The decline in credit card debt is troubling, but expected in light of the lack of a new fiscal stimulus which had prompted many of the same households that levered up during the summer on hopes of continued government generosity to their recent credit card loans as uncertainty rose.

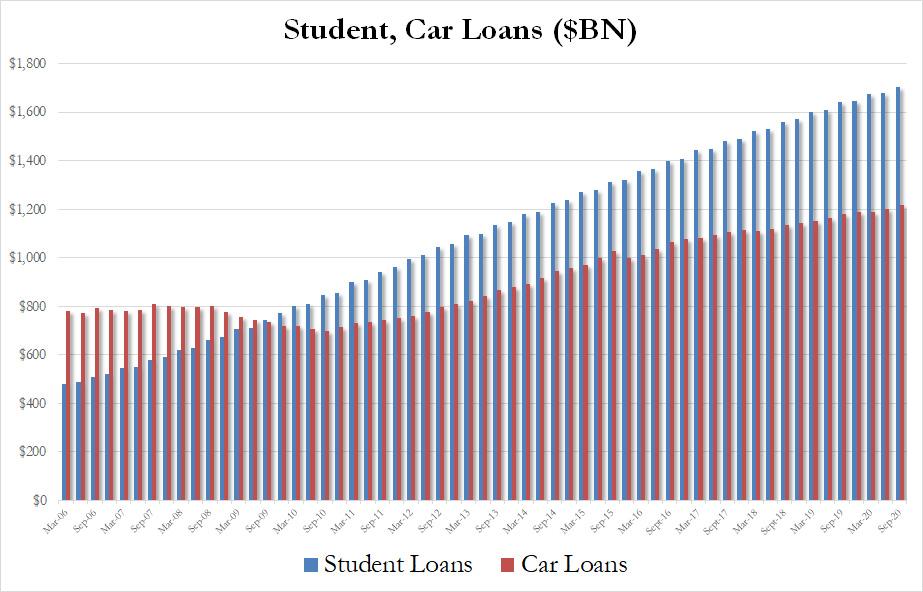

Finally, there were no such repayment concerns when it came to auto and student loans, which make up the bulk of non-revolving credit: according to the latest quarterly update, both student and auto loans hit a new all time high, increasing by $24.5BN and $16.5BN to $1.705 trillion and $1.219 trillion, respectively, both new record highs.

Why? Because since the paydown schedule on these loans is so far off into the future, Americans largely expect that either one or both will eventually be extinguished by future socialist administrations.

Continue reading at ZeroHedge.com, Click Here.