Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

ECB Meeting Preview

Tyler Durden

Wed, 10/28/2020 – 20:45

Submitted by NewsSquawk

-

ECB policy announcement due Thursday 29th October; rate decision at 1245GMT/0745CDT, press conference 1330GMT/0830CDT

-

The upcoming meeting takes place against a backdrop of a resurgence in COVID-19 which has led to the reimposition of various lockdown measures in the EZ

-

Policymakers are likely to wait until December to unveil any further easing measures, at which point the GC will have greater clarity on the impact of recent developments

OVERVIEW: Policymakers are once again expected to stand pat on rates with the balance sheet remaining the tool of choice for the Governing Council. Expectations are for an eventual expansion of the current Pandemic Emergency Purchase Programme (PEPP) remit of EUR 1.35trl and extension of its duration, however, consensus suggests that December is viewed as a more opportune time for this action. In December, policymakers will be able to present their winter economic projections and have greater clarity on the impact of various lockdown measures on the Eurozone economy. As such, the upcoming meeting will be more of an opportunity to set the stage for further stimulus, rather than unleash it in the immediacy.

PRIOR MEETING: At the prior meeting, policymakers opted to stand pat on rates, whilst leaving policy settings unchanged for its bond-buying operations, as was expected. The introductory statement noted that incoming data suggested a strong rebound in activity, which was broadly inline with previous expectations, though, ultimately activity will remain at pre-pandemic levels. The GC’s conviction in its outlook resulted in just minor tweaks to the accompanying growth projections which saw the 2020 GDP forecast raised to -8% (prev. -8.7%), 2021 held at +5.0% and 2022 tweaked lower to 3.2% from 3.3%. The 2021 HICP outlook was upgraded to 1% (prev. 0.8%) with 2020 and 2022 held at 0.3% and 1.3% respectively. With regards to the EUR, in an interesting turn of events, Lagarde’s comments were front-run by a sources piece suggesting that the ECB were in agreement that there is no need to “overreact” to EUR gains. Lagarde herself remarked the ECB does not target an FX level but will continue to monitor developments, including the EUR. With regards to further stimulus, the press conference offered little beyond the guidance provided in the policy statement with Lagarde suggesting that there was no discussion on an expansion to the PEPP envelope and a reiteration that the Governing Council’s baseline scenario envisages a full usage of that envelope.

RECENT DATA: The upcoming meeting will take place against a backdrop of Y/Y CPI remaining in negative territory of -0.3%, with the core-reading at 0.4%. Q3 growth data will not be published until the day after the meeting, however, survey data signals a waning of activity in Q4. The latest PMI releases saw the EZ-wide composite reading fall into contractionary territory of 49.4 (prev. 50.4) with IHS Markit warning that “the eurozone is at increased risk of falling into a double-dip downturn as a second wave of virus infections led to a renewed fall in business activity”. On the labour market front, the unemployment rate sits at 8.1%, however the true extent of the damage from COVID-19 continues to be masked by various government support schemes. The greatest cause of concern for policymakers will be the recent reimposition of lockdown measures across the region. Restrictions thus far have not been as harsh as those seen in the spring, however, they will provide a greater headwind to activity than envisaged at the prior meeting.

RECENT COMMUNICATIONS: Since the September meeting, President Lagarde has continued to stress the Bank’s willingness to provide further stimulus if required whilst attempting to reassure markets that the Bank’s toolbox has not been exhausted. That said, remarks have done little to suggest that any further easing is on the cards for the upcoming meeting. Chief Economist Lane, who many regard as one of the thought-leaders on the Governing Council, has drawn attention from his warnings that “there is no room for complacency” in the Bank’s efforts to restore inflation back to target with the central banker cautioning that the resurgence of COVID cases is “posing new problems”. Interestingly, Lane has suggested that there is “no indication that we are hitting the lower bound in rates”. Potentially of greater interest moving forward (subject to no policy tweaks this week) will be assessing the balance of views at the Bank and whether or not a consensus will be reached at the December meeting. The hawks have been vocal in their stance with Germany’s Weidmann opining that the current policy stance is “appropriate” and cautioning that relaxing PSPP constraints could present legal issues. Additionally, Austria’s Holzman recently remarked that it would need a significant worsening in the economy before more stimulus would be required; it’s unclear exactly how bad things would need to get before he would consider further easing. On the opposite side of the spectrum, the peripheral nations whose economies have been hit harder by the crisis are likely to lean more in favour of further stimulus, however, the calls for such action at the upcoming meeting have not been made, yet.

RATES: From a rates perspective, consensus looks for the Bank to stand pat on the deposit, main refi and marginal lending rates of -0.5%, 0.0% and 0.25% respectively. Despite holding the deposit rate at -0.5% throughout the crisis, recent remarks from Chief Economist Lane and Germany’s Weidmann have noted that the reversal rate (the rate at which accommodative monetary policy reverses its intended effect) is yet to be reached, with the latter suggesting that rate cuts are possible at some stage. As a guide, markets currently have around 2bps of further loosening priced in by year-end and around 10bps by the end of 2021.

BALANCE SHEET: With the balance sheet seen as the preferred easing tool for the Governing Council, focus remains on any adjustments to its bond-buying operations. Its PEPP currently has an envelope of EUR 1.35trl and is set to run at least until the end of June 2021, whilst its regular Asset Purchase Programme (of which the Public Sector Purchase Programme is a component) runs at a monthly pace of EUR 20bln together with the purchases under the additional EUR 120bln temporary envelope until the end of 2020. As mentioned above, no action on this front is expected to be taken at the upcoming meeting as policymakers wish to see how the economy responds to the reimposition of lockdown measures and the presentation of the December economic forecasts. From a technical perspective, the ECB has also been given some opportunity to hold fire on a decision given that PEPP purchases are set to run until the middle of next year as planned, according to SEB (who assume H1 2021 will see around EUR 83bln PEPP per month). As such, market participants will be looking for any indication of the nature and extent of potential easing in December. Investors will be looking to see if policymakers have any preference over whether any balance sheet expansions will come via the PEPP or PSPP. A recent Bloomberg News poll suggested that surveyed economists predict on average that EUR 500bln will be added to the EUR 1.35trl PEPP, with most anticipating action in December. In terms of house views, Goldman Sachs look for a EUR 400bln PEPP extension until the end of 2021 and a lengthening of the PEPP reinvestment commitment at the December meeting with the Bank highlighting that the account of the September meeting shows that PEPP remains the primary tool at the Bank. Taking a contrary view, ING lean in favour of an expansion to the PSPP in December on the basis that “PEPP was aimed at bringing inflation expectations and projections back to their pre-Covid-19 levels, while in the second stage PSPP should be used to bring these expectations and projections from their pre-Covid-19 levels in line with the ECB’s own aim.”

EUR: The EUR exchange rate could provide another line of inquiry for journalists at the accompanying press conference, however, since EUR/USD has failed to venture meaningfully close to 1.20 since the prior meeting, there is little need for President Lagarde to weigh in further on the matter. As such, the central bank chief will likely reiterate that the “ECB does not target an FX level” and will “continue monitoring developments, including the exchange rate”.

STRATEGIC REVIEW: One issue lingering at the Bank is its ongoing strategic review. The review has been delayed by the pandemic with its findings now not due to be released until September 2021. However, on the 30th September, President Lagarde delivered a speech in which she highlighted some preliminary considerations for the review. Lagarde noted that the ECB would be considering whether or not to depart from its current inflation target of “below, but close to 2%” and move towards a more “symmetric” target that would tolerate overshooting the 2% threshold. Morgan Stanley suggests that accelerating the release of the outcome of the review could amount to another policy option for the Bank. However, MS notes that given the current H2 2021 timeframe, it seems implausible that the findings could be released in the near-term, particularly given reports of differing views on the Governing Council, which will make fostering consensus a more difficult task.

TLTROs: After easing terms of Targeted Longer-Term Refinancing Operations (TLTROs) in April, TLTROs have also been seen as another potential policy tool for the Bank with the account of the September meeting noting that they remain in the toolbox. However, no action is expected to be taken on this front at the upcoming meeting. Adjustments to TLTRO-III are likely to be more of a feature of the December meeting, at which Goldman Sachs expect further operations to be announced and a sweetening of their terms.

TIERING: Morgan Stanley notes speculation that the current tiering multiplier of six (exempt from negative interest rates) might need to be increased as a result of rising excess liquidity in the Eurozone. However, the Bank suggests that such a move would be unlikely unless accompanied by a rate cut; something that the Bank’s economists do not currently forecast.

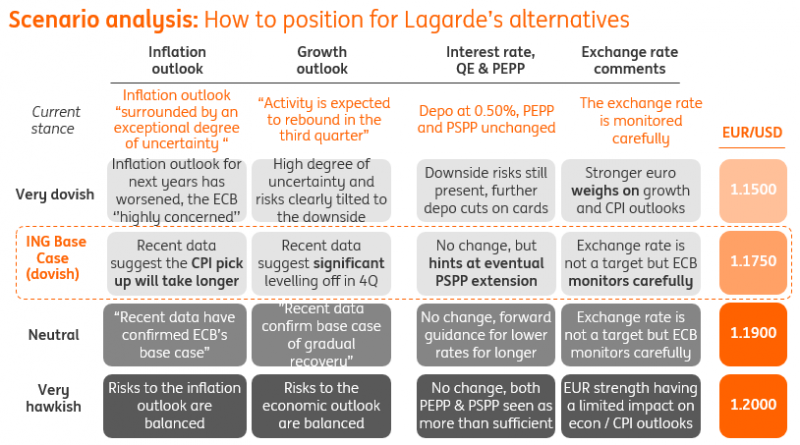

SCENARIO ANALYSIS: Finally, courtesy of ING Economics here is a brief recap of all the possible scenarios in tomorrow’s announcement:

Continue reading at ZeroHedge.com, Click Here.