Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Banks, Big-Tech, & Black Gold Bust As Bitcoin & Bond Yields Bounce

Tyler Durden

Thu, 10/15/2020 – 16:00

A 3rd day lower in a row for big-tech-heavy Nasdaq…

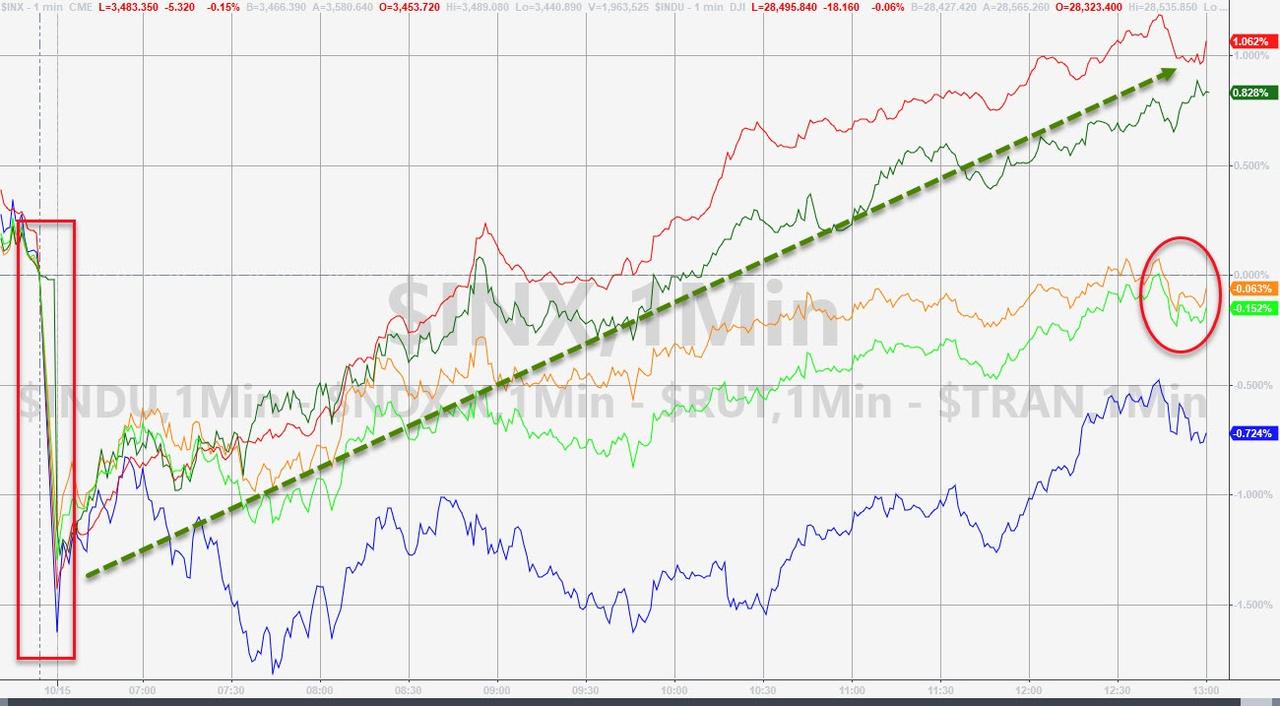

US equity markets tumbled overnight on the back of reaccelerating COVID cases and the concomitant lockdowns across Europe. Once the US cash markets opened, we were off to the races with Small Caps and Trannies ramped back into the green (and Dow & S&P tried their best). Nasdaq underperformed again…

On the week, thanks to today’s buying panic during the day, S&P and Small Caps managed to scramble back into the green (Dow is red on the week while Nasdaq is holding gains for now, ahead of tomorrow’s op-ex)…

Today’s rampage was all about squeezing the shorts once again…

Source: Bloomberg

Notably, Nasdaq scrambled back above its Zero Gamma level (289 for QQQ) ahead of tomorrow’s significant op-ex shift…

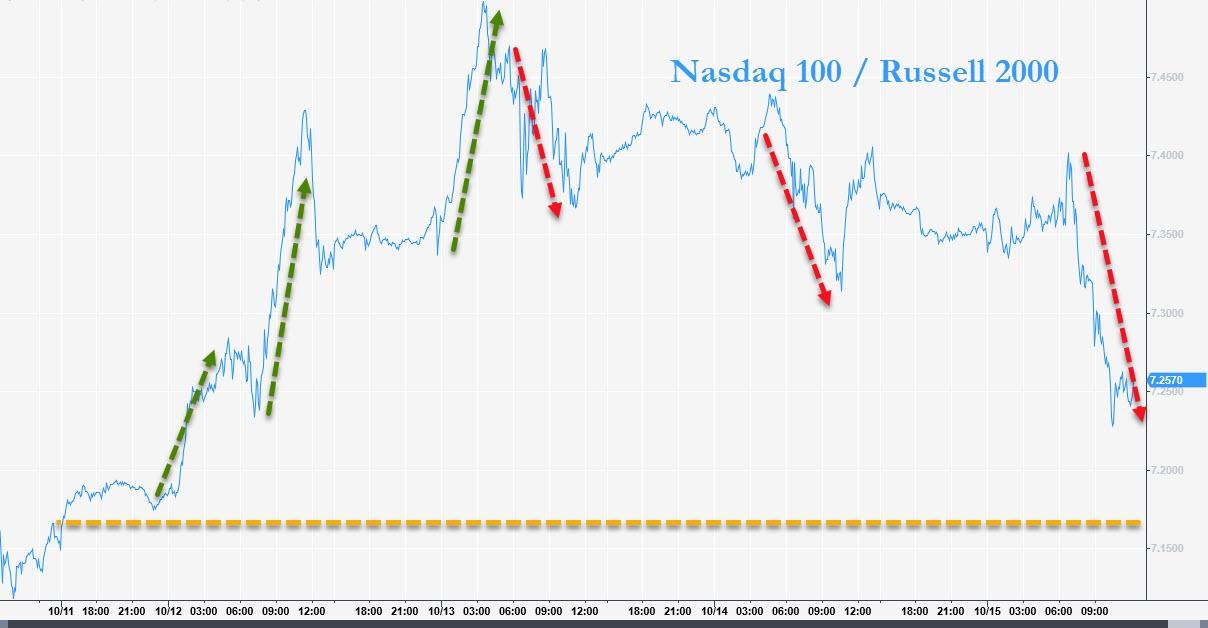

After the early week outperformance, Nasdaq has given back a lot of its gains against Small Caps into today;s close…

Europe had a bad day…

Source: Bloomberg

After an ugly week, things didn’t get much better today for banks with Goldman actually erasing all its gains and Wells unable to mount any rebound…

Source: Bloomberg

Cyclicals were rallied back to unch…

Source: Bloomberg

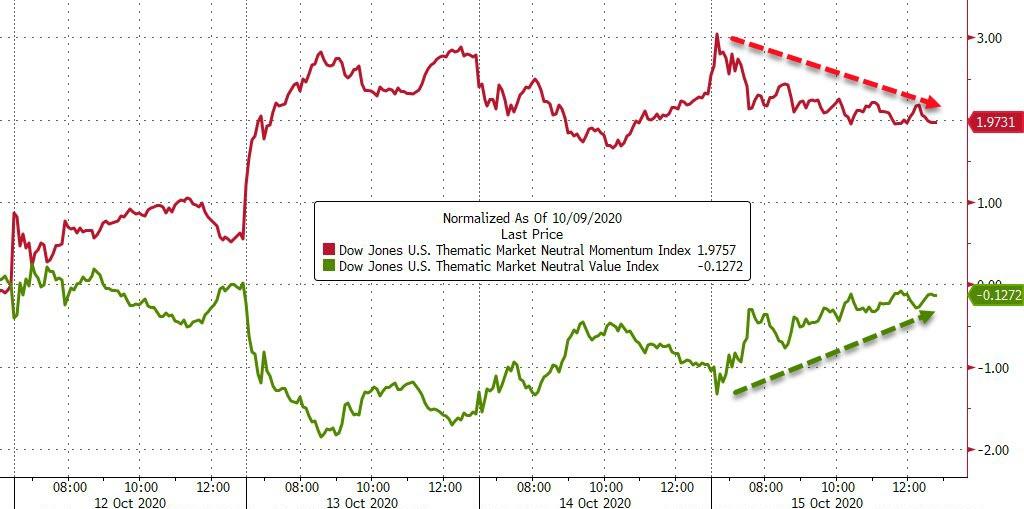

Momo was weak today as value rallied…

Source: Bloomberg

Treasury yields ended the day modestly higher, with bonds sold from the US open as stocks rallied…

Source: Bloomberg

10Y Yields ended higher by around 1bps…

Source: Bloomberg

Cable was weak once again as UK-EU talks broke down…

Source: Bloomberg

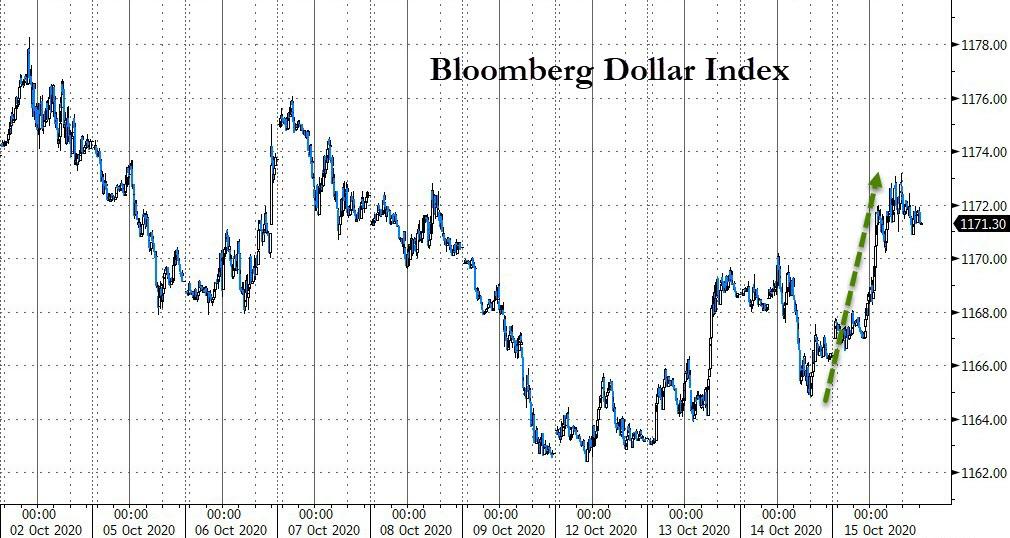

And that helped lift the dollar…

Source: Bloomberg

A seriously chaotic day in black gold today with WTI dumped and pumped but ending lower…

Gold rallied on the day, with futures back above $1900…

And Silver futures found support at $24 once again…

Finally, liquidity in the US equity markets is plunging once again…

Source: Bloomberg

After hitting all time lows (based on data going back to 1996) in March, liquidity improved over the course of the summer, peaking with the equity market at the end of August. Since then, the measure has continued to deteriorate steadily despite the bounce in stocks over the last three weeks.

And don’t forget, Monday is the anniversary of 1987’s Black Monday…

Source: Bloomberg

Continue reading at ZeroHedge.com, Click Here.