Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Gartman: It Does Appear That Biden Is Going To Win The Presidency

Tyler Durden

Mon, 10/12/2020 – 16:20

In what may prove to be an ill omen for Joe Biden, Dennis Gartman – who no longer publishes his Gartman Letter but appears in official capacity as chairman of the University of Akron Endowment Investment Committee – appeared on a Fox Business panel for Varney & Co, in which he said that “it does appear Mr. Biden is going to win the presidency unless something untoward is to happen in his campaign and I wish otherwise but that seems to be the reality.”

Considering Gartman’s “predictive” track record duly chronicled both here and elsewhere, Gartman’s assessment may have been the best news for the incumbent since a recent poll by the Trafalgar Group – which correctly predicted the outcome of the 2016 election – called for not only Trump to retain the presidency but for Republicans to keep the Senate.

Sarcasm aside, Gartman did make some notable observations in the context of whether there would be a Blue Sweep on Nov 3, which the market has no concluded is the best possible news for stocks…

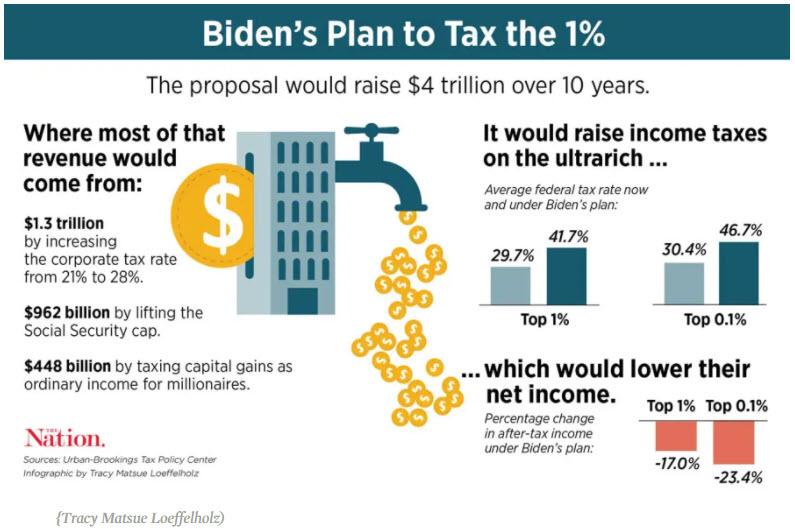

… regardless of Biden’s plan to raise $4 trillion in taxes over the next 10 years.

Discussing why stocks are just shy of all time highs weeks before the election, Varney said that stocks will stay strong regardless of whether Trump is re-elected or Biden takes office, because Trump will cut taxes and Biden will “spend big.” But Varney and Gartman said the biggest concern politically would be a “Democrat blowout,” where they take the White House and majorities in both chambers of Congress.

Well, actually no, as we pointed out last week, in a 180-degree shift in narrative, Wall Street has now decided that a Democratic Sweep would be the best outcome for stocks, one which Wall Street will gladly – and immediately – reverse on should Republicans keep the Presidency and/or Senate. After all, as even 16-year-old Robinhood traders know, everything is bullish for stocks when the Fed is micromanaging risk.

To this point, Gartman – who said he believes Biden is set to defeat Trump on November 3 – agreed that while Republicans must maintain the senate majority in order to keep stocks high, maintaining the Fed Chairman, Jerome Powell, is the much more important factor. Gartman. He did, however, offer an interesting spin on what happens to the Senate after Nov 3:

“It does look like the Republicans are going to be able to hold the Senate, the race that really is important is what’s happening in North Carolina, where the Democratic candidate [Cal Cunningham] who was leading is probably now behind following a marital problem that he’s had. That takes away one of the concerns that you explained, that there would be a tidal wave of Democrats,” said Gartman.

As a result, Gartman does not “think [the Democrats] are going to win the Senate, and as long as the Republicans continue to hold the Senate, that will give us gridlock and I’m always a great fan of gridlock because nothing really gets done.” In any case, the former “commodities king” said that no matter who is president “there will be passage of infrastructure spending and there will be much greater spending coming in the next year… so right now, it’s still a bull market.”

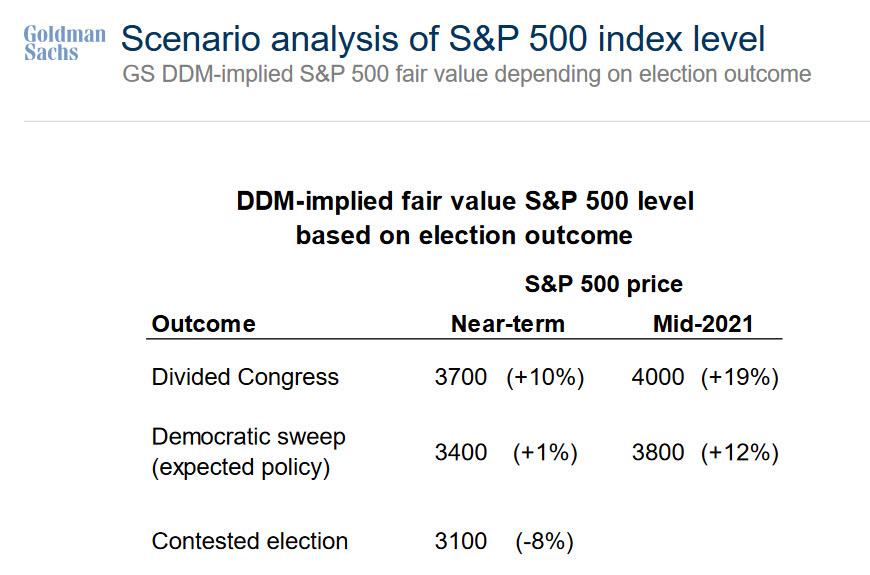

As a reminder, according to Goldman, a divided Congress is the best possible outcome for stocks, with the S&P expected to hit 3,700 in the “near-term”, and rise to 4,000 by mid-2021.

Meanwhile, Varney said that if Democrats “sweep”, that will signal “neo-Socialist America,” which could tank stock values, although clearly Wall Street disagrees – for now – despite the specter of much higher taxes. Additionally, a contested or protracted election could create instability that would do the same, and indeed that according to Goldman is the worst case scenario, one which could push the S&P down to 3,100 in the near-term.

Ultimately, as we said previously when we concluded that only the Fed matters for markets, both Varney and Gartman noted that as long as the Fed keeps printing trillions of dollars “no matter what,” then stocks can remain bullish.

“I’m not as concerned about a shift politically, but it does appear Mr. Biden is going to win the presidency unless something untoward is to happen in his campaign and I wish otherwise but that seems to be the reality,” Gartman said.

Varney countered that “If Trump wins the election, he’ll cut taxes, good for stocks,” while “if Biden wins, he’ll spend big, good for stocks. The baseline for stock prices are forecast to improve.”

And as if on cue, Trump – who sometimes is better known as Donald Pump – blasted on Monday afternoon that the “STOCK MARKET UP ANOTHER 300 POINTS – GREATEST LEADING INDICATOR OF THEM ALL!!! DON’T RUIN IT WITH SLEEPY JOE!!!”

Continue reading at ZeroHedge.com, Click Here.