Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Yuan Slides After China Makes It Easier To Short Currency, Signals “Discomfort” With Recent CNY Surge

Tyler Durden

Sun, 10/11/2020 – 16:14

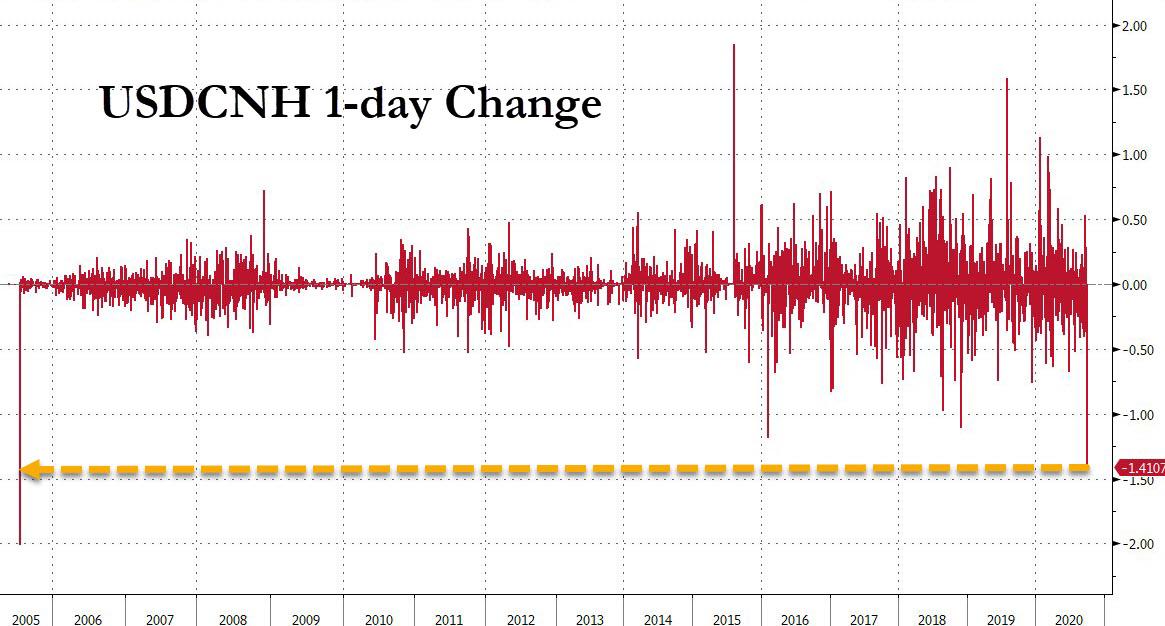

On Friday, following its week-long Golden Week (National Day) holiday, we noted that the onshore yuan (CNY) which had not traded since the previous Friday, soared the most since China’s 2005 de-pegging – as it rushed to catch up to the recent gains in the offshore yuan (CNH) driven by a shift in market sentiment that a pro-China Biden administration may replace Trump, as well as the continued slide in the dollar.

This also resulted in the strongest Yuan print since since April 2019.

Well, it appears that Beijing also noticed the relentless – and deflationary – gains in the yuan since May, and on October 10th, the PBOC announced the reserve requirement ratio for FX derivative sales – which was introduced in late 2015 in order to stem fast FX outflows in the aftermath of China’s devaluation – would be reduced from 20% currently to 0%, effective October 12th, in a which Bannockburn Global said was “an attempt to moderate the yuan’s increase”, and which Goldman said “likely signals the PBOC’s discomfort with the recent rapid appreciation of CNY” as the relaxation of the reserve requirement itself would lower the cost for FX liabilities hedging and encourage FX derivative sales (which represents FX outflow).

“It is difficult to decipher Beijing’s intent, but it does appear that it is willing to accept a stronger yuan against the dollar. It is not clear the extent of the move officials will tolerate” said Bannockburn’s Marc Chandler.

Actually, it’s not that difficult: China wants a weaker yuan and its telegraphing to the world it will have a weaker yuan. Here are the three main points surrounding this “telegraphed” announcement, courtesy of Goldman:

1. Background of the reserve requirement on FX derivatives sales:

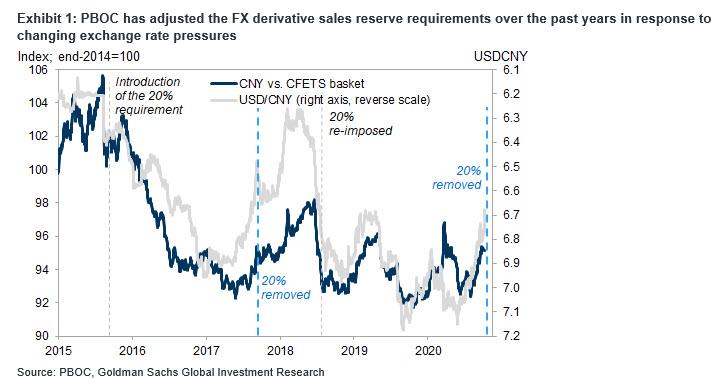

First introduced in September 2015, the reserve requirement on FX derivative sales is part of macro-prudential management and effectively a tariff on the non-bank sector for buying FX/selling CNY through derivatives. Specifically, banks need to deposit reserves with the PBOC for their sales of FX derivatives (such as forwards, swaps etc.) to customers (non-bank sectors, including corporate and households). Banks would then pass on the higher costs to non-bank sectors who buy FX/sell CNY through derivatives. The reserve requirement was introduced in response to the fast FX outflows in late 2015 and has been adjusted multiple times over the past years. The 20% reserve requirement was relaxed in September 2017 on the back of reduced FX outflow pressures and continued CNY appreciation, and reimposed in August 2018 amid CNY depreciation and FX outflow pressures related to weakening economic growth and intensified trade tension with the US (Exhibit 1).

2. Background of this announcement

This announcement comes after rapid CNY appreciation both against the USD and against a basket of currencies. In light of favorable interest rate differentials and muted policy signals from the PBOC previously, CNY appreciated against the USD from 7.16 in late May to below 6.70 as of October 9th, and on October 9th (the first working day after the week-long national day holiday), the CNY recorded the largest single-day appreciation (1.4%) since it was depegged with the USD in late 2005. On a trade weighted basis, the CNY appreciated by around 3% against the CFETS basket basis since August and is back to the levels in March-April this year. FX flows in recent months have been broadly balanced. There have been small outflows since June partially on the back of seasonal investment income payouts, while foreign buying of Chinese assets (in particular bonds) remained strong.

3. Implications from this policy change

The relaxation likely signals the PBOC’s discomfort of the rapid appreciation of CNY recently. In the announcement, the PBOC claimed it would continue to “keep CNY exchange rate flexible; stabilize market expectation and maintain the CNY exchange rate broadly stable at an equilibrium level”. The reduction of reserve requirement would encourage outflows in the near term – after the PBOC relaxed the reserve requirement in September 2017, banks’ FX forward sales rose from an average monthly level of US$9bn in June-Aug 2017, to an average monthly level of US$24bn in Sep-Nov 2017, and the CNY depreciated by around 2.7% against the USD and by around 1% against the CFETS basket in the two to three weeks after the relaxation of reserve requirement. The removal of reserve requirement reduces FX hedging cost and is by nature a relaxation of macroprudential management, so it is consistent with the broad policy objective of a more flexible and market driven CNY exchange rate. Absolute values of countercyclical factors (CCF) in the CNY fixing averaged at around 20pips for the past two months, relatively small in comparison with the intra-day moves of USDCNY.

If all that sounds a little Greek, then consider this: when the PBOC last did this, in September 2017, the yuan fell around 2.5% in the following few weeks, and a similar move now would bring USD/CNY toward 6.865 versus Friday’s close of around 6.695.

And while it has a ways to drop, the offshore yuan was trading 0.66% weaker in early Asian trading, with the USDCNH spiking from Friday’s close of 6.6878 to 6.7317…

… and also pushing the dollar notably higher, a move which may upset the risk complex where upside in recent days was synonymous with USD weakness. Of notes, the Aussie slipped ahead alongside yuan weakness with the AUDUSD down 0.4% to 0.7212, while the EURUSD was down 0.2% to 1.1806 as U.K. Prime Minister Boris Johnson told German Chancellor Angela Merkel that there were gaps with the EU ahead of the October 15 deadline.

Continue reading at ZeroHedge.com, Click Here.