Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Hedge Fund CIO: “Why Would Our Political Parties Oppose Trillions In Stimulus When These Create No Real Pain”

Tyler Durden

Sun, 10/11/2020 – 16:10

By Eric Peters, CIO of One River Asset Management

“I would like to see a bigger stimulus package frankly than either the Democrats or the Republicans are offering,” said President Trump on Friday, just days after abruptly ending the very same stimulus negotiations he was re-advocating. And of course, if Trump is calling for a bigger package than Democrats or Republicans, then it must mean he is neither.

Which is in fact true. He’s first and foremost a president in desperate need of securing a second term. And as the NY Attorney General marches onward in his investigation over possible tax fraud by Trump, the stakes are higher for the President and his family than in any race we’ve seen in our lifetimes. Fiscal profligacy wins elections. So if Trump has his way, he’ll deliver something close to the Democrat’s demand for a $2.2trln stimulus. Remember, this is on top of the $3trln stimulus approved on May 15th, and it’s in advance of next year’s inevitable $2trln infrastructure stimulus.

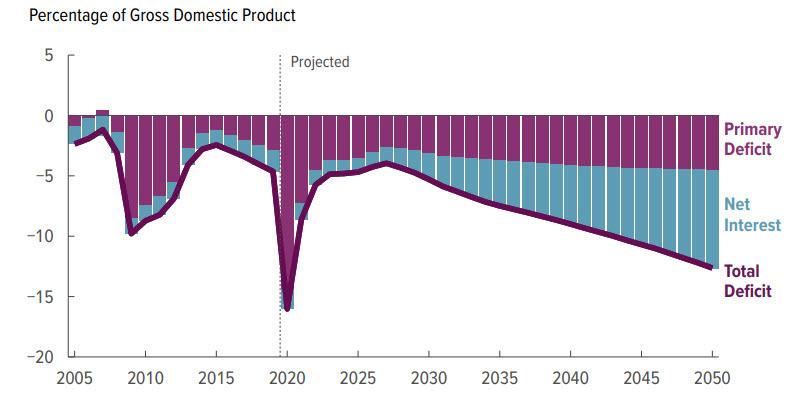

Before any of this new stimulus, the Congressional Budget Office had forecasted a 2020 federal budget deficit of 16% of GDP (triple the 2019 deficit) and a 2021 budget deficit of 8.6%. And while such massive numbers are unprecedented outside of wartime, so far, there have been no negative consequences. Rather, quite the opposite.

Since the May 15th stimulus the S&P 500 has rallied +21%, the US dollar index has fallen -6.4%, and 10yr treasury note yields are +10bps higher. Unemployment has declined. So why would our political parties stand in opposition to something that produces so much pleasure and no real pain? The answer is that they will not, provided that each party can claim a victory in the negotiation.

And this dynamic will persist, until there are consequences. Which will first be felt in the markets, then reverberate through the economy, and circle back to our political parties.

And when such dynamics reverse, they do so fast, ferociously.

* * *

Anecdote:

“MMT has already led us to a better place,” said Warren Mosler, pioneer of Modern Monetary Theory. “If Washington had done just $1trln in fiscal stimulus like Obama did in 2009 rather than the $3trln they’ve already approved, we’d be overwhelmed by civil unrest,” he added, expecting another $2trln this year, followed by another $2trln in 2021 infrastructure.

In recent years, central bankers called on politicians to expand fiscal stimulus. They did so because monetary policy had failed to influence the real economy as desired. Each successive reduction in interest rates continued to fail to pull demand from a depleted future to the present.

Paradoxically, impotent rate cuts appeared to support a general rise in financial asset prices; widening wealth inequality and expanding the chasm between the real economy and financial economy. And this simultaneously increased social and financial instability to levels that threaten America’s national fabric.

“MMT has saved the world. It hasn’t necessarily rescued it from its future, but it has saved the present,” said Mosler. “This crisis pushed politicians and policy makers to do things that would’ve otherwise been practically impossible for them to justify, and this then allowed them learn one of the most important principles in Modern Monetary Theory – national governments do not have a solvency problem.” [ZH: Venezuelans may disagree.]

This year’s unprecedented fiscal deficits have not led to a collapsing dollar, a bond market meltdown, or runaway inflation. “Politicians are now past the easy part, but without really understanding what they’ve done or how it works. It’s a little like the decision to nuke Japan to end World War II. In many respects, that tragedy was the easy part. And it led to complications that the whole world is still grappling with seventy-five years on,” said Mosler.

“We have unleashed a power that few knew existed. And with potential consequences that hardly any truly understands. So how will we use it?”

[ZH: Ideally to buy gold, because what is coming next is truly unprecedented…]

Continue reading at ZeroHedge.com, Click Here.