Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Stocks & Gold Jump, Bonds & The Dollar Dump As Election Fears Fade

Tyler Durden

Mon, 10/05/2020 – 16:01

It all feels a bit fragile…

But this appears to be the message from the markets…

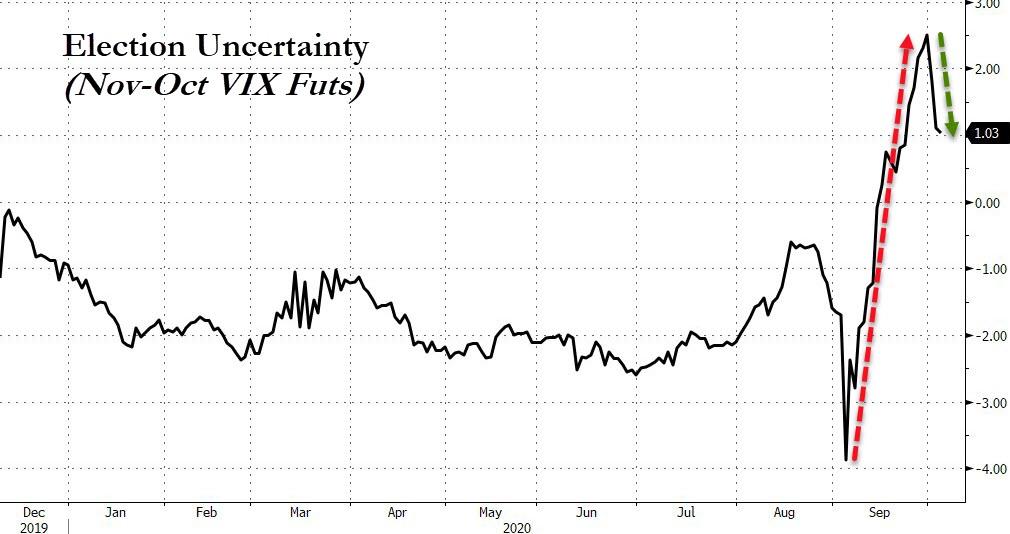

It appears Trump catching COVID has sparked a relief compression in election anxiety priced into the volatility market…

Source: Bloomberg

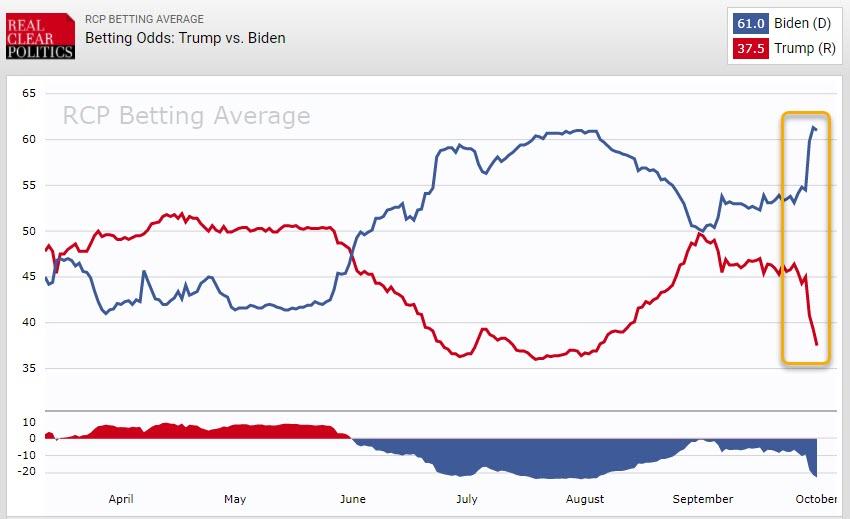

And betting appears to be favoring Biden quite dramatically (bearing in mind of course that these illiquid markets can be moved by anyone with large pockets)…

Both of which ‘may’ explain why stocks were panic-bid at the cash open today (look at the insta-bid in Small Caps at the cash open). Stocks did roll over around 1300ET that Pelosi and Mnuchin had no stimulus deal today but then rebounded higher when Trump tweeted that he was leaving hospital today. Stocks then accelerated more on headlines that Pelosi and Mnuchin will exchange proposals this afternoon on the fiscal stimulus…and then finally dipped on rumors that GOP sources say a stimulus deal is doubtful…

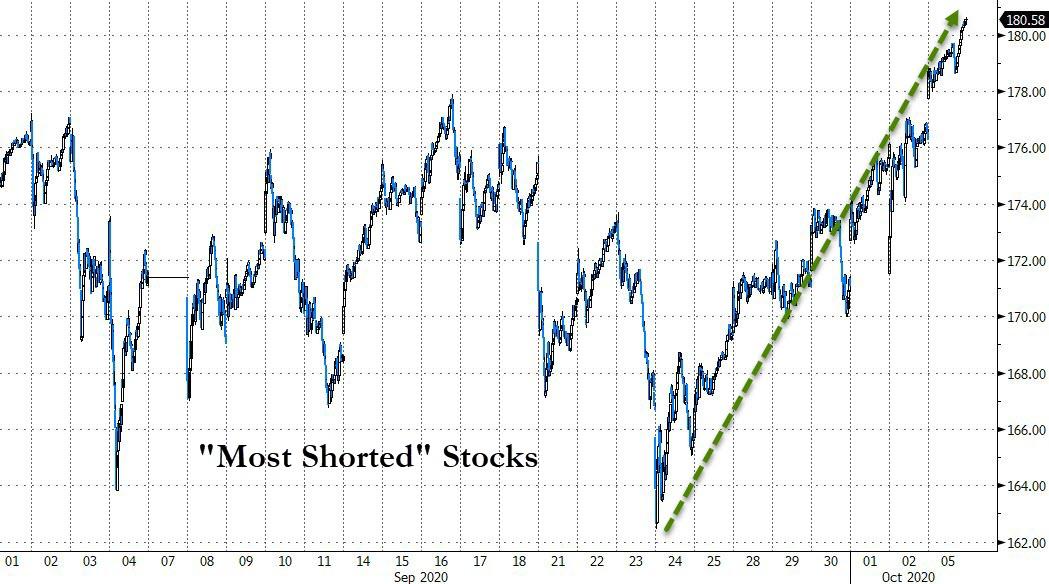

This is the 7th day in a row of significant short-squeeze…

Source: Bloomberg

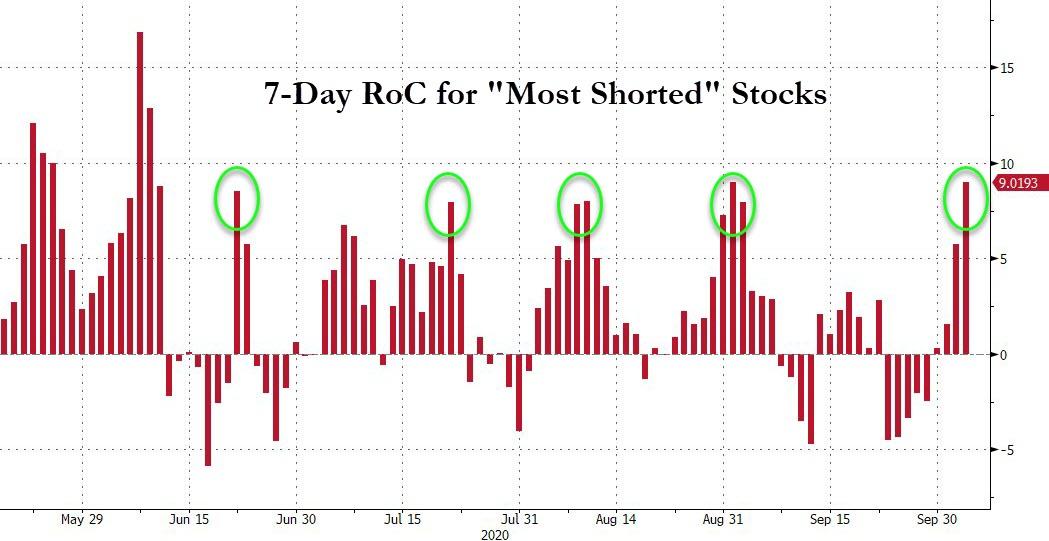

The 9%, 7-day surge is eerily in line with the 4 previous squeezes since June that have all run out of energy at this point…

Source: Bloomberg

Dow topped 28k, S&P topped 3400, and Nasdaq filled its gap down from last week…

NOTE that stocks (except Nasdaq) have erased the initial plunge loss on Trump’s COVID diagnosis…

Financials outperformed as the yield curve steepened…

Source: Bloomberg

And bonds were dumped (despite very mixed messages from PMI/ISM) especially the long-end (+8bps!)…

Source: Bloomberg

With 10Y Yields back above 76bps (6 week highs)…

Source: Bloomberg

And 30Y closed at its highest in 4 months, perfectly reaching its 200DMA…

Source: Bloomberg

Interestingly, gold spiked (is Biden and the left’s MMT a bigger fear?)…

Even as real yields surged (which empirically has not been good for the precious metal)…

Source: Bloomberg

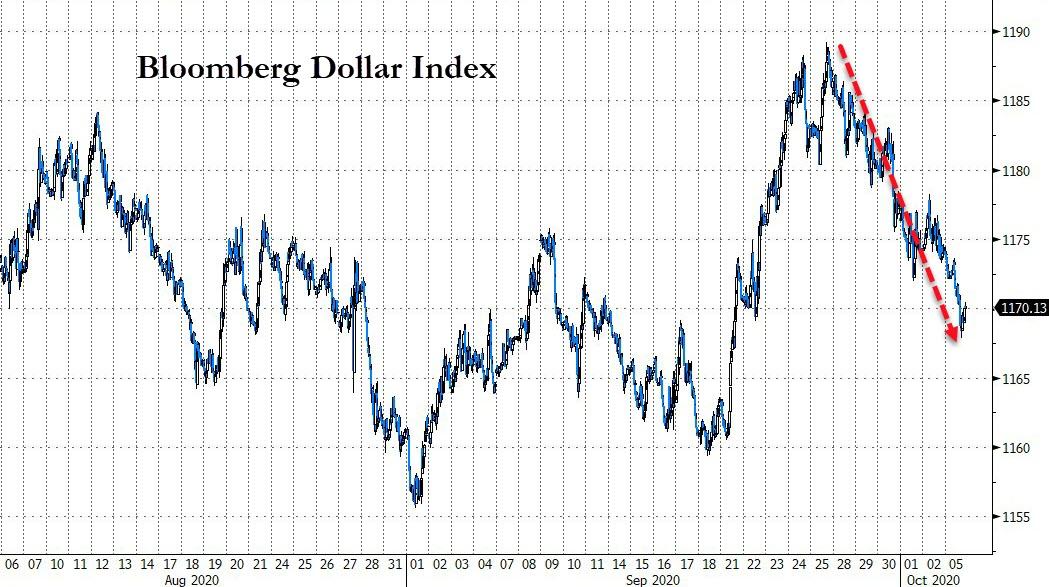

But then again, the dollar did continues its recent renewed decline…

Source: Bloomberg

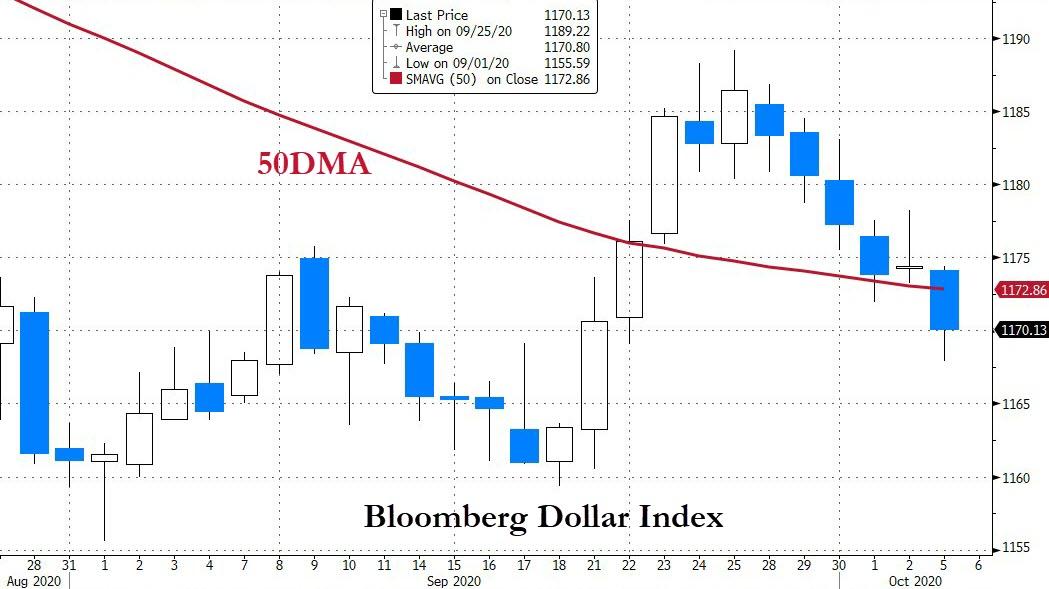

The dollar broke and closed below its 50DMA…

Source: Bloomberg

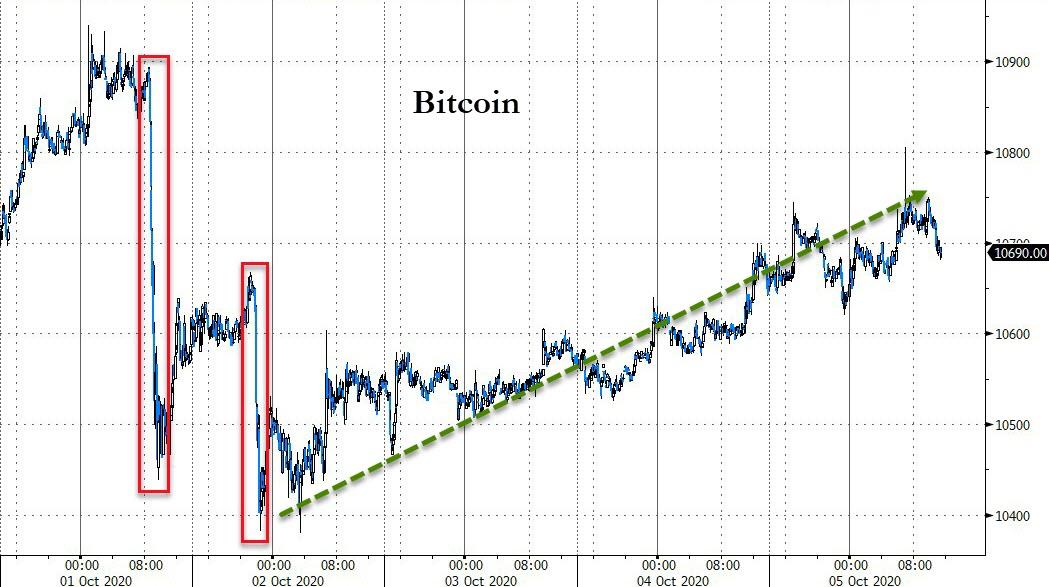

Bitcoin continued its rebound today, testing $10,800 briefly…

Source: Bloomberg

Silver jumped back above $24.50…

Oil prices exploded higher today, but reversed after topping $39.50…

Finally, here’s some context for the “bond yield spike”…

Source: Bloomberg

Continue reading at ZeroHedge.com, Click Here.