Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Morgan Stanley: The 2020 Market Cycle Is Actually… Normal

Tyler Durden

Sun, 10/04/2020 – 16:30

By Andrew Sheets, chief global strategist at Morgan Stanley

This Normal Cycle

Of all the adjectives to describe 2020, ‘normal’ seems pretty far down the list. The year has witnessed a global pandemic and the worst quarter for global growth on record. Those emergencies produced the highest levels of government and central bank support ever seen. And beyond these obvious extremes are the daily disruptions that remain impossible to ignore. The family and friends not seen. The offices sitting empty. The stadiums filled with artificial noise.

All this (and more) has made it tempting to think of 2020 as so unusual and extreme that any historical playbook needs to be thrown out the window. Don’t. We think that this current market cycle is surprisingly normal, a view that continues to underpin our investment strategy. While we expect choppy, range-bound markets between now and the US election, reflationary, early-cycle strategies should ultimately prevail.

Although all economic cycles are different, they often share characteristics which drive similar patterns of market performance. This is a central tenet of our cross-asset framework, which combines cycle-adjusted return expectations with our bottom-up strategy forecasts. We think that this still applies in these unusual times:

First, ‘normal’ late-cycle markers had emerged before the recession of 2020 hit, and we’d disagree with the notion that all was well before the arrival of COVID-19.

Consider the following: Prior to the US recessions of 1990, 2001 and 2007, core CPI had risen above the five-year trend, unemployment had dipped below trend and the yield curve had inverted. On average, those recessions started 15 months after the last Fed rate hike.

And prior to February 2020? Core CPI had risen above trend, unemployment was below trend and the yield curve had inverted. February 2020 was 14 months after the last Fed rate hike. Eerie.

Other ‘normal’ late-cycle patterns were also apparent. Consumer and investor confidence were high, expected volatility was low and equity leadership was narrow. And while markets hadn’t reached dotcom or subprime levels of excess, we had an unusually large late-cycle fiscal stimulus and record levels of corporate gearing, which suggest at least some animal spirits.

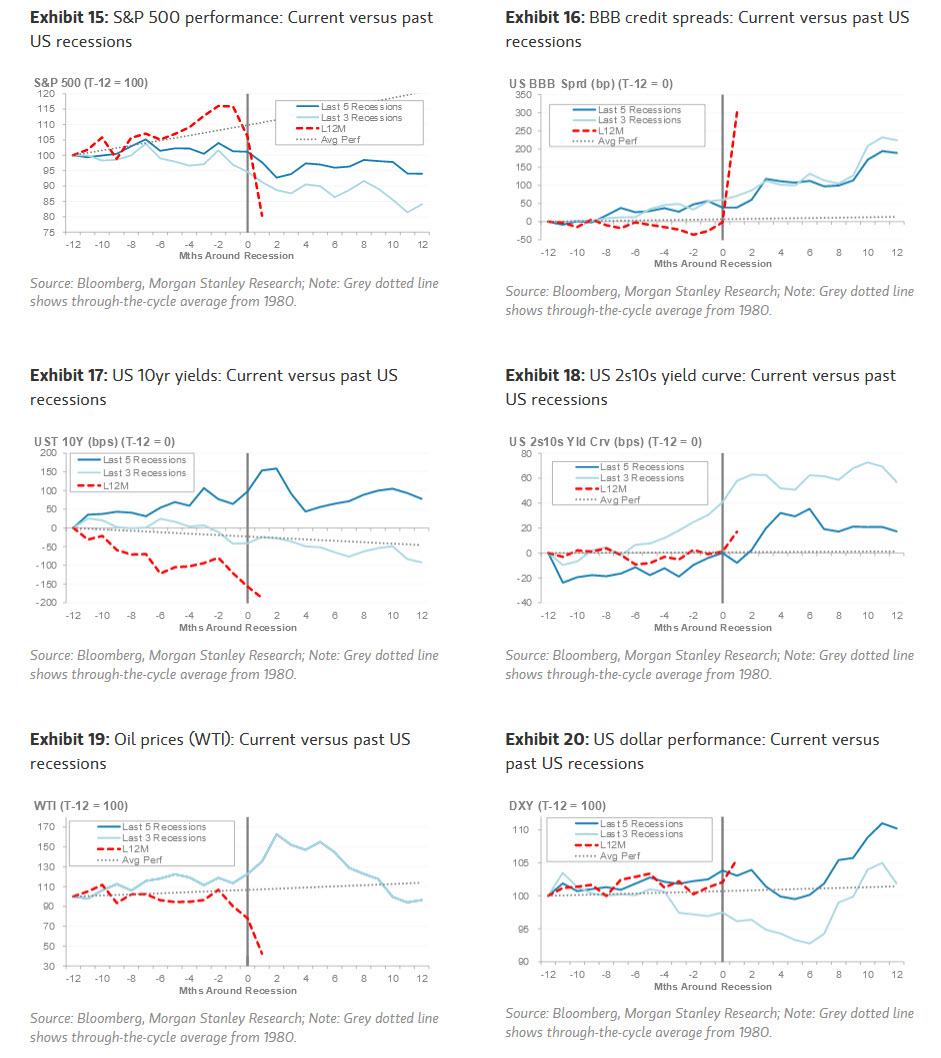

The second sign of normalcy came in what followed: The argument that ‘this time is different’ is rooted in just how extreme this recession was. But if we look at the way markets performed relative to these extreme data, the pattern is, again, eerily familiar.

Back in late March, we looked at where asset classes made their ultimate lows in the prior five US recessions, relative to when the data bottomed.

Assuming a data ‘low’ in April, the prior five recessions would have suggested the following months for bottoms in the S&P 500, US high yield, US 10-year yields and the 2s10s curve:

March 2020, March 2020, April 2020 and August 2019.

And when were the actual lows?

March 2020, March 2020, August 2020 and August 2019.

In other words, even with the most extreme decline in data on record and a global pandemic, markets mostly led the data by the ‘normal’ interval.

* * *

The final chapter of this story is how markets have behaved following the March lows: This recovery has seen its share of ‘unusual’ events, especially the stunning outperformance of the NASDAQ. But plenty of familiar post-recession patterns are on view: EM equities have performed well, the US dollar has weakened, inflation expectations have risen, yield curves have steepened, small caps have outperformed and defensive stocks have lagged (even as yields have remained range-bound).

So yes, there’s a lot about 2020 that is unusual, extreme and unprecedented. A lot that is scary. A lot that tempts one to throw out the rulebook. There’s more uncertainty to come, not the least of which is the outcome of the US election in less than a month. But for investors, we think the inquiry into whether this cycle will be ‘normal’ needs to begin with the presumption of innocence, especially when so many historical patterns are evident.

We think plenty of skepticism remains about that ‘normality’, which means that valuations for many early-cycle winners remain attractive. In equities, that’s in places like US small over large caps, US financials, European cyclicals and Australian equities. In macro markets, it’s why our strategists like being short US 30-year duration.

Twists and turns as the US election nears, the uncertainty regarding additional US fiscal stimulus, a rise in global COVID-19 cases and a still-unresolved Brexit saga all create significant uncertainty, and should keep markets volatile and range-bound over the next month. But amid that volatility, we maintain our central tendency – this cycle is more normal than appreciated, and should be treated as such until proven otherwise.

Continue reading at ZeroHedge.com, Click Here.