Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Luongo: “What’s Coming Next Will Not Be Pretty”

Tyler Durden

Fri, 10/02/2020 – 16:21

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

While we were all distracted by the Kabuki Theater of the first ‘debate’ between Donald Trump and Joe Biden on Tuesday the bigger event was simply the turning of the calendar from September to October.

What is painful about so much market commentary is that it is focused on price. The Dow went up, huzzah! The dollar fell, huzzah?!

But prices are nothing without time. And most prices are meaningless. The only ones that truly matter are the ones we know definitively for any given period of time — Open, High, Low, Close.

Everything else is noise and errata.

So, the calendar shifting from September to October creates another opportunity to aggregate all the noise of two different time periods, one month and one quarter-year, and assess what people actually thought of the Dow or the dollar or Tesla or a micro-cap furniture company in Saigon.

Given the extreme political landscape, central bankers who have no answers and the obvious push for a remaking of society through the fear-mongering over COVID-19 this quarterly close may be one of the most important in the history of financial markets.

And the fight over important closing prices didn’t disappoint.

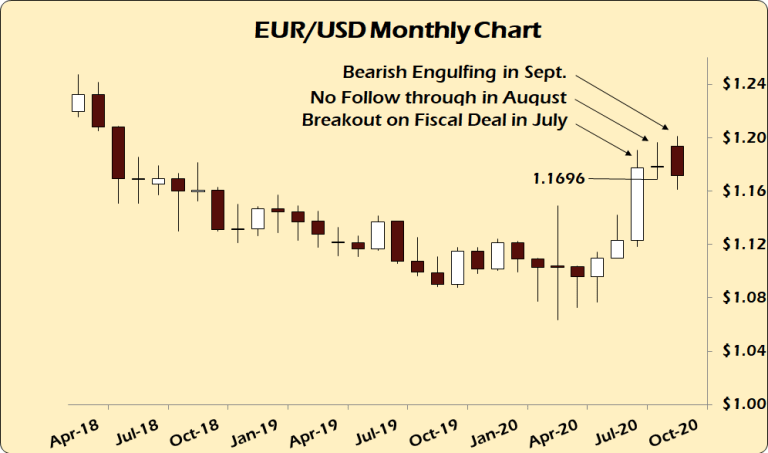

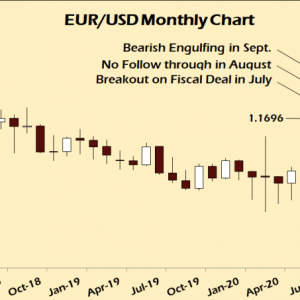

Last week I talked about what happens if the dollar really starts to rise, citing a massively bearish monthly chart pattern in the euro. To pull off one of the most bearish signals possible all the euro had to do was close below $1.1696 on Wednesday.

It didn’t. $1.1718 was the close. Bearish engulfing one-bar reversal avoided. Whew!

But for how long?

Germany slipped into deflation last quarter. The ECB can’t allow the euro to fall lest it begin putting upward pressure on rates as carry trades unwind. Right now the only thing keeping any of the markets afloat is insane levels of sovereign debt buying by central banks.

They are going through the motions that there are actual markets for these bonds and we are going through the motions that we actually want to own them.

If not for trillions in liquidity sloshing around looking for a home this whole system would collapse overnight. And yet there is no escape from it collapsing at some point anyway.

This is why the WEF’s Great Reset is happening. Those in power want to stay in power and remake the world in a different image. It’s becoming increasingly clear that COVID-19 is an excuse to introduce draconian lock downs to minimize the public’s outrage when they pull the plug on the current system.

Dividing the population into those that submit to this state of affairs and those who don’t was useful data for them. They now know how much push back they will get from the people and how many newly-minted brown shirts and Karens they will have to help them remake the world for the ‘common good.’

And whether anyone is aware of what is going on always shows up in the capital markets. The strong close by U.S. equity markets on Wednesday in the wake of Trump’s debate performance was your first clue.

As I noted in Wednesday’s post, “Elephants vote.”

Trump spoke to people’s elephants loudly and clearly amidst the calls from Chris Wallace and Joe Biden to, “Just shut up.” And those elephants realize that Trump is the only positive force in politics for the future of any vestige of capitalism.

Well, elephants also manage money.

And that’s why the subtle cues that happen in important markets after significant events are more important than 99% of all the price moves we see. It’s why obsessive ticker watching can easily lead you astray unless you are day-trading.

With the news that Donald Trump has COVID-19 and it’s not an asymptomatic post-hoc positive but rather a real diagnosis, the markets reacted badly to the news.

They want to believe there is a stimulus compromise coming from D.C. but as I’ve explained before, Pelosi and the Democrats work for the WEF and want the Great Reset to wipe us all out so they can remake the world and make it safe for their planned technocratic oligarchy.

But, the reality is that traders know this. That’s why the euro is weak today, stocks are closing the week with a whimper but U.S. markets look a helluva lot stronger than European ones.

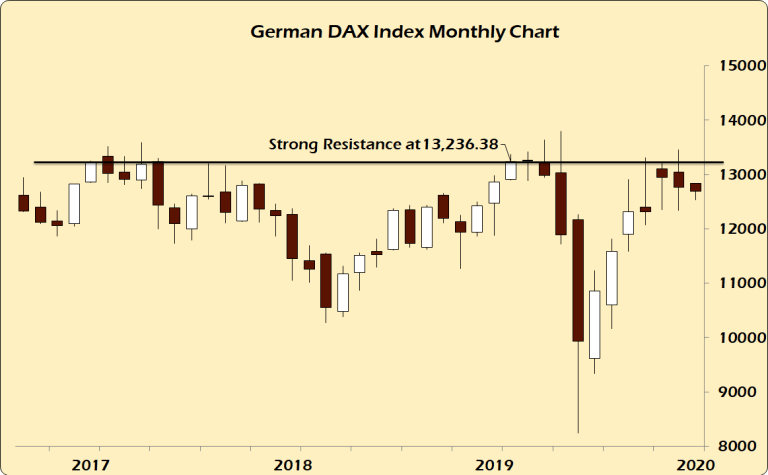

Case in point. Here are the monthly charts for both the Dow Jones and the German DAX indexes.

The DAX is stuck below the 13,300 level and there is simply no appetite to take it higher. Look at the last four bars of the chart. It’s a strange pattern of higher highs and higher lows, which should be bullish but they are all, at the close, down bars — closing lower than the open.

That kind of non-committal action should be viewed as insider distribution rather than any kind of expression of strength. Powerful people trading the German markets are bailing on German stocks selling into the post-Coronapocalypse reaction rally high.

And they’ve been doing it for months.

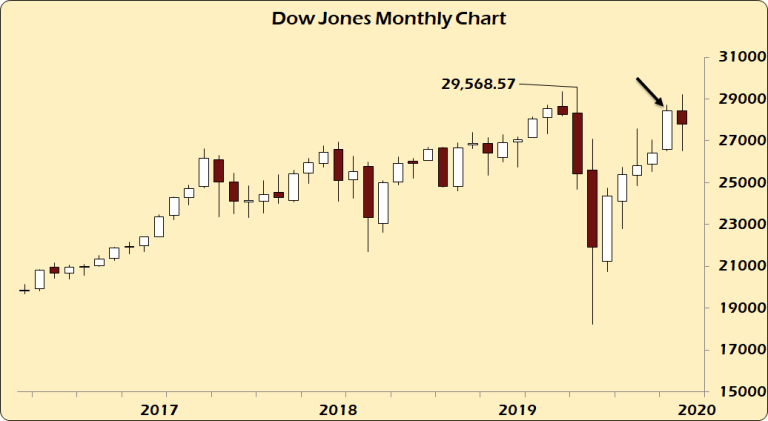

Now, here’s the Dow Jones Industrials monthly chart. As Martin Armstrong routinely observes, the Dow is the best proxy for international capital movements into U.S. markets.

The Dow surged into the close on Wednesday (black arrow). It was the second-highest monthly close on record. That is remarkable given the state of the U.S. economy and the political desire to watch it burn.

Now I’m no fan of the larger bullhorn-like chart pattern stretching back four years and that signifies a potential crash in the future.

The differences between the DAX and the Dow Jones tell you that the smart people in Europe are moving their money out ahead of whatever is on the horizon.

But, right now, international equity markets are trading on the hope that Donald Trump wins re-election while the whole of the political class is expending every erg of capital they have to stop him and destroy the capital markets.

In spite of that, he is absolutely the odds-on favorite to win the election. Now whether or not he’ll be allowed to take office is a different story.

And the truth of it is all of what’s happening is their fault. They created this mess with moronic post-Keynesian economics, late-stage corporatist corruption and maleducating two generations into the believing Communism didn’t kill 200+ million people in the 20th century.

This is what undermined the structures built post-WWII as they’ve worked assiduously to weaken all social bonds, sow division and hide behind their minions in governments and the media.

Remember folks it’ll all be better when we embrace the Green New Deal Biden is confused about supporting and over throw everything good and decent in the world because there’s too much freedom in our first-world police states.

That’s the messaging of the Great Reset.

And if you don’t like what is planned well, they’ll be sending a bunch of UBI-sotted, fat-assed and tattooed BLM/Antifa thugs to your house to denounce you as racist while burning it down and taking your stuff while telling themselves their ‘fighting the power.’

What’s coming next will not be pretty regardless of Trump surviving COVID and getting re-elected. Deflation is here because it couldn’t be stopped. Now there is only oceans of money to print to throw into the abyss.

And that why there’s a plan in place and it will unfold because the people driving it have painted themselves into a corner if they want to retain power.

And they do at all costs.

* * *

Join my Patreon if you want to connect the dots from politics to markets. Install the Brave Browser to give Google two fingers up.

Continue reading at ZeroHedge.com, Click Here.