Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Dollarnado Slams Stocks, Gold, & Silver As Election Angst Spreads

Tyler Durden

Wed, 09/23/2020 – 16:01

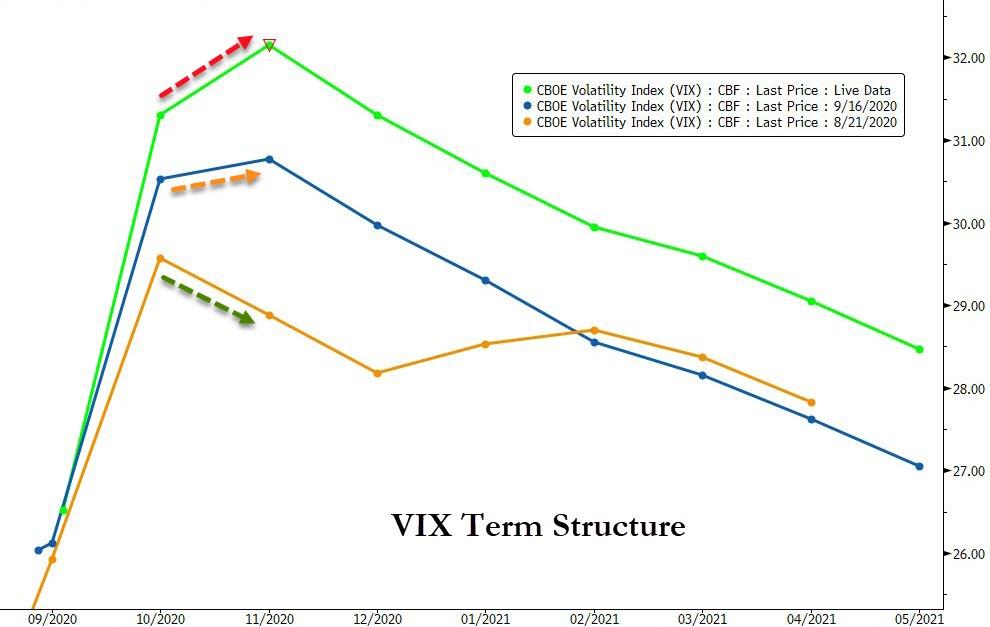

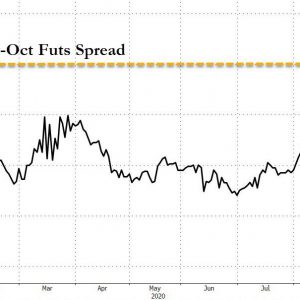

Anxiety over the election (and any thoughts of fiscal stimulus) continues to rise…

Source: Bloomberg

Quite a serious shift in risk perceptions around the election over the last month and week…

Source: Bloomberg

Which matched with very heavy FedSpeak today with most bearish on growth without more fiscal stimulus (messaging was clear!):

-

Chair Powell continued to wave the fiscal flag carefully at another hearing today, saying that more support was likely to be necessary.

-

Cleveland Fed President Loretta Mester saying fiscal stimulus was very much needed given the “deep hole” the economy is climbing out of.

-

Boston Fed President Eric Rosengren suggested it’ll take another wave of infections to prompt action, and likely not until next year: “The most difficult part of the recovery is still ahead of us.”

-

Chicago Fed President Evans desperately tried to walk back his more hawkish comments (on hiking rates below 2% inflation) but was ignored.

-

And finally, Fed Vice Chair Richard Clarida, in an interview on Bloomberg Television, emphasized the recovery has so far been stronger than officials predicted a few months ago. He also made clear the road ahead will be difficult and repeated the theme that fiscal support would help.

And tomorrow is another shitshow of FedSpeak…

Is the stock market’s drop a message to Washington? “Get back to work?”

Things could have been a lot uglier as NKE’s surge added 60pts to The Dow.

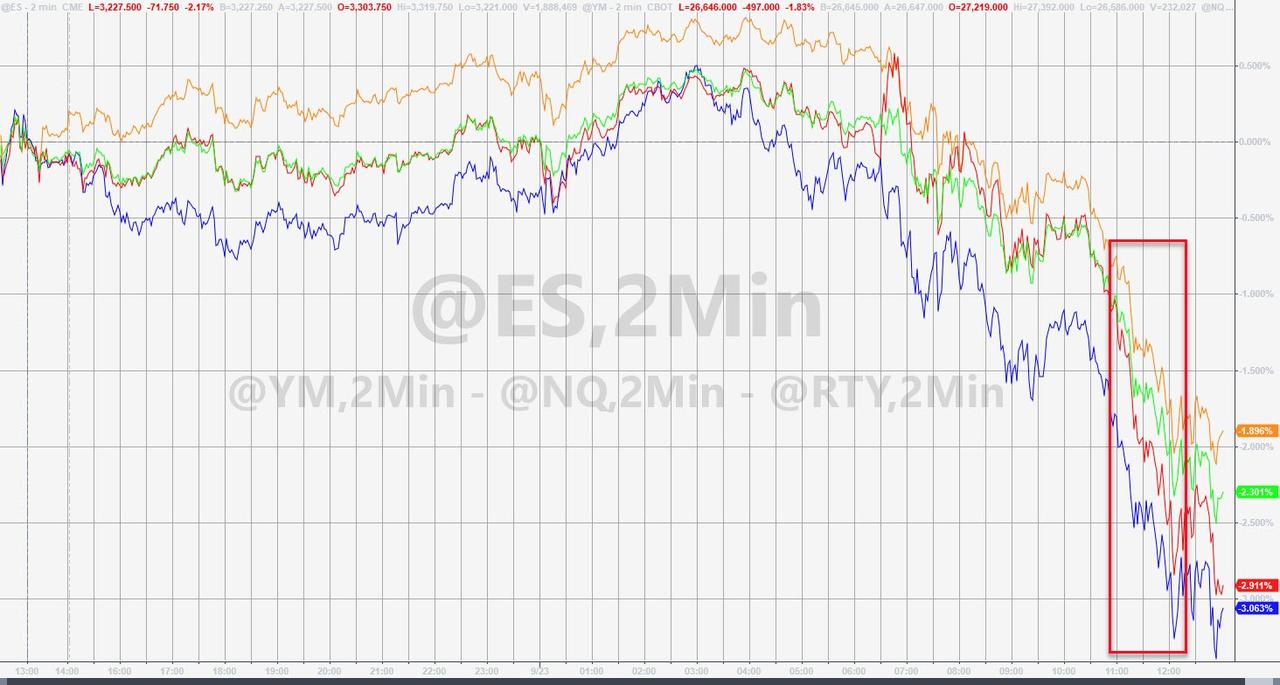

The Dow dumped 800 points from intraday highs…

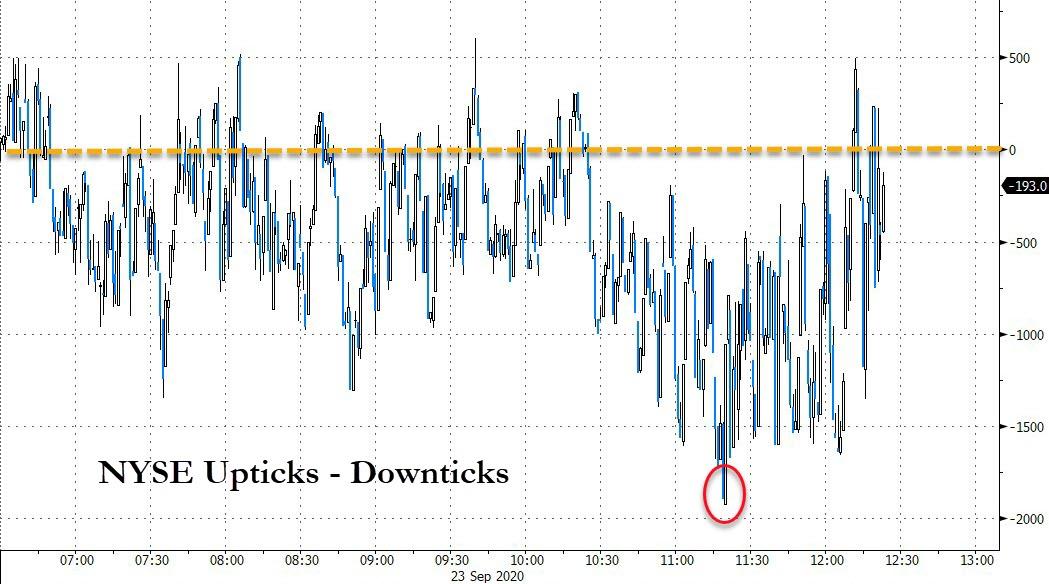

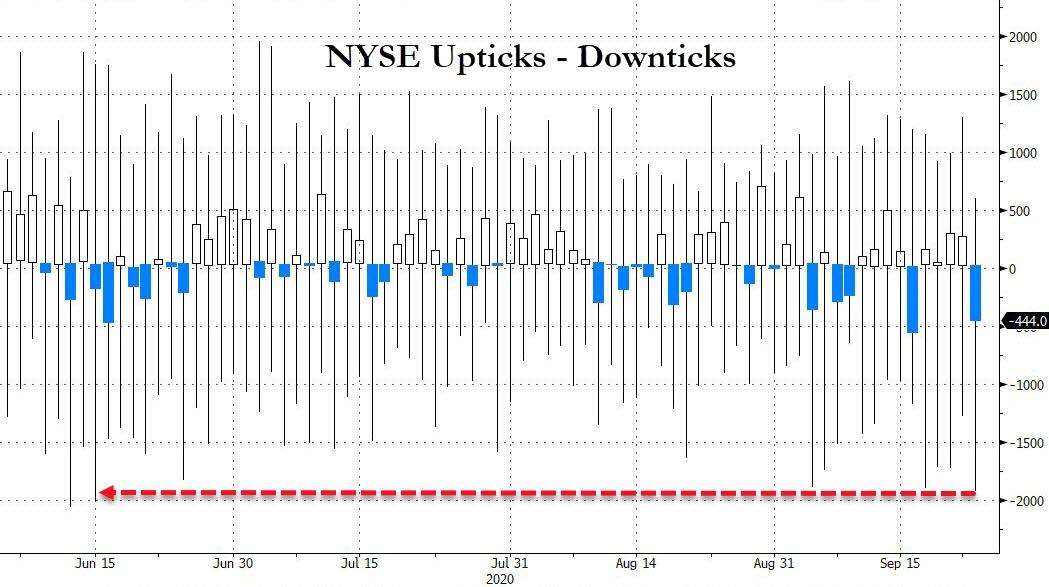

The timing of the plunge this afternoon syncs up almost too well with margin-calls. Today’s selling accelerated right around 1430ET…

Source: Bloomberg

That is the biggest flush since June…

Source: Bloomberg

The S&P 500 is almost back to unch YTD and Nasdaq is back at almost 2-month lows…

Source: Bloomberg

Cyclicals and Defensives were both hit today and both accelerated losses at 1430ET (margin calls)…

Source: Bloomberg

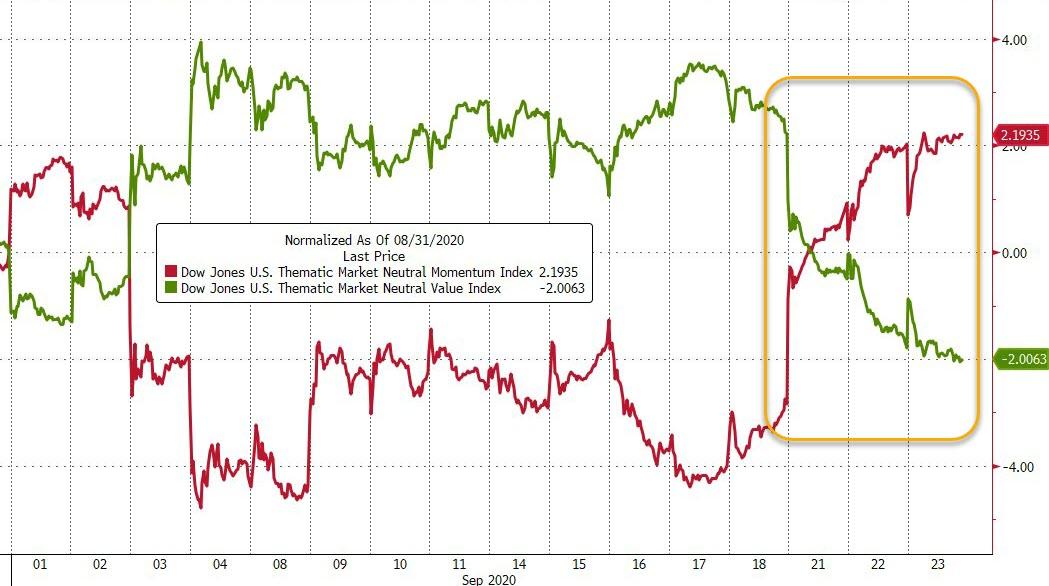

This week has seen a dramatic reversal higher in momo names…

Source: Bloomberg

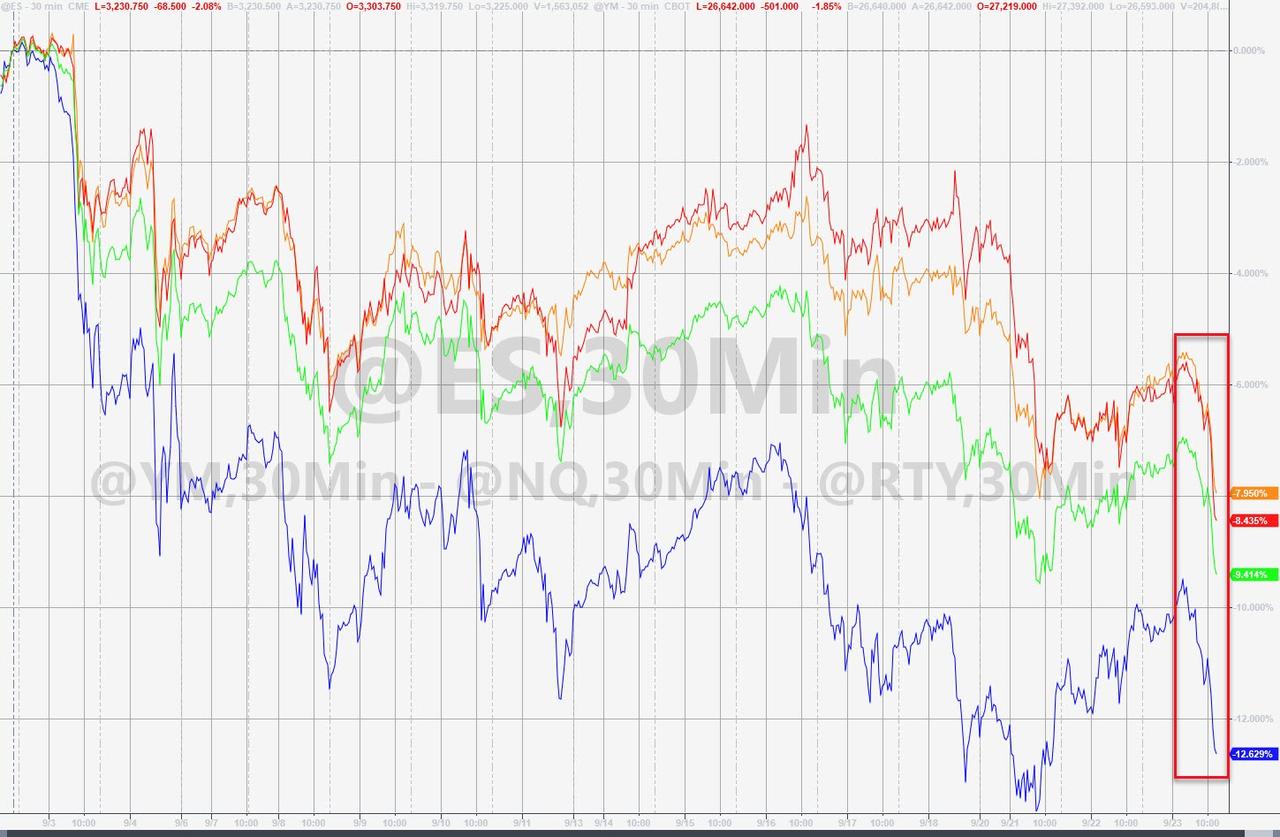

Nasdaq is now back near its cycle lows, down around 13$ from record highs and the S&P 500 near a 10% correction from its highs…

Today’s tumbles sent the US majors to key technicals – Russell 2000 at its 100 and 200DMA; rest of the majors below their 50DMAs and falling…

TSLA stock was monkeyhammered back below the critical $420 level…

NKLA crashed… again…

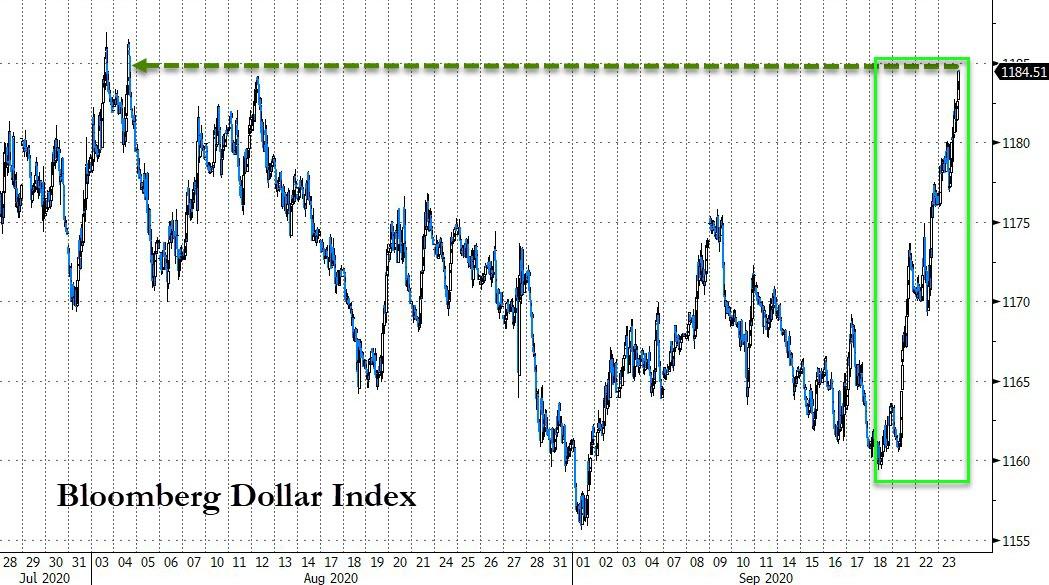

The lack of dovish comments by any of the Fed speakers accelerated the dollar surge to fresh cycle highs again amid the biggest 4-day surge since March (up over 2%)…

Source: Bloomberg

Dollar strength triggered selling in Precious metals – which also were hit with liquidation purges.

Silver futs dropped below $23…

And gold futs below $1900…

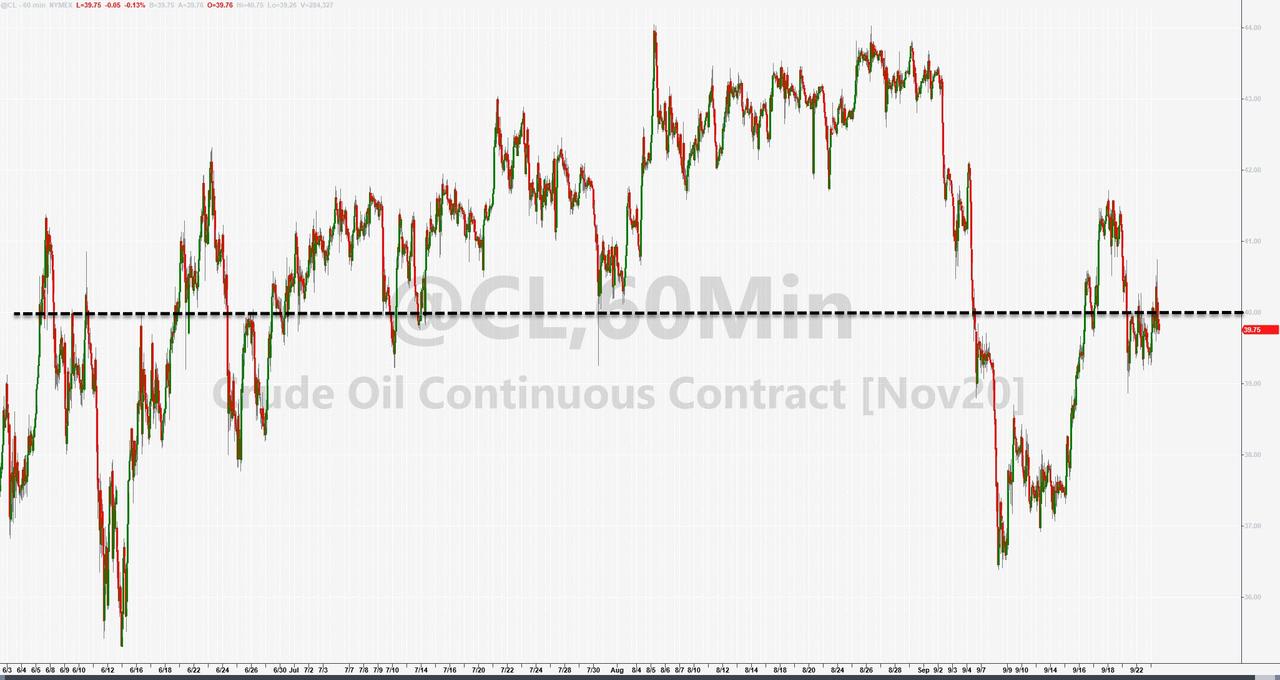

Black gold also closed red, unable to hold above $40 despite notable product draws…

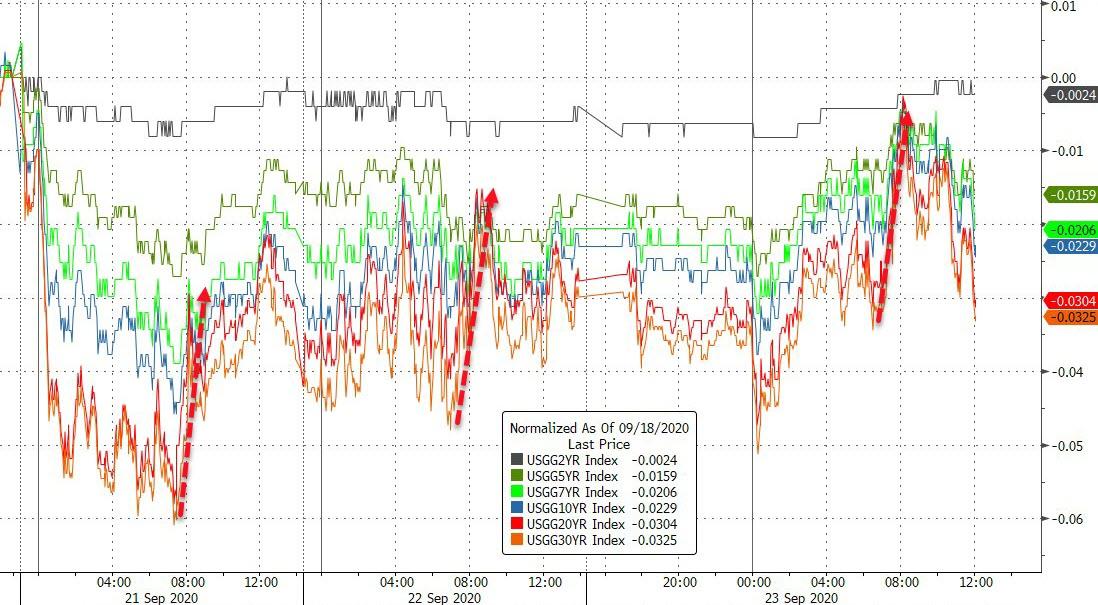

Bonds ended the day with a massively UNCH move in yields (notice TSY selling once again at the US open to EU close)…

Source: Bloomberg

Real yields surged to their highest in 2 months (still notably negative), which weighed on gold…

Source: Bloomberg

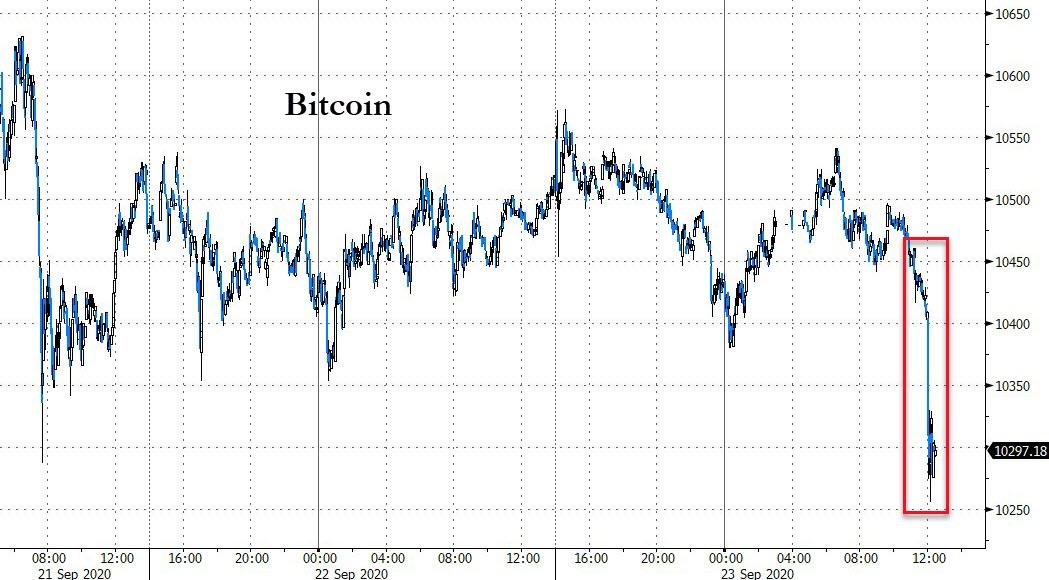

Bitcoin was also hit around 1430ET…

Source: Bloomberg

Dr.Copper was clubbed like a baby seal back below $3.00… (oddly we did not hear CNBC discussing it as a sage of economic growth today!?)

Today really had the smell of “liquidate everything into dollars”

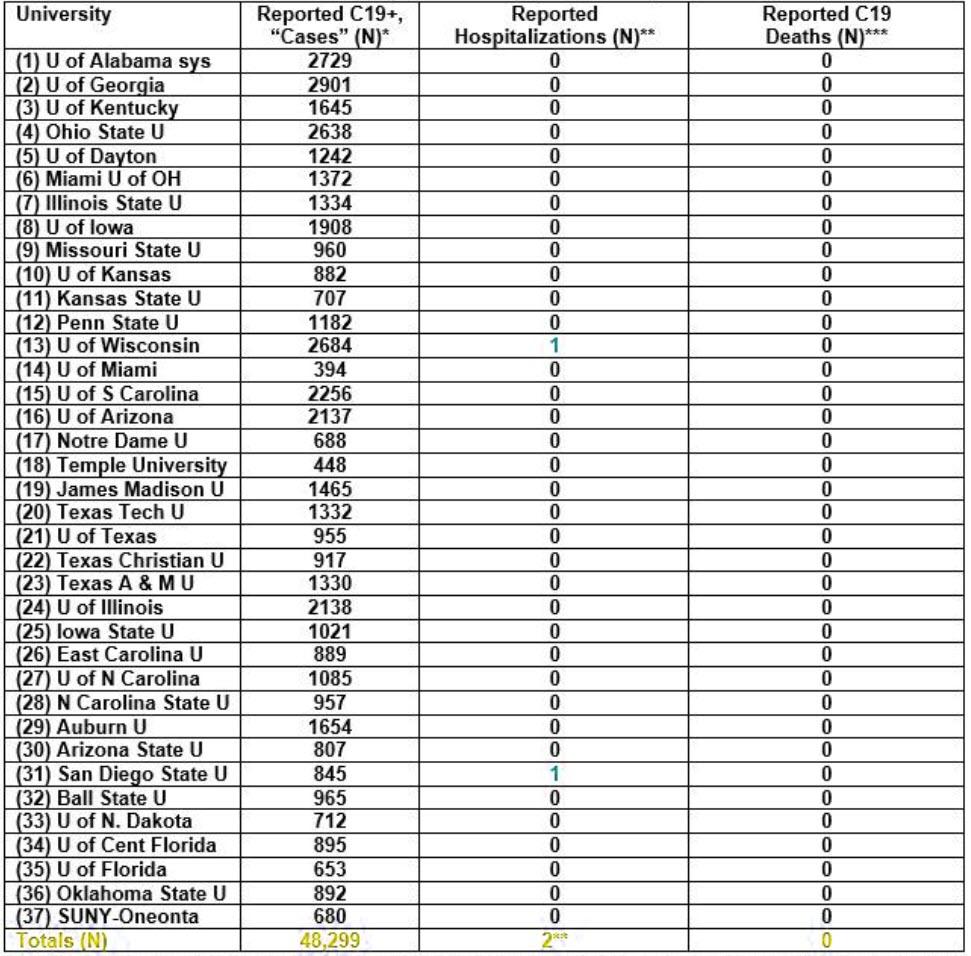

Finally, off-topic for a moment… COVID College Box Score: 48,299 Cases… 2 Hospitalization… 0 Deaths!

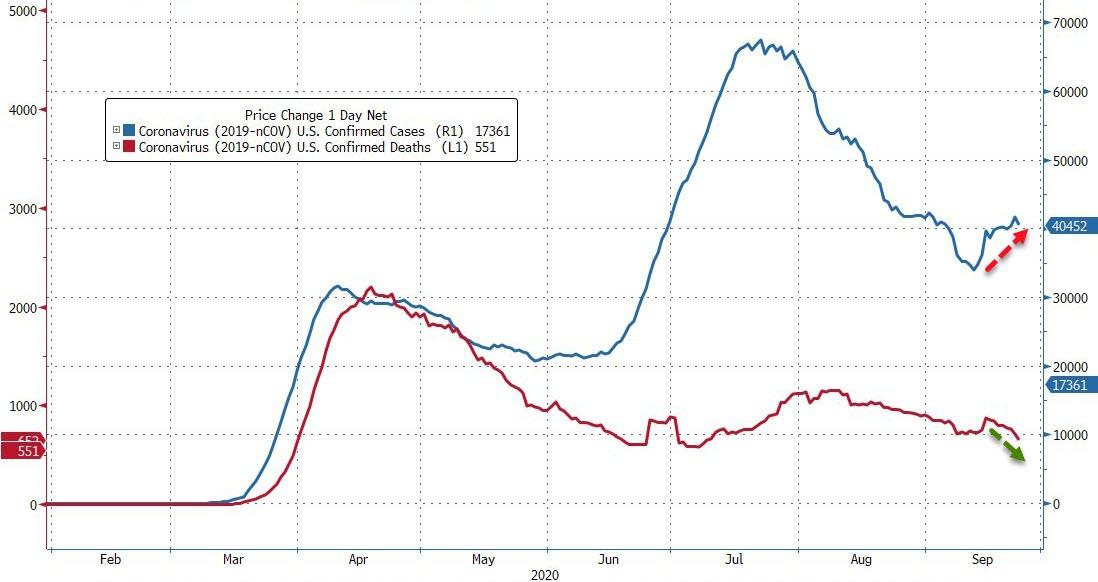

And as cases rise (cough colleges cough)… deaths tumble…

Source: Bloomberg

Still think this f**king farce is all about the “science” and not political?

Continue reading at ZeroHedge.com, Click Here.