Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

‘Bad’ Banks, Bader Ginsburg, And Limey Lockdowns Slam Stocks & Silver, USD Soars

Tyler Durden

Mon, 09/21/2020 – 16:00

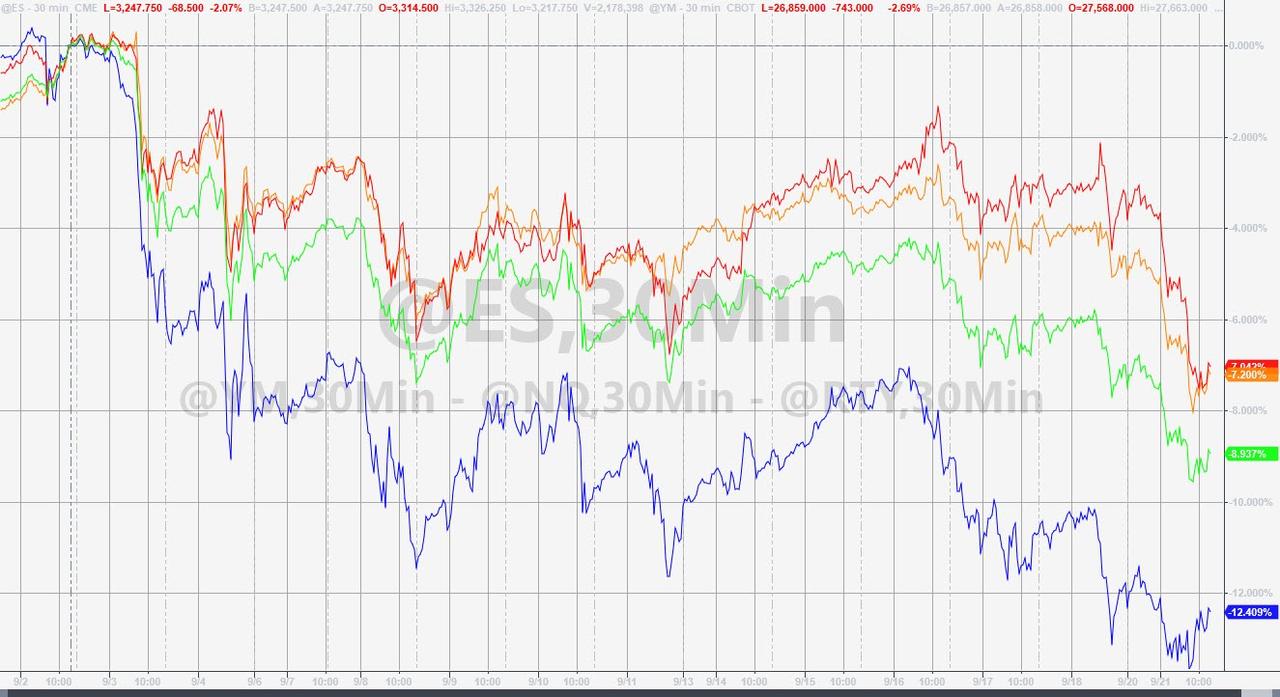

RBG’s death ramps up election, and thus stimulus, uncertainty to ’11’; blowback from the FinCEN leaks on the world’s biggest banks did nothing to comfort investors; and the resurgence of COVID across various European nations (and increasing chatter of lockdowns) was the cherry on the top of today’s derisking. Thanks to the magic of post-EU close dip-buying, Nasdaq – rather shockingly – managed to get back to green (up 2% in 70 minutes on nothing)!!!!!

Everything bottomed at 1450ET (no obvious news catalyst for the reverse but perhaps just the 1430ET margin calls were not as aggressive as expected)

It’s bullish o’clock.

— zerohedge (@zerohedge) September 21, 2020

And that’s when AAPL went panic-bid (cough buybacks cough)…

Bonds and the dollar completely ignored the panic-bid in stocks…

Source: Bloomberg

VIX was pressured lower in the last hour, back below 28…

From the highs, Nasdaq remains worse and closed in correction. The S&P almost made it down to 10% correction…

The technical picture has deteriorated, especially for the Nasdaq 100. The S&P500 and Nasdaq 100 both closed below their respective 50-day moving averages for the first time since late April. Furthermore, the NDX is breaking-down on a relative basis for the first time since the rally began in March. While corrections in bull markets are to be expected, the 200-day moving average isstill 10-20% lower for many of the leading and most crowded stocks. The S&P 500 and Nasdaq 100 remain vulnerable to a test of their 200-day moving averages, which are 7% and 14% lower, respectively.

Many funds that are long tech/growth have significant P&L to play with and are letting it ride, not to mention this has been the right strategy for the past decade. Morgan Stanley fears that may come into play and provide some fuel for this correction to go a little further than most are expecting.

It all felt a little like this…

I guess I should check and see how my portfolio is doing so far today… pic.twitter.com/vyjiNzBYZ1

— Rudy Havenstein, six ways from Sunday.. (@RudyHavenstein) September 21, 2020

The S&P practically erased all its gains YTD…

Source: Bloomberg

Cyclicals and Defensives were both hit hard today (though the former was worse)…

Source: Bloomberg

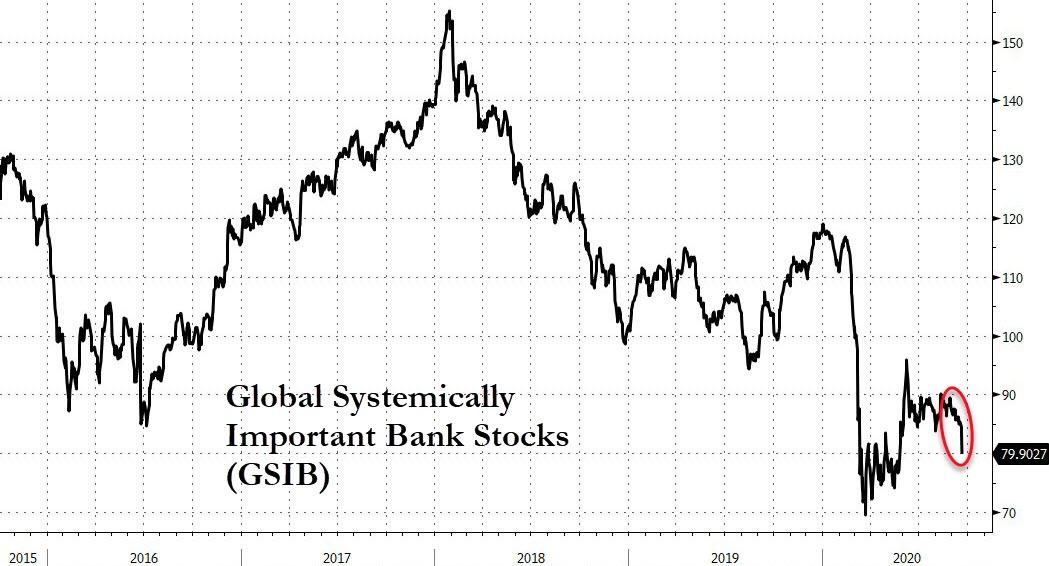

Banks stocks puked today…

Source: Bloomberg

And European stocks were really ugly as the major financials lagged so hard…

Source: Bloomberg

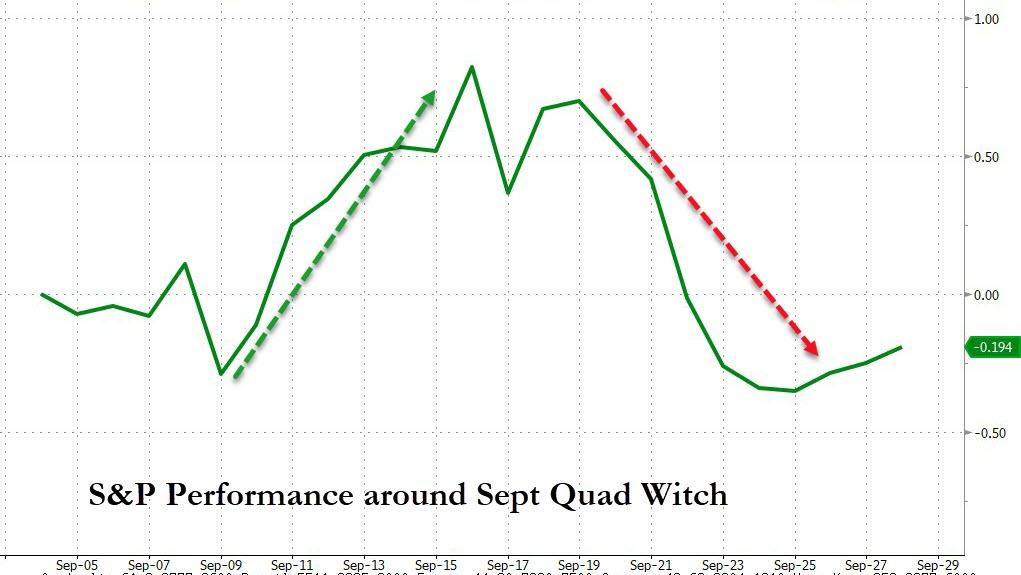

The weakness in stocks should not be totally surprising since post-September-Quad-Witch suggest this is very normal seasonally…

Source: Bloomberg

Treasury yields slid notably intraday but bonds were sold after the European markets closed…

Source: Bloomberg

30Y Yields fell to 1.38% handle intraday before rising back a little in the afternoon…

Source: Bloomberg

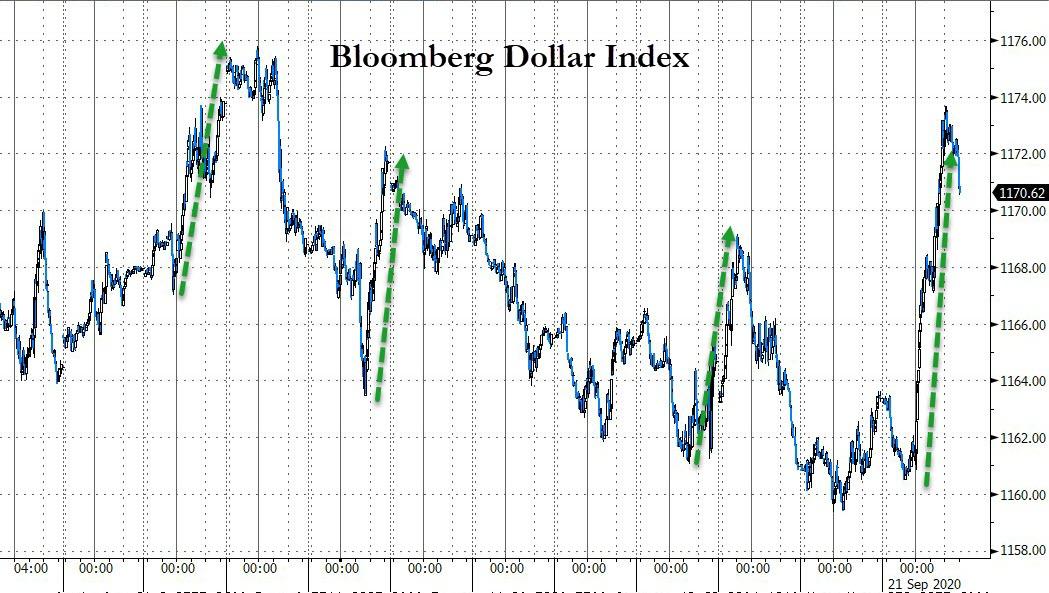

The dollar was panic-bid today (best day since June) as stocks sank…

Source: Bloomberg

And as the dollar surged, cryptos were crushed (led by Ethereum)…

Source: Bloomberg

Silver was clubbed like a baby seal but all commodities were ugly today…

Source: Bloomberg

Silver futures briefly fell to a $23 handle intraday…

And gold was hit hard as real yields spiked…

Source: Bloomberg

WTI fell back below the $40 handle…

Nattie futures plunged further below $2 on speculation that Tropical Storm Beta may spur power outages and curtail LNG exports along the Gulf Coast…

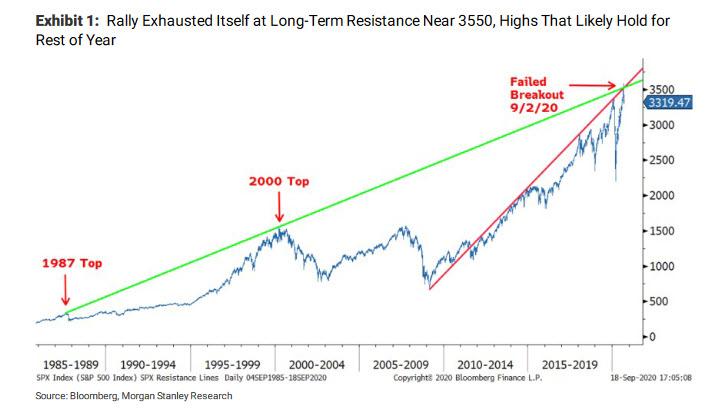

Finally, is the bounce off the March lows officially over?

Source: Bloomberg

And did we just ‘peak’…

Continue reading at ZeroHedge.com, Click Here.