Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bonds & Stocks Battered After Bombed Auction, Silver Soars

Tyler Durden

Thu, 08/13/2020 – 16:00

Everything was lining up nicely for a new record high in the S&P 500 this morning after the better than expected claims data (only 963,000 Americans filed for first time claims last week!!)… and then the 30Y auction hit (at 1400ET) and was a disastrophe coinciding with a spike back above the record closing high for the S&P…

Just one ‘wafer-thin mint’ more of fiscal and monetary largesse…?

Triggering weakness in bonds and stocks and a bid for gold and silver…

Nasdaq managed to bounce back from its drop but the rest of the US majors ended red…

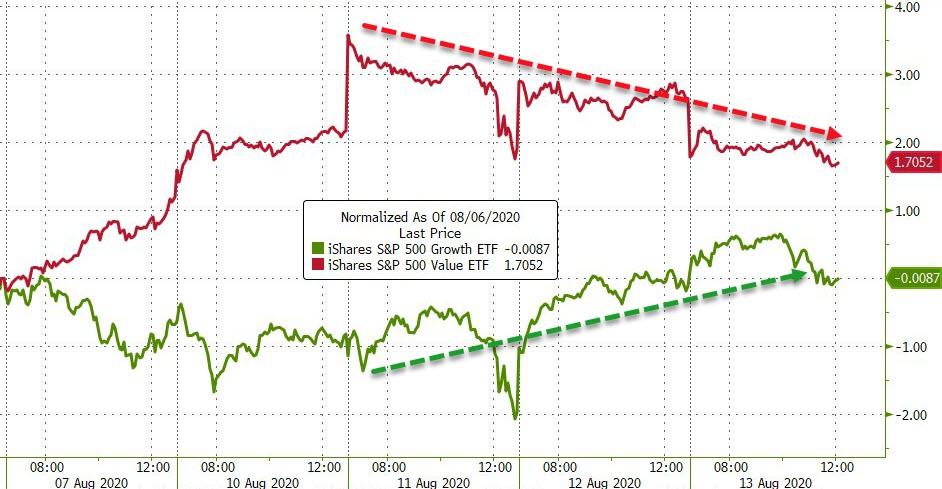

The momo/value rotation un-rotation accelerated…

Source: Bloomberg

Value stocks continued to sink after their surge earlier in the week…

Source: Bloomberg

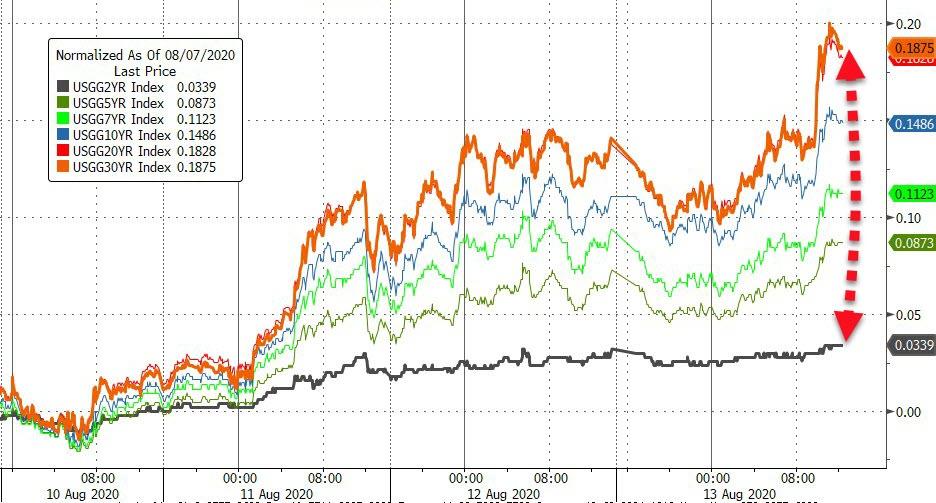

Bonds were clubbed like a baby seal, with the longer-end up around 5bps (2Y unch)…

Source: Bloomberg

30Y Yields are back at the June FOMC Minutes release levels…

Source: Bloomberg

We do note that while this move higher in rates ‘feels’ large, it is of a smaller scale than the early June bear

Source: Bloomberg

And while bonds and stocks were hit, gold was bid on the auction ‘fail’ (though came back and steadied after)…

Silver followed a similar path but was strongly higher on the day…

There was a major divergence between real rates (spiked) and gold (spiked) after the auction chaos…

Source: Bloomberg

Mark Gutman (@MarkGutman9) noted this odd move:

“Interesting to see Gold up & Bonds down. Yields are kept low so there isn’t enough demand at the price. Fed will be forced to buy more to keep yields low, in turn pushing fair prices higher thus reducing demand even more – forcing the Fed to buy even more. Cycle of death.“

Of course, all this (falling bond and stock prices and rising vol) was bad news for Risk-Parity funds and may lead to some exaggerated swings as forced deleveraging takes place…

The Dollar ended the day lower but rallied as the SHTF this afternoon…

Source: Bloomberg

CNH weakened after Larry Kudlow’s comments…

Source: Bloomberg

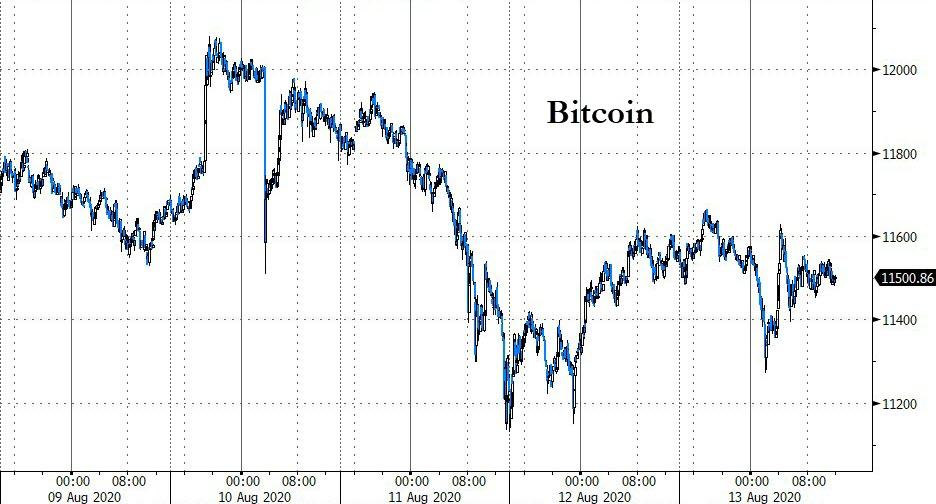

Bitcoin trod water on the day, recovering from some overnight weakness…

Source: Bloomberg

Copper continued to tumble…

And oil ended lower…

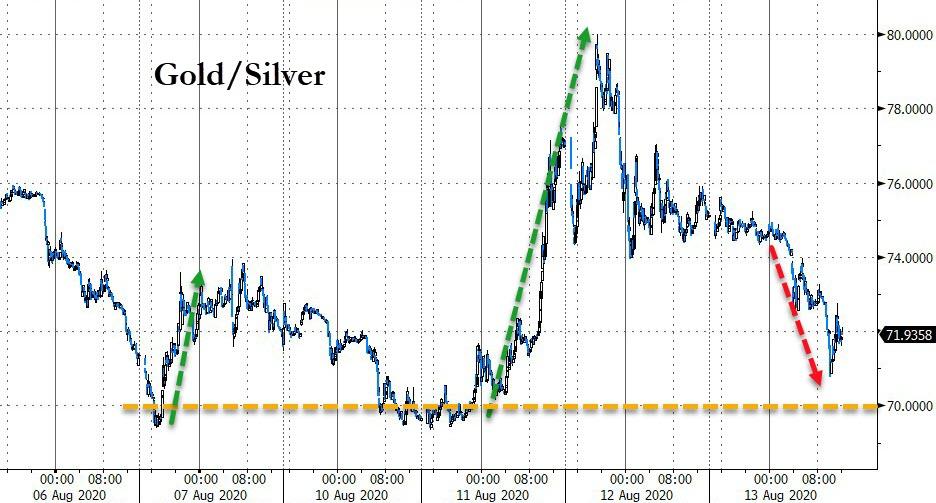

The Gold/Silver ratio erased most of last week’s spike thanks to silver’s gains today, but stalled again around 70x…

Source: Bloomberg

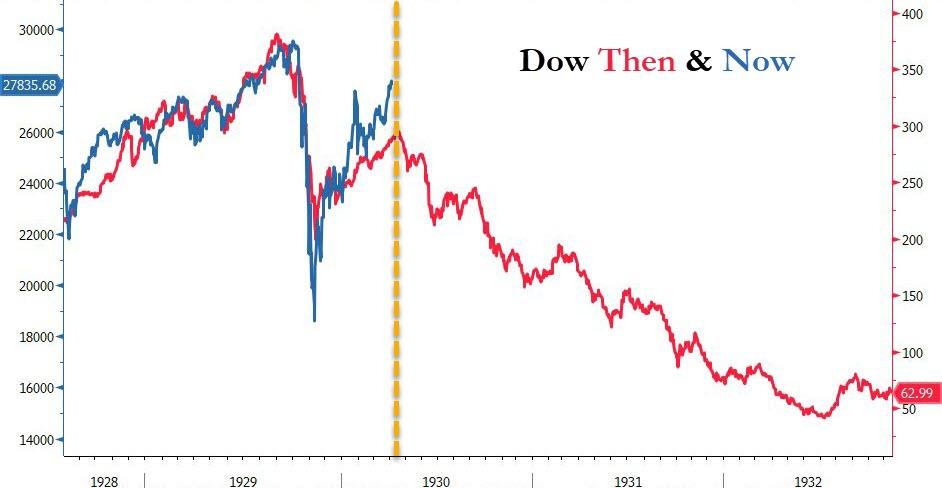

Finally, is time up?

Source: Bloomberg

And it’s still a long way for bonds and stocks to ‘meet in the middle’…

Source: Bloomberg

Continue reading at ZeroHedge.com, Click Here.