Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

This Is “Unsustainable”: Why Even Bullish Morgan Stanley Sees An Imminent Market Correction

Tyler Durden

Mon, 08/03/2020 – 16:25

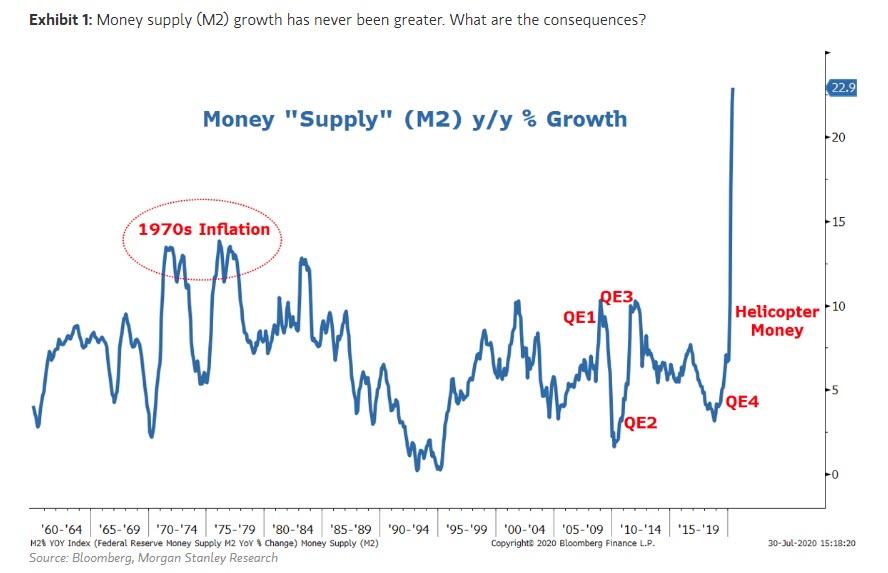

Yesterday we published the latest weekend note from Morgan Stanley’s chief equity strategist Michael Wilson in which he explained why he believes that in the long run his bullish take on risk assets would be validated, for the simple reason that long-absent inflation would finally emerge due to the launch of helicopter money which has triggered a record surge in M2 money supply…

… and because “congress is now in the driver’s seat when it comes to the money supply with its fiscal programs and, as Milton Friedman also famously said, “Nothing is so permanent as a temporary government program.”

This, as Wilson explained, was very different from the post GFC era when aggressive monetary policy was unmet with a willing borrower and spender: “We think this poses a greater likelihood for inflationary pressures to build. That’s actually a good thing for equities broadly because stocks tend to do well in rising inflationary environments, particularly when we are starting from such low levels.”

Furthermore, this time around, with the financial system in much better shape, and the direct intervention of Congress, “there’s a real chance that the money multiplier doesn’t fall so much, and money supply growth remains elevated, thereby driving aggregate demand and inflation – i.e., nominal GDP growth.”

That said, Wilson cautioned that there is a chance that in order to prompt Congress to move forward on the latest round of fiscal stimulus, the market will have to drop first, or as Wilson said, it is likely that we will “weather some uncertainty about it before it passes, and this may weigh on equity markets in the near term. In fact, this is what we expect, but we would use any weakness around such a delay to add to equities, especially cyclicals geared to higher inflation and economic growth.”

To be sure, if it was Wilson’s contention that stocks needs to drop first for Congress to reach a decision on the latest stimulus round, stocks clearly did not get the memo, with the S&P rising above 3,300 on Monday and now just a whisker away from its all time high. In fact, if anything, stocks are telegraphing that a new (multi) trillion stimulus is not at all necessary and this will only delay the final passage of a new stimulus round, which in turn will sooner or later – end up hitting stocks (not to mention crushing them if Neel Kashkari gets his way and the US economy is shut down again for another 4-6 weeks).

However, one way or another, it is virtually certain that Congress will pass a new stimulus bill, and if not, then perhaps Trump will simply sign another executive order seeking to pump up the market, if not economy, in the critical 90 days before the election.

So is Wilson correct and is there really nothing that can derail the market’s bubbly ascent?

Well, no, and as Wilson himself points out in the “Weekly Warm Up” follow-up note on Monday morning there are two issues, the first of which is that equity market leadership is skewed toward deflationary winners – namely growth and tech names – and thus making any sudden surges in inflation quite disruptive to portfolios.

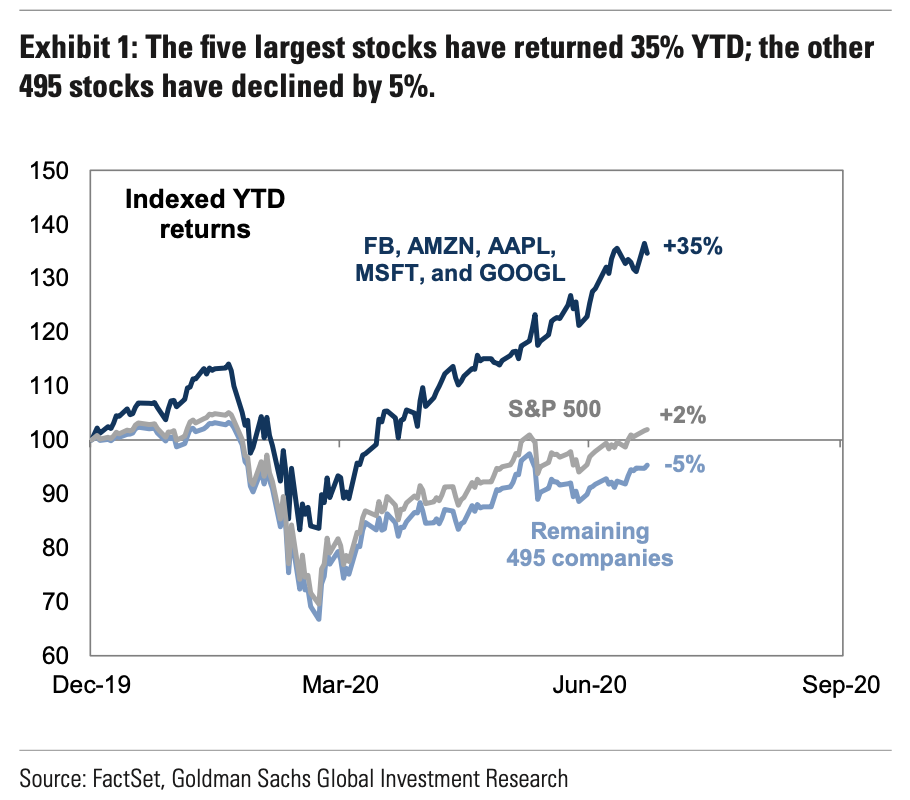

The other problem highlighted by Wilson is the same one that kept Goldman’s chief economist David Kostin up at the end of April, when as we noted in “Goldman Sees Imminent “Momentum” Crash As All S&P Gains Come From Just 5 Stocks”, Goldman warned that virtually all market gains comes from a handful of stocks (specifically, five of them Microsoft, Apple, Amazon, Alphabet and Facebook), which have soared more than 35% since the start of the year, while the rest of the market remains in the red.

Picking up on this, Wilson warns that “breadth continues to narrow, and something has to give.” Specifically, the MS strategist writes that “either the risks to the recovery–COVID case spike, election concerns, fiscal cliff–need to subside and the market broadens or these risks will ultimately topple the winners, too” almost verbatim repeating what Kostin said back in April (so far Kostin has been proven dead wrong).

Wilson also echoes Kostin’s lament that not nearly enough traders are positioned to benefit from a return in inflation, since “coming out of recessions, portfolios should be skewed more cyclically than normal. With many cyclical stocks and sectors recently underperforming on concerns about the recovery, the pitch may be fattest here for new investments. This is not to say COVID beneficiaries / growth stocks can’t do well too, but the valuation and positioning is already reflective of the strong recovery in such stocks.”

And so in addition to the lack of proper positioning to benefit from the coming inflationary surge, coupled with the expiration of unemployment benefits as well as the extreme crowding into a handful of stocks, Morgan Stanley believes that “very near term, the risk for the overall market is to the downside.”

And just in case the “5 vs 495” chart above is now enough, here is a striking example of just how narrow the market’s advances have become: Wilson points to Friday’s price action which he says “may have been a top in terms of narrowness of performance” – the reason: the Nasdaq 100 was up most of the day but only 20 % of the stocks in the index were up until the last hour mark up for month end.

In short, Wilson views the current skew between the COVID beneficiaries and laggards “as an unhealthy sign, and therefore unsustainable” and thinks that “the most likely outcome remains a 10 percent correction in the broader index by the biggest market winners at this point rather than the laggards.” However, once that correction is complete, Morgan Stanley expects the bull market to resume on its merry way and “to broaden out based on what we think will continue to be a surprising recovery in the economy and earnings later this year and into 2021” not to mention the coming surge in inflation, which Morgan Stanley – unlike so many others of its peers – is convinced is now just a matter of time.

Continue reading at ZeroHedge.com, Click Here.