Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

What Ad-Boycott? Facebook Shares Jump After Crushing Every Major Metric

Tyler Durden

Thu, 07/30/2020 – 16:16

Heading into earnings tonight, Facebook had been making plenty of headlines on twitter as an increasing number of virtue-signalers claim they are boycotting ad spend on the social media network (and not merely cutting costs amid COVID).

“We’re glad to be able to provide small businesses the tools they need to grow and be successful online during these challenging times,” said Mark Zuckerberg, Facebook founder and CEO.

“And we’re proud that people can rely on our services to stay connected when they can’t always be together in person.”

There appears to be zero impact from the ad-boycott (though the boycott didn’t technically start until July 1, the first day of the third quarter, so it’s unlikely there’s any impact visible in these numbers) as Facebook smashed the ball out of the park, beating on every major metric:

-

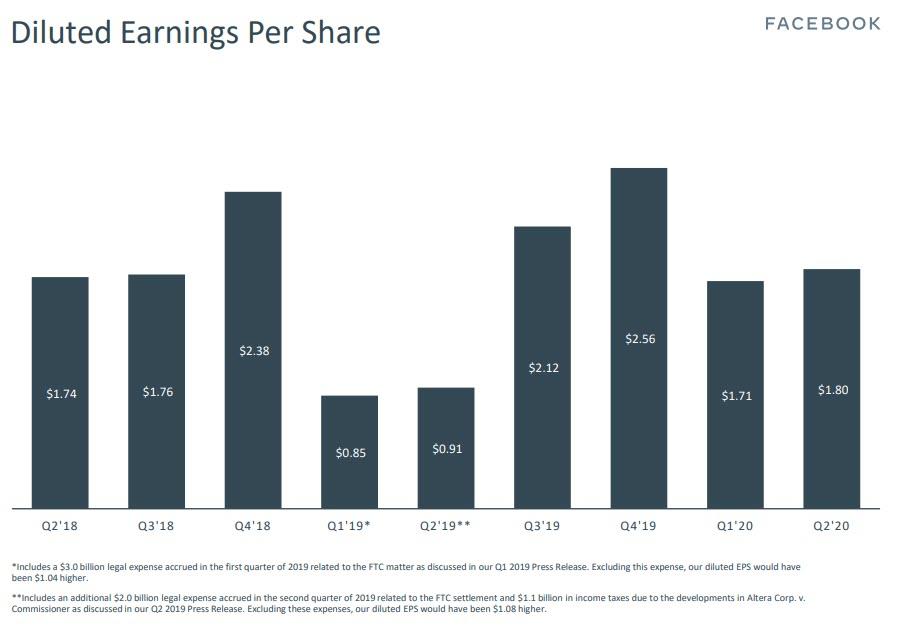

*FACEBOOK 2Q EPS $1.80, EST. $1.39

-

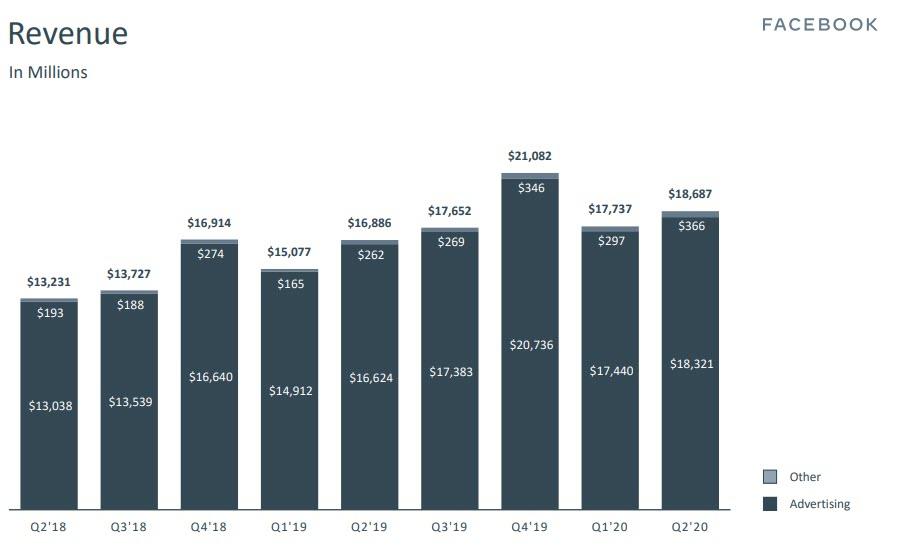

*FACEBOOK 2Q REV. $18.69B, EST. $17.31B (+11% YoY – its lowest since the IPO)

-

*FACEBOOK 2Q AD REV. $18.32B, EST. $16.92B

-

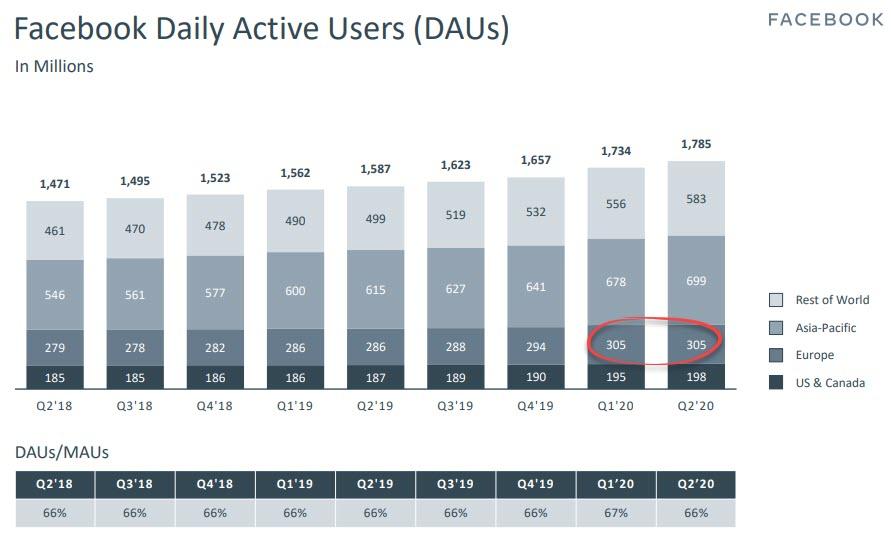

*FACEBOOK 2Q MONTHLY ACTIVE USERS 2.70B, EST. 2.63B (+12% YoY)

-

*FACEBOOK 2Q DAILY ACTIVE USERS 1.79B, EST. 1.74B (+13% YoY)

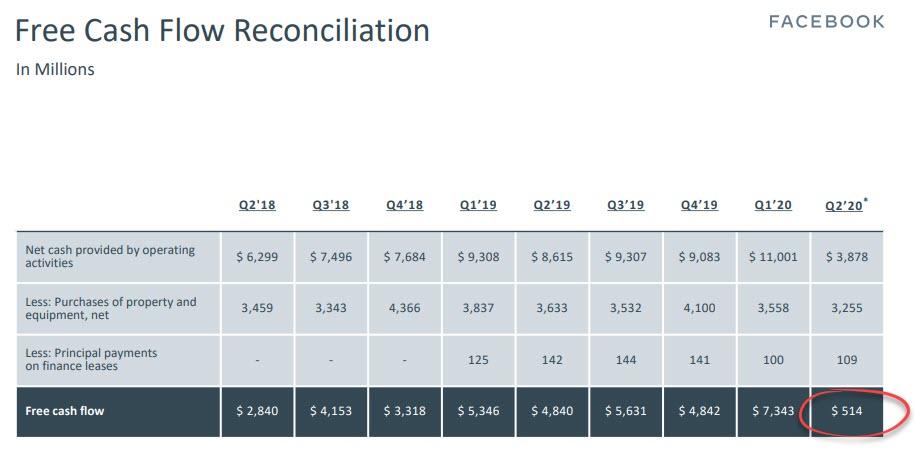

We do note that Free Cash Flow fell significantly…

Looking ahead, Facebook sees DAUs and MAUs “flat to slightly down QoQ,” and ad revenue for Q3 in line with July (which given the boycott may mean weaker) and expects FY20 CapEx at the high of the $14-16bn range.

“In the first three weeks of July, our year-over-year ad revenue growth rate was approximately in-line with our second quarter 2020 year-over-year ad revenue growth rate of 10%. We expect our full quarter year-over-year ad revenue growth rate for the third quarter of 2020 will be roughly similar to this July performance.”

This sent FB shares up almost 9% after hours to a new record high…

Facebook outlines several factors contributing to its outlook, including:

-

First, continued macroeconomic uncertainty, including the pace of recovery and the prospects for additional economic stimulus;

-

Second, our expectation that some of the recent surge in community engagement will normalize as regions reopen;

-

Third, the impact from certain advertisers pausing spend on our platforms related to the current boycott, which is reflected in our July trends; and

-

Lastly, headwinds related to ad targeting and measurement, including the impact of regulation, such as the California Consumer Privacy Act, as well as headwinds from expected changes to mobile operating platforms, which we anticipate will be increasingly significant as the year progresses.

Finally, we note that Facebook’s headcount was 52,534 as of June 30, 2020, an increase of 32% year-over-year.

Continue reading at ZeroHedge.com, Click Here.