Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

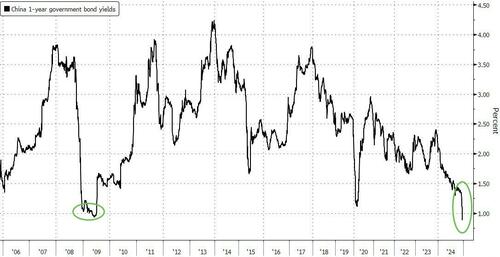

Trump Effect? China’s 1Y Yield Crashes Below 1% For First Time Since GFC

For the first time since the Great Financial Crisis (2008/9), short-dated Chinese bond yields have plunged back below 1%. In fact they are now at record lows…

Source: Bloomberg

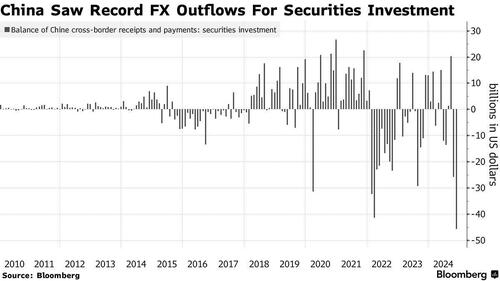

As we head into the end of the year, impatient investors are left waiting for a real plan to underwrite consumption (as yields melt inexorably lower), and capital flight accelerates (spurred by concerns about yuan weakness). China suffered a record fund exit last month under the category of securities investment, according to official data released this week.

The drop in one-year yields reflects “prevailing expectations for PBOC’s strong easing next year amid the moderately loose policy and the shortage of high quality fixed-income assets,” said Ken Cheung, chief Asian foreign-exchange strategist at Mizuho Bank in Hong Kong.

“Such developments could intensify concerns over US-China monetary policy divergence, and reinforce yuan depreciation pressure.”

Demand for shorter-maturity debt is also rising after the central bank pushed back against the bond-buying frenzy, prompting traders to shift away from longer-dated securities that are more exposed to the risk of intervention.

Shorter-dated bonds may be benefiting from several factors, including ample liquidity and the central bank’s operation of “buying short-term government bonds and selling some longer-dated notes,” said Zhaopeng Xing, a senior strategist at Australia & New Zealand Banking Group Ltd.

While the PBOC’s operations may have contributed to the front-end rally, the slide in yields “looks quite extreme,” said Zhaopeng Xing, a senior strategist at Australia & New Zealand Banking Group Ltd.

That’s because yields have fallen below the level of about 1.1% paid by banks for deposits that are often used to buy bonds, he said.

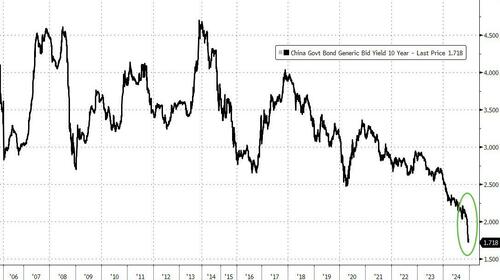

However, as Bloomberg reports, some analysts at least are warning the bond rally may be nearing its end.

A pickup in economic growth, along with a shift in consumer savings behavior and a more cautious-than-expected PBOC policy, may turn the bond bull run into a rout next year, said Adam Wolfe, an emerging markets economist at Absolute Strategy Research in London.

“China’s bond market likely overstates the easing that’s expected.”

The decline in yields is spurring debate about whether China’s economy is heading toward a recession… especially if Trump’s tariff threats become real and not just a negotiating tactic.

There’s some speculation interest rates may fall to zero if government efforts to bolster consumption and property demand continue to fall short.

The nation’s longer-maturity yields dropped below their Japanese counterparts last month in a sign investors are positioning for so-called Japanification of the world’s second-biggest economy.

Tyler Durden

Fri, 12/20/2024 – 15:00

Continue reading at ZeroHedge.com, Click Here.