Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Nvidia Dumps, Gold Pumps As Dollar General Craters Most On Record

It was all about Nvidia’s earnings, and how the market would react to them, and… well, it left a bit to be desired.

After initially spiking as high as $128 on blowout Q2 earnings, NVDA then dumped instantly as the market was disappointed with the company’s Q3 guidance, before staging a modest rebound into the Thursday premarket, only to see the gains then fade, and slide more than 6%, and wiping out $200 billion in market cap.

Still, the move was not as big as the option straddle suggested – market was pricing in a 10% swing – so both calls and puts saw their value tumble as vol repriced dramatically lower.

While NVDA failed to reverse losses, the same can not be said for the Nasdaq which after tumbling almost 1.5% overnight, scrambled to rebound and even turned briefly green at one point, before it too also reversed and stumbled lower, dragging spoos with it. In fact, the only index that did well today was the Russell, because now that earnings season is officially over, all focus turns back to the Fed and the looming rate cut in September which will benefit heavily debt-laden small caps more than all other companies.

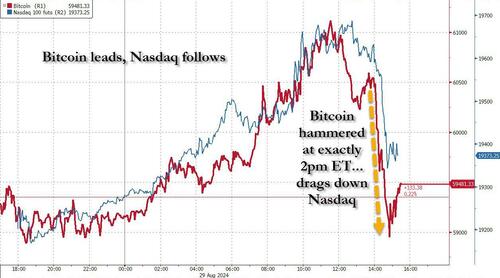

While there was no specific catalyst for this afternoon’s swoon, one possible reason behind the move was a slamdown of bitcoin (really Solana) at exactly 2pm ET, which then quickly dragged down the Nasdaq and the rest of the risk complex.

While stocks swung at the whims of crypto HFT market makers such as Jane Street, oil managed yet another rebound and after hitting YTD lows just a few days ago, Brent once again rebounded back over $80, on growing concerns about Libyan production.

The oil recovery naturally meant that yields would have a tough day staying down, and sure enough the 10Y hit a one week high rising just shy of 3.90%, having broken out of a triangle formation to the upside, and clearing the path for higher highs (today’s poor 7Y auction certainly helped push yields higher)…

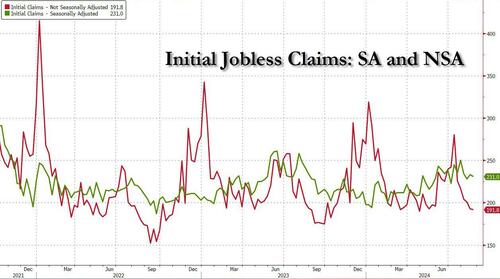

… especially after today’s unadujsted initial claims hit a new 2024 low, assuring that next week’s jobs report will come in well hotter than expected, as last week’s near record negative jobs revision was the big reset the BLS needed to “come clean”, allowing the agency to once again resume cooking the books heading into the election.

And let’s not forget today’s much hotter than expected GDP print, which came in at 3%, and was entirely on the back of a spike in personal spending…

…. which of course is a joke when one considers the record implosion in ultra discount retailer Dollar General – which now caters to not just the lower class but also a substantial portion of the “middle class” – which suffered its biggest market cap drop on record, and sent its stock price to 6 year low!

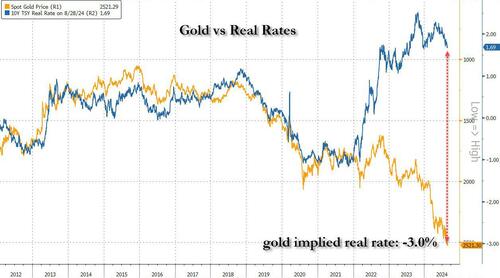

The above chart of course reeks of massive fiscal or monetary looming stimulus, whether it is under president Kamala or Trump, something which gold is clearly sniffing out as it hits another record high, and stronly suggests that real rates should be about 4.5% lower, at -3.0%!

TL/DR: the countdown to the next stimmy has begun.

Tyler Durden

Thu, 08/29/2024 – 16:04

Continue reading at ZeroHedge.com, Click Here.