Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Gold Soars To Record High, Dollar Dumps As Kamala Unveils ‘Populist’ Economic Plan

We are sure it’s just a coincidence…

…but on the day that Kamala Harris unveils her price-fixing, vote-buying agenda for economic growth…

…the dollar plunged to 5-month lows…

Source: Bloomberg

… and gold soared to a record high, topping $2500 for the first time…

Source: Bloomberg

US equities also soared this week to their best week since 2023, led by a a 5%-plus surge in the Nasdaq (up 12% from last Monday’s lows)…

Nasdaq rallied up to a key technical resistance level – at its 50DMA and the last July high…

Which mirrors the rebound in Mag7 stocks (as they rallied up to the late-July highs, but couldn’t break it)…

Source: Bloomberg

Small Caps were lifted by an ongoing short-squeeze…

Source: Bloomberg

VIX was clubbed like a baby seal on the week, extending its largest/fastest retracement ever…

The collapse of implied vol this week leaves a massive discount to the realized vol of the last month…

Source: Bloomberg

Credit markets rallied hard this week, adjust back from “hard landing” to “soft landing” scenarios…

Source: Bloomberg

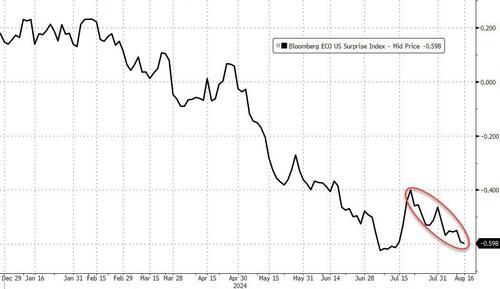

Despite all the focus on jobless claims, CPI, and retail sales, this week was actually a ‘weak’ one for US macro surprises…

Source: Bloomberg

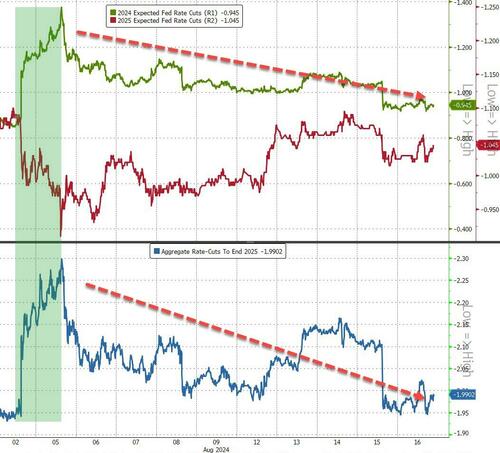

…and that sparked a hawkish drop in rate-cut expectations – back to pre-payrolls levels (less than 200bps of cuts to end-2025)…

Source: Bloomberg

That prompted weakness at the short-end (+1bps) of the Treasury curve on the week (but the long-end ended 7bps lower on the week). The obvious shift was the bearish rise in yields after CPI…

Source: Bloomberg

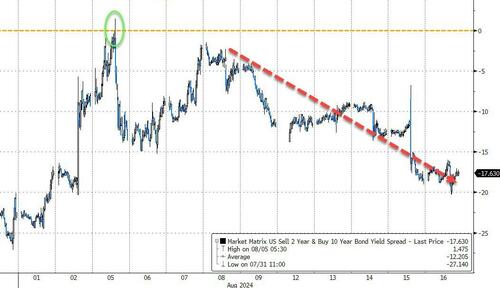

The yield curve flattened significantly on the week, with 2s10s re-inverting…

Source: Bloomberg

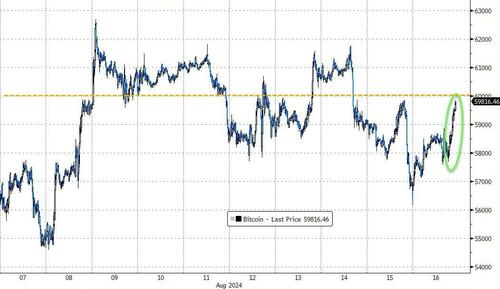

Another choppy week for crypto but today saw Bitcoin surge back up to $60,000 as Kamala spoke. to end the week unchanged…

Source: Bloomberg

Oil prices were flat on the week after some volatile days…

Source: Bloomberg

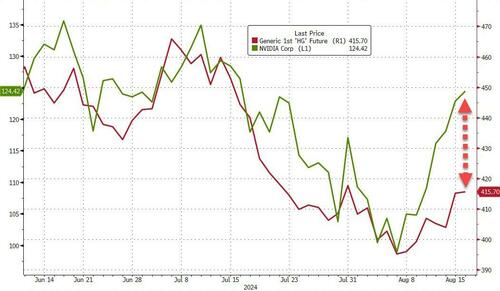

The other side of the AI-trade – copper – is not buying the euphoria in AI stocks…

Source: Bloomberg

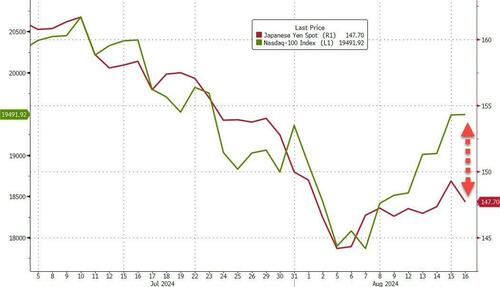

Also worth noting is that the yen carry trade was not fully embraced to lift stocks…

Source: Bloomberg

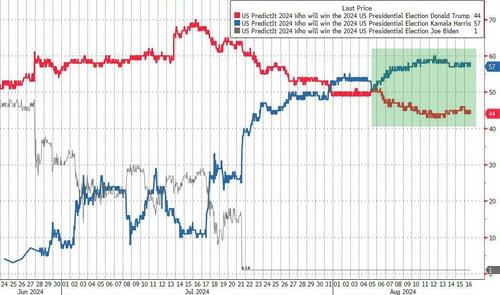

Finally, the plunge in the dollar and surge in stocks and gold all took place since Kamala overtook Trump in the prediction markets…

Source: Bloomberg

Coincidence?

Tyler Durden

Fri, 08/16/2024 – 16:00

Continue reading at ZeroHedge.com, Click Here.

_4.jpg?itok=zhiHhqVI)