Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bitcoin & Bullion Bid As Hawkish FedSpeak Hammers Stocks & Bonds

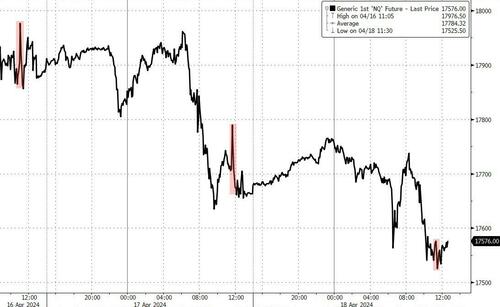

Stocks had limped higher all night after four straight days lower but into the cash open, Fed’s Williams ruined the party by admitting that while rate-hikes are not ‘his baseline’ they are possible if the data warrants. But that dip was bought aggressively after the open.

Stocks were spooked a little by the ‘no landing’ narrative screaming from Philly Fed’s data (showing HL improvement but soaring prices-paid, and despite the weakest workweek since COVID lockdowns, expectations for prices are at multi-year highs…), boringly (and mysteriously) solid jobless claims, and benign home sales…

Source: Bloomberg

But then more hawkish FedSpeak wrecked the ramp-fest as Bostic warned The Fed “won’t be in a position to cut rates until the end of the year.”

That leg pushed Nasdaq down to break its MT CTA ‘sell’ threshold (17,569) and things got interesting. A late-day bid put some lipstick on an otherwise pig of a day, but it couldn’t hold. The Dow closed green, Nasdaq was the biggest loser, with S&P and Small Caps red…

S&P down for five straight days hasn’t happened since October 2023 (just ahead of The Fed ‘Pivot’)…

Source: Bloomberg

Albeit much smaller, we once again saw a pump-n-dump around 1400ET…

Source: Bloomberg

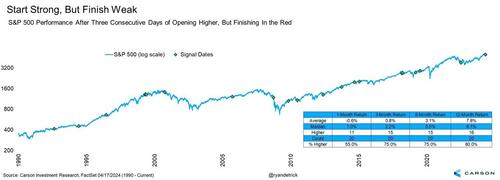

Additionally, as @Ryan Detrick noted on X:

Since 1990, I found 20 other times the S&P 500 opened green, but eventually closed red three consecutive days. It just happened today.

Negative returns on avg a month later and up only 55% of the time.

Could this be a subtle clue the bulls are losing control?

Having broken down through the ST CTA ‘sell’ threshold earlier in the week, today saw Nasdaq lose the MT CTA ‘sell’ threshold (17,569) and chop (support at 17462 (100DMA))…

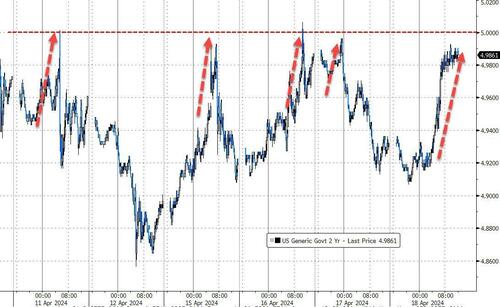

As Goldman’s trading desk confirmed ” a combo of continued hawkish fed and strong macro data….testing some key levels too, with 2y notes right around 5%, and would think as we approach the weekend, there’s likely gonna be a push/pull between geopolitical weekend risk premium vs supply next week.”

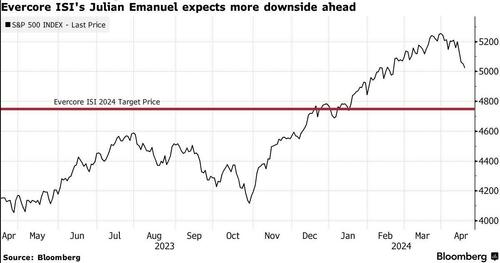

“As a strategist, it is an uncomfortable place to be to have a target below the market, but our work continues to lead us in the same direction,” Evercore ISI’s Julian Emanuel said in an interview.

“Valuations are very, very taxing and the forward returns at these valuations tend to be subpar.”

The average pullback in a non-recession year is 13%, Emanuel added, pointing to stickier cost pressures and monetary policy that is “more of a question mark” as catalysts for further declines.

“Part of the story that got us — particularly in the momentum stocks — as overextended as we were at peaks in March, was that the public was an incredibly enthusiastic player in equity markets who saw some record flows,” Emanuel said.

“We now think this is an environment where people are going to temper their optimism and do a little bit of reset.”

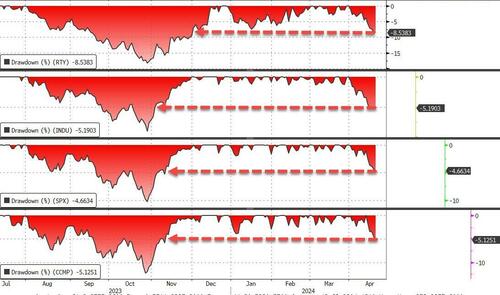

Indeed, the US majors are suffering their biggest drawdowns since Sept 2023 (right before the Fed Pivot)…

Source: Bloomberg

VIX is now near its 6m high as markets continue to grapple with geopolitical tensions in the Middle East, and credit markets have started to crack…

Source: Bloomberg

But, while equities were not pretty, bonds were just as ugly with yields up 6bps across the short-end and belly with the long-end modestly outperforming (30Y +4bps)…

Source: Bloomberg

…with 2Y yields pushing back up to 5.00%…

Source: Bloomberg

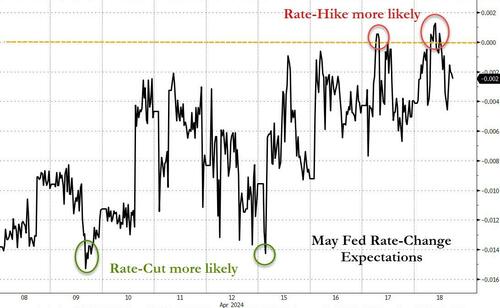

For some brief moments today, May rate HIKES were more likely than CUTS…

Source: Bloomberg

…and 2024 rate-cut expectations closed at a new low with just 38bps priced-in…

Source: Bloomberg

After a couple of hard days, Bitcoin extended yesterday’s bounce off $60,000 ahead of what is expected to be the ‘halving’ tomorrow…

Source: Bloomberg

Gold also gained on the day, back above $2390 intraday…

Source: Bloomberg

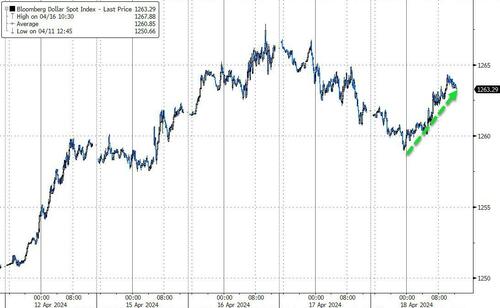

…even as the dollar rallied…

Source: Bloomberg

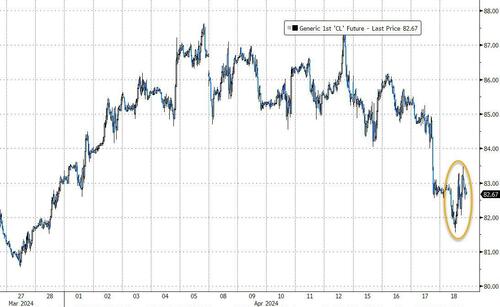

Oil prices ended unchanged on the day, recovering from an early puke to an $81 handle (WTI)…

Source: Bloomberg

Finally, the “no landing” narrative is winning…

Source: Bloomberg

…and as Nomura’s Charlie McElligott pointed out “‘no landings’ lead to ‘hard landings'”.

Tyler Durden

Thu, 04/18/2024 – 16:00

Continue reading at ZeroHedge.com, Click Here.