Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Silicon Valley Bank’s Bankruptcy: 100% guaranteed no Bailout because of the Dodd-Frank Act.

The Silicon Valley Bank’s bankruptcy had sent ripples across the financial landscape, striking fear into the hearts of its customers and investors alike. Yet, amidst the uncertainty, one thing is certain: there will be no bailout.

The Dodd-Frank Act, a federal law passed in 2010 to respond to the catastrophic 2008 financial crisis, guarantees this assurance. The Dodd-Frank Act ensures the orderly liquidation of failing financial institutions, preventing any disruption to the financial system. It is a shield against any kind of avarice, providing a safe haven for those who fear the perils of the past.

The FDIC has the authority to assist failing banks, including injecting capital or providing guarantees, but the Act ensures that taxpayer funds are limited. Instead, the shareholders and creditors will bear losses first. It is a far cry from the bailouts of the past, where taxpayers had to foot the bill for the failures of the banks.

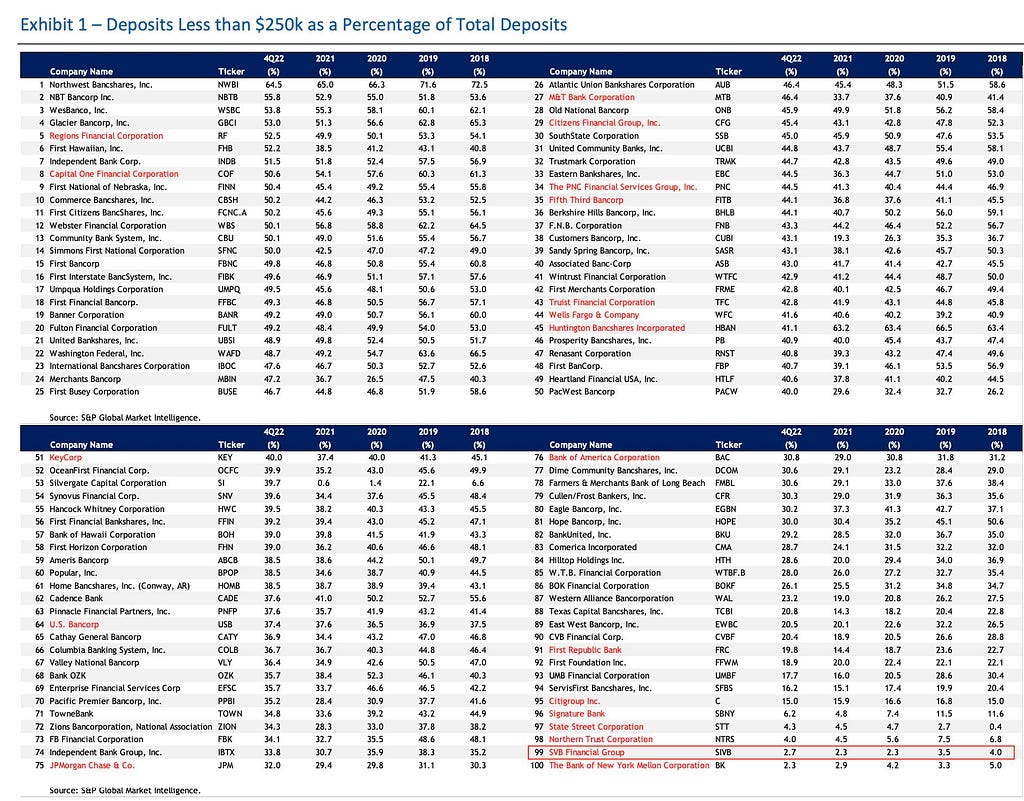

In the case of Silicon Valley Bank’s bankruptcy, the shareholders and creditors, not taxpayers, will bear any losses incurred during the liquidation process. With only 2.7% of SVB deposits under $250,000 FDIC insurance protection, there will be no privatized wins and socialized losses this time. The Dodd-Frank Act is a 100% guarantee for that.

The OLA provision of the Dodd-Frank Act prohibits using taxpayer funds to bail out failing financial institutions, creating a clear and equitable distribution of the costs of a bank’s failure. It is a significant departure from the past, reflecting the public outrage and calls for reform that followed the 2008 financial crisis.

The Dodd-Frank Act is meant to prevent another such disaster from occurring again. It creates a more transparent and fair system, preventing moral hazard, and the risk of banks taking excessive risks knowing that the government would bail them out if they failed.

The Silicon Valley Bank’s bankruptcy is not without consequences for its customers and investors. Losses may still be incurred during the liquidation process, and depositors may take some time to access their funds. But the Dodd-Frank Act provided a framework for an orderly resolution, which should minimize disruptions to the financial system.

In conclusion, the Silicon Valley Bank’s bankruptcy will cause fear and uncertainty, but the Dodd-Frank Act provided a shield against the perils of the past. It ensured that there would be no bailouts, protecting taxpayers from the excesses of the banks. It creates a more equitable system, preventing moral hazards and ensuring a fair distribution of costs.

About the Author

Patrick Mehrhoff is the Founder and CEO of MEHRHOFF DIGITAL, a leading Marketing Consultancy for Financial Services. He has a proven track record of success, having established marketing departments for Swiss FinTech startups, MoneyPark and Crypto Finance, that generated exit values exceeding 400 million and valuations over two billion. Patrick is a German national, Certified FinTech Professional, and holds an MBA from the Power Business School.

About the Company

MEHRHOFF DIGITAL is the #1 trusted marketing consultancy for Financial Services, combining high-level strategy and creative imagination with meticulous execution, fueled by a results-driven and intuitive genius, reliable data, success-based performance, and outstanding conversational wit. We help Financial Services gain a competitive edge, driving MRR, PQLs, and MQLs with meticulously crafted marketing solutions, products, and services.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Silicon Valley Bank’s Bankruptcy: 100% guaranteed no Bailout because of the Dodd-Frank Act. was originally published in The Capital Platform on Medium, where people are continuing the conversation by highlighting and responding to this story.