Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Wall Street’s Biggest Bear Buys The Dip: “I Don’t Think This Rally Is Over”

Less than a month ago, as the S&P 500 face-ripped higher off the mid-October puke opening lows, Wall Street’s biggest bear – Morgan Stanley’s Mike Wilson – warned traders that this rally could have legs…

… we may get another overshorted, oversold rally on Monday and we may get a powerful bear market rally in November that pushes stocks to 4,000 or higher by year end, but the bear market won’t end until the Fed pivots. The timing of that still remains to be determined, however after the midterm elections when the political blinders drop, we expect that the full – and dire – picture of the US labor market will finally emerge and shock everyone, especially the Fed.

Today, following the softer than expected CPI print, Wilson reiterated during an interview with Bloomberg TV that the recent rally in US equities isn’t finished and should keep running over the coming weeks.

“There’s probably further to go, probably through Thanksgiving, maybe even into early December,” Wilson, the bank’s chief US equity strategist, said in an interview on Bloomberg Television on Friday.

“I don’t think the rally is over at this point.”

But once the S&P 500 breaks through its 200-day moving average, which currently sits around 4,081, that may “get the animal spirits going” and draw in more passive flows, he explained.

That could propel the broad index to 4,200 or 4,300, he added.

As rates begin to ease back this week, Wilson confirms that will help alleviate pressure on longer-duration assets like growth stocks, which will help lead to the next leg of the equity rally,

“As rates come down… the Nasdaq, which has been the laggard in this rally so far, can now catch up,” Wilson said.

“That’s tied directly to the move in rates.”

Of course, there is downside risk as Wilson hedged in October, “if this market cannot hold the 200-WEEK moving average, then it’s likely there will be no meaningful countertrend move. Instead, we can make straight shot to 3400 or lower. A break below last Thursday’s lows would seal the deal in that regard, in our view.”

“It’s going to remain volatile,” Wilson cautioned.

“It’s still a bear market so it could rip you apart.”

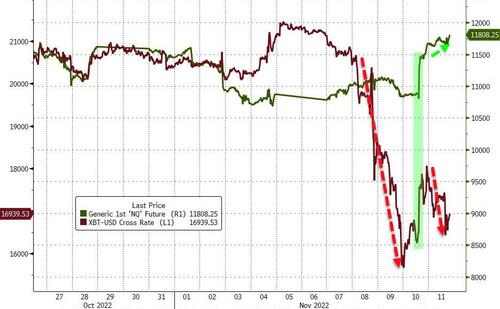

Finally, Wilson pointed out that US equities have held up despite the selloff in cryptocurrencies in the wake of the meltdown in Sam Bankman-Fried’s FTX crypto empire.

“Clearly, this overhang from crypto isn’t constructive,” Wilson said.

“We’re having this event, which is a little bit scary, and yet the market was up…which tells me that people were just out of position.”

We do note that cryptos tried to rally on the CPI print (green box), but the overhang from FTX is too strong…

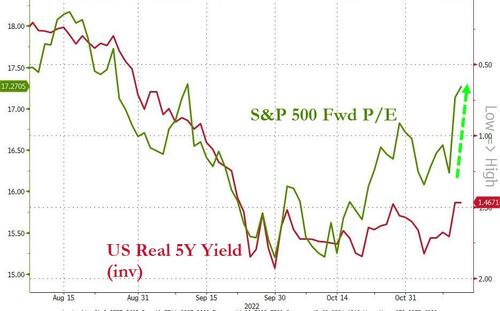

The gains this week, as rates fell, have been all valuation-driven as P/Es soared. However, as the Morgan Stanley equity strategist explained, while P/Es are close to fair value assuming EPS estimates are correct; they’re still not.

In other words, “until earnings fall, the market can dream and P/Es can even increase if rates come down.”

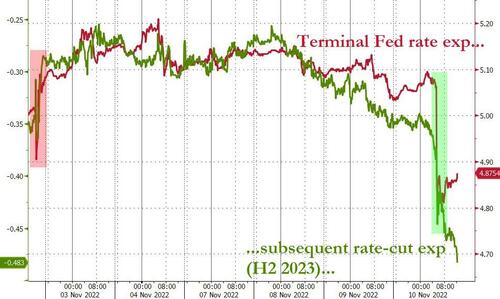

But, those P/Es will soar dramatically rich if/when the ‘E’ is repriced… and if the market really thinks The Fed will be cutting 50bps in H2 2023 (as seen below), then equity valuations are clearly not pricing in the only thing that would prompt The Fed to pivot that aggressively dovish – a recession…

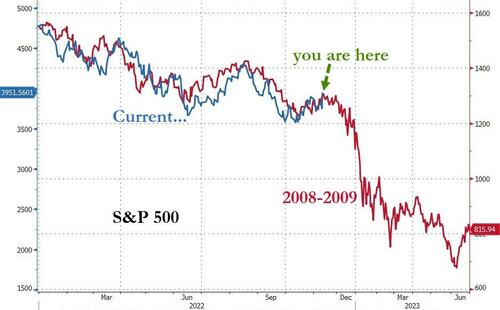

Finally, Wilson noted, “we do think this ultimately is a bear-market rally.” And we have seen this kind of bounce before…

Watch the full interview below:

Tyler Durden

Fri, 11/11/2022 – 14:20

Continue reading at ZeroHedge.com, Click Here.