Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Markets Turmoil As Bad News Is Not Great News Anymore

Shitty data has been very supportive for the last few days in markets as the world and their pet rabbit anticipates a Fed pivot being forced on Powell by recessionary forces.

Three things changed today

1) Jawboning – A smorgasbord of Fed (former and current) Speakers jawboned down the idea that a Fed Pivot is imminent.

2) Really Ugly Global Data – ISM Manufacturing data shit the bed and GDPNOW followed suit with a sizable downgrade of its Q3 growth forecast, (which followed terrible data out of China and EU)

3) WW3 Worries – Perhaps only of side notice but Pelsoi’s plan to visit Taiwan raises the risk of WW3 and that is just too bad of news to be buying.

And that prompted the ‘bad news is good news’ narrative to implode, leaving stocks lower, oil down hard, bond yields tumbling (and curve inverting), crypto dumped, and the Dollar and Yuan sold… with Gold bid.

The ugly China and EU data (accelerated by the Pelosi headlines) sent futures lower into the cash equity open, the algos kneejerk bought the dip on the ugly ISM data (prices paid were down), but those gains never held as confidence waned. By the close, the S&P was the ugliest horse in the glue factory…

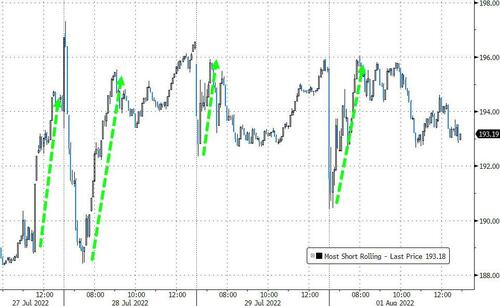

The opening weakness was short-squeezed back up but could not hold…

Source: Bloomberg

Treasuries were mixed with the short-end underperforming (2Y +1.5bps, 30Y -10bps)…

Source: Bloomberg

Which inverted the curve even more dramatically, erasing all the steepening since The Fed…

Source: Bloomberg

The 10Y Yield closed at its lowest in 4 months…

Source: Bloomberg

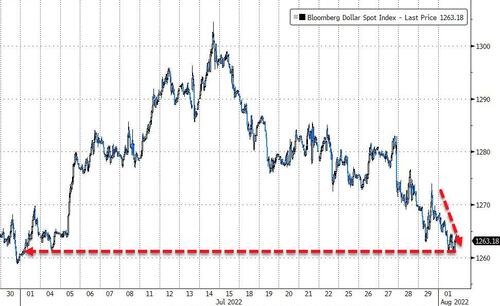

The dollar lost ground today, back at one month lows…

Source: Bloomberg

As did the Chinese yuan on Pelosi headlines (and an ugly PMI print overnight)…

Source: Bloomberg

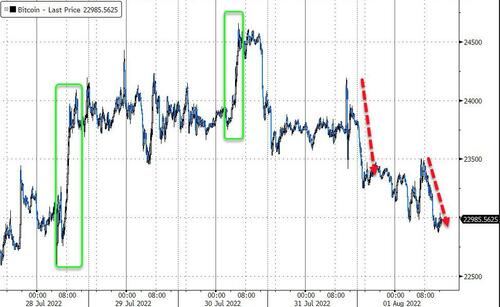

Cryptos slipped lower after strong gains on Saturday…

Source: Bloomberg

Gold rallied today, extending its bounce off $1700 and nearing $1800…

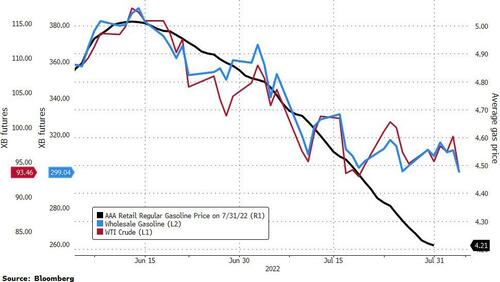

Oil prices tumbled amid ugly data from China, EU, and US (and news that EU/UK will delay their insurance sanctions against Russia)…

Finally, we note that the drop in gas prices may be coming to an end very soon as wholesale gasoline and crude prices have decoupled from retail pump prices…

Source: Bloomberg

Not good news for President Biden’s ratings. Nor is this…

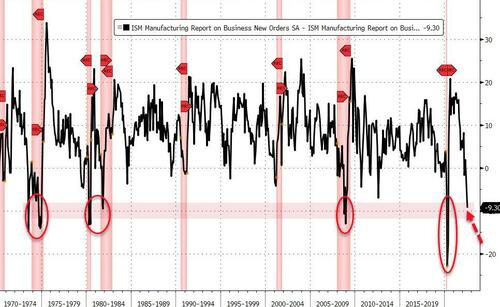

Finally, in case you needed any convincing, this morning’s ISM data had some interesting subcomponent action under the surface.

As @charliebilello notes, the last 4 times the spread between New Orders and Inventories in the ISM Manufacturing Index was this negative, the US was already in a recession. The 2001, 1990-91, and 1981-82 recessions never had readings this low…

But of course, it’s different this time right… because President Biden is in office?

Tyler Durden

Mon, 08/01/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.