Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Crude Crashes, Yield Curve Inverts, Bonds & The Dollar Surge

With July 4th hangovers, America came back to work focused on growth scares, Fed reaction-functions, and shrugging off inflation anxiety. The dollar roared higher on euro weakness (because ECB is scared to hike as aggressively as The Fed as the European economy looks like its collapsing). Oil and bond yields plunged on recession fears – and the yield curve inverted. Breakevens were battered as inflation fears fade (sparking a dovish shift in rate-hike trajectory which helped send growthy stocks soaring in anticipation of Fed rate-cuts and QE), and gold was clobbered on the soaring dollar.

about time https://t.co/L6Wjq5jxDM

— zerohedge (@zerohedge) July 5, 2022

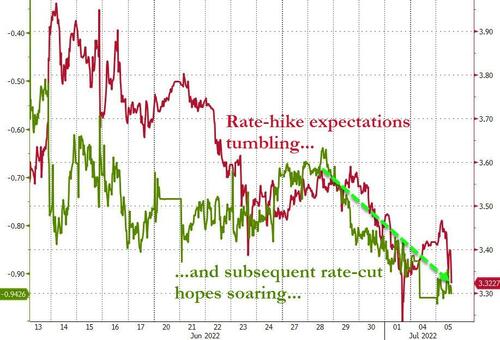

The market is now pricing in less than 7 more rate-hikes (having peaked at over 12 more) and almost 4 subsequent rate-cuts in 2023…

Source: Bloomberg

With a 50% chance of a rate-cut happening in Q1 2023…

Source: Bloomberg

And as that dovishness was priced in, so stocks rebounded as Europe closed. The Nasdaq screamed from down 2% to up over 1.6%, the S&P was down over 2% at its lows and rallied back into the green in the last hour. Small Caps stalled at overnight highs…

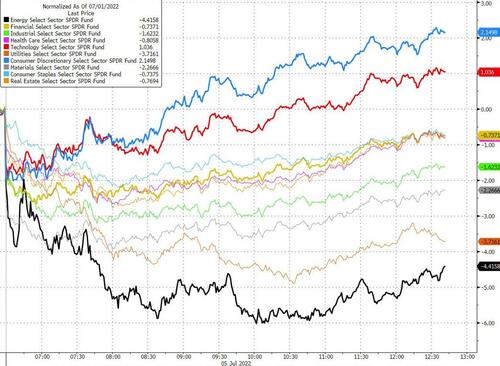

Energy stocks were the hardest hit but only Tech and Discretionary stocks made gains on the day…

Source: Bloomberg

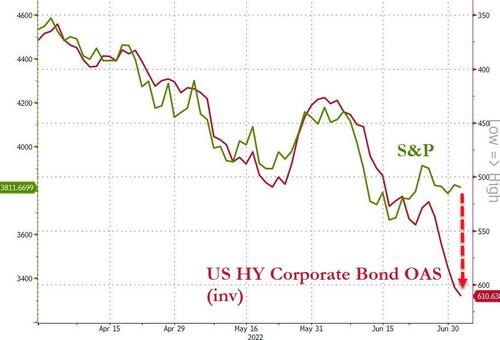

However, credit markets were not buying this bounce in stocks…

Source: Bloomberg

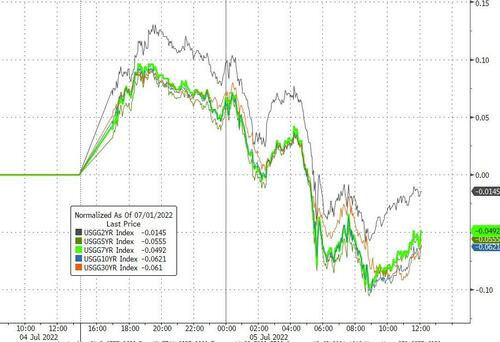

Treasury yields were lower on the day with a massive 20bps swing from high to low on the day…

Source: Bloomberg

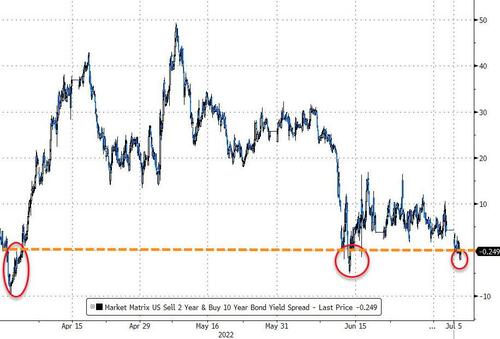

All of which inverted 2s10s for the 3rd time this year…

Source: Bloomberg

And inverted 2s5s for the first time since the 2020 COVID lockdowns…

Source: Bloomberg

As inflation fears abate, Breakevens tumbled back to Oct 2021 levels…

Source: Bloomberg

The Euro was routed to near parity and 20 year lows against the dollar…

Source: Bloomberg

Which smashed the Dollar Index back nears its COVID Lockdown crisis safe0-haven spike highs (if biggest one day jump since June 2020)…

Source: Bloomberg

Cryptos rallied today, in sync with Nasdaq’s gains, erasing all the early losses…

Source: Bloomberg

As the dollar ripped, gold was clubbed like a baby seal back below $1800 to its lowest level since Oct 2021…

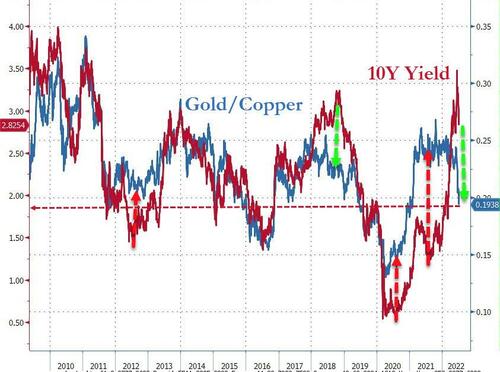

Copper crashed to its lowest since Nov 2020, which along with Gold implies a dramatically lower 10Y Yield…

Source: Bloomberg

Worst day for WTI since the world locked down in March 2020 and back below $100 for the first time since May 11…

Wholesale gasoline prices crashed alongside, back to $3.27 at their lows…

US National gas prices are down 21 straight days…

Source: Bloomberg

Finally, however, the falling gas prices are not helping President Biden’s approval rating…

Source: Bloomberg

Perhaps it’s not just about that after all?

Tyler Durden

Tue, 07/05/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.