Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Soaring CPI Crushes ‘Peak Inflation’ Narrative, Sparks Global Market Turmoil

There have only been 2 months in the last two years where CPI has printed less than expected and CPI has risen for 14 straight months (Biden has been president for the last 16). Additionally, sentiment among Americans collapsed to a record low (UMICH) and inflation expectations surged (signaling Fed credibility is plunging), all of which sent the US Macro Surprise index down to its weakest since Aug 2019…

Source: Bloomberg

The reaction was violent… and everywhere.

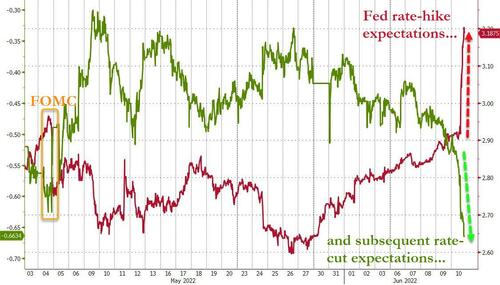

First things first, STIRs exploded with year-end rate-hike expectations soaring by 30bps today alone! And at the same time, the subsequent rate-cut expectations have soared (as The Fed desperately digs America out of recession)…

Source: Bloomberg

The market is now pricing in 10 more rate-hikes by the end of 2022 and then 3 rate-cuts following it.

And it appears to be the latter that sparked a surge in gold to its highest in one month…

But sent everything else lower (in price) on the day: US & EU stocks puked, US & EU bond prices plunged US HY bond prices were battered, oil dropped, copper dropped, crypto dropped, banks and big tech were battered.

The US equity market was monkeyhammered in the last two days after early-week attempts at a short-squeeze. Nasdaq was the worst performer, down 5% on the week…

This was the S&P 500 and Nasdaq’s worst weekly loss since Jan 2021.

How it feels to buy the dip while inflation keeps rising pic.twitter.com/KD0bQpXsay

— Wall Street Memes (@wallstmemes) June 10, 2022

The S&P 500 is down 10 of the last 11 weeks – the worst stretch since the Great Depression…

Source: Bloomberg

Financials were clubbed like a baby seal on the week while Energy stocks tried to get back to even this afternoon but closed red but were the prettiest horse in the glue factory…

Source: Bloomberg

VIX spiked back above 28 this week but remains drastically decoupled from credit market risk which is exploding to new cycle highs…

Source: Bloomberg

The last time US HY bond prices were this low, The Fed stepped in to buy them in an unprecedented action

Source: Bloomberg

European stocks were no less hammered (not helped at all by The ECB) with Italy worst…

Source: Bloomberg

European bond markets were a bloodbath as ‘fragmentation’ fears were not assuaged by ECB’s Lagarde and peripheral sovereign spreads spiked…

Source: Bloomberg

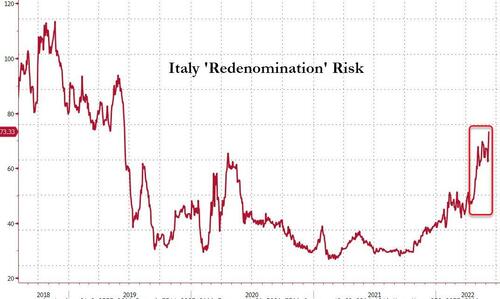

Italian yields topped their 2018 highs (highest since 2014), German 10Y yields topped 1.50% for the first time since 2014 and 2Y Gilts spiked above 2.00% for the first time since 2008…

Source: Bloomberg

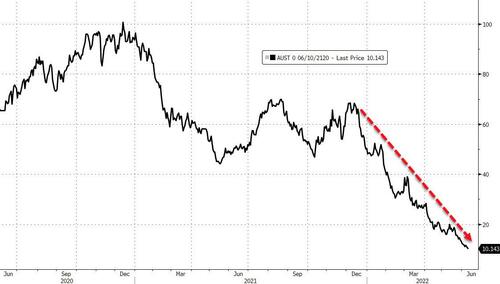

“Italeave” odds are soaring again…

Source: Bloomberg

Oh, and before we leave Europe. Remember this?

Well things aren’t going so great…

But hey at least you get ‘zero coupons’ to count while you wait

US Bond markets were a total shitshow with short-end yields spiking massively higher today. 2Y Yields rose 24bps while 30Y yields rose only 2bps…

Source: Bloomberg

On the week, it was even more of a bloodbath with 2Y Yields up a stunning 40bps and 30Y up just 10bps (‘just’)…

Source: Bloomberg

3s10s and 5s10s both inverted today as the yield curve flattened dramatically…

Source: Bloomberg

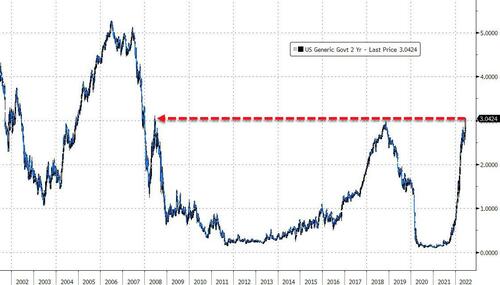

2Y Yields topped 3.00% for the first time since 2008…

Source: Bloomberg

Real yields pushed to their highest since April 2019. Is gold calling real yield’s bluff?

Source: Bloomberg

The dollar soared today, back up near the cycle highs…

Source: Bloomberg

Cryptos had another bad week but Bitcoin and Ethereum were ‘only down modestly’…

Source: Bloomberg

Bitcoin fell back below $30,000 but remains in its recent range…

Source: Bloomberg

Commodities were mixed with copper crapping out (growth concerns) while crude managed modest gains amid all that chaos…

Source: Bloomberg

WTI traded above $123 – well above Biden’s SPR release levels – back near post-Putin highs…

Gas prices hit a new record (nominal) high…

Source: Bloomberg

US NatGas (front-month fut) prices pushed above European NatGas (1Mo ahead) prices for the first time since July 2021…

Source: Bloomberg

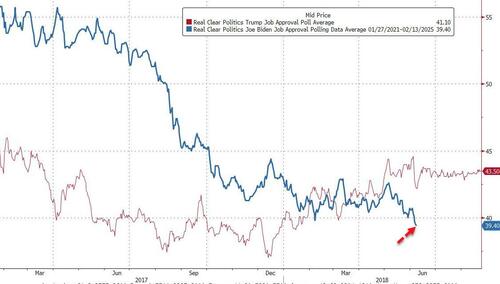

And that sent President Biden’s approval rating to yet another new record low…

Source: Bloomberg

We can’t understand why…

BIDEN: I HOPE CONGRESS TAKES ACTION ON SHIPPING COMPANIES’ PRICE INCREASES

Inflation is now the fault of:

Putin

Climate change

Oil companies

Profiteering corporations

The Fed

Shipping companies https://t.co/pzN81LBJGE— zerohedge (@zerohedge) June 10, 2022

Finally, we note that stocks are not “cheap”… just average-valued…

Source: Bloomberg

So how much further will Powell let valuations go before he flip-flops? The frequency with which the Biden admin is ‘referring’ all inflation questions to The Fed suggests Powell is stuck on this path and will take the fall for all the damage.

Tyler Durden

Fri, 06/10/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.

.png?itok=ePf_sqmA)

.jpg?itok=fXi4GkrW)

.png?itok=2ESal06d)