Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Oil Pops, Stocks Drop As Hawks & ‘Hurricanes’ Killed The Dead-Cat-Bounce

Jamie Dimon downshifted his economic outlook from “clouds on the horizon” to an imminent hurricane”, Goldman President John Waldron confirmed Dimon’s anxiety noting that “the shocks to the system are unprecedented,” and finally, Elon Musk warned he has a “super bad feeling” about the economy.

FWIW…

McLovin’s fake ID from “Superbad” says he was born June 3, 1981.$TSLA pic.twitter.com/4Qsk5NDp5A

— Timothy Connolly CFA (@SconsetCapital) June 3, 2022

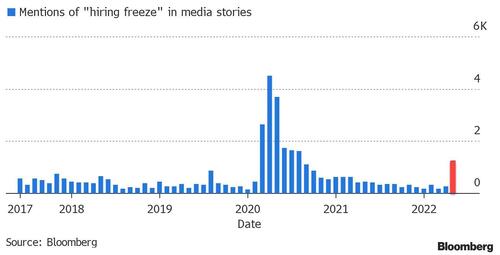

Apparently confirming the ‘hurricane’, the number of news articles mentioning “hiring freeze” has recently jumped to a level not seen since the first few months of the pandemic in 2020.

Source: Bloomberg

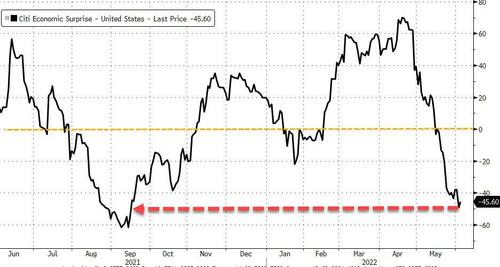

And so, despite a beat in the headline payrolls print today, other jobs data disappointed and just added to a week of ugliness for US economic growth expectations…

Source: Bloomberg

But, as we noted earlier, the cavalcade of FedSpeak this week definitely put the hawkish narrative back on the table, as even Bostic admitted he was talking out of his arse about a September ‘pause’ and Mester piled on. That drove Fed rate-hike expectations significantly higher…

Source: Bloomberg

And until today’s “good” news in the jobs data, stocks were loving the “bad” news from US data. But all that went to shit today as jobs beat and another bear market rally bit the dust…

Bear market rallies.pic.twitter.com/F03JlBPJzY

— Drew Dickson (@AlbertBridgeCap) June 3, 2022

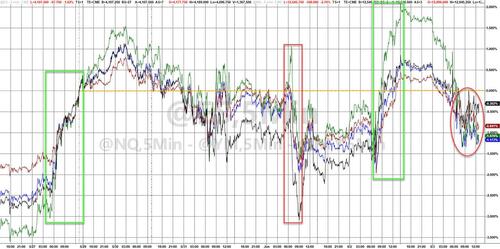

Futures were already sliding but as the ‘good’ data hit, the selling accelerated hard. Nasdaq was clubbed like a baby seal today, down over 2.5%. Small Caps and The Dow were the best of a bad bunch on the day…

Sending all the majors into the red for the week (the S&P was actually the week’s biggest loser while Small Caps were the prettiest horse in the glue factory)…

Industrials and Energy stocks were the only sectors that managed gains on the week. Healthcare and Financials were the biggest losers…

Source: Bloomberg

“Most Shorted” stocks ended the week lower as the Weds/Thurs squeeze quickly ran out of ammo…

Source: Bloomberg

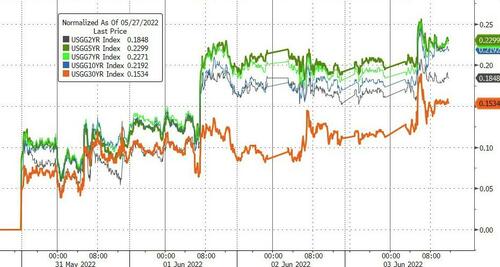

Treasuries were also lower (in price) this week, with the belly underperforming on the holiday-shortened week (5Y +23bps, 30Y +15bps)…

Source: Bloomberg

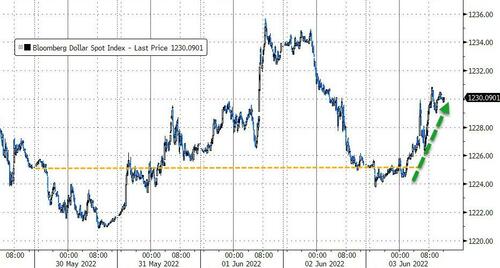

The Dollar ended the week higher, bouncing of support at unchanged today…

Source: Bloomberg

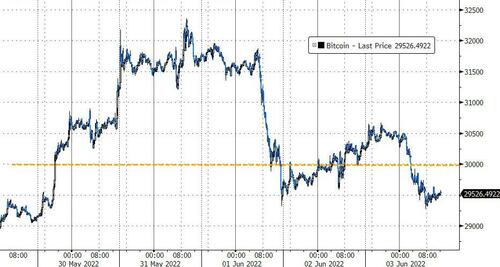

Bitcoin roundtripped on the week, ending back below $30,000…

Source: Bloomberg

Gold whipsawed down then up and back down again to end the week unchanged at around $1850…

Copper had a big week, surging up to 6-week highs as China re-opened…

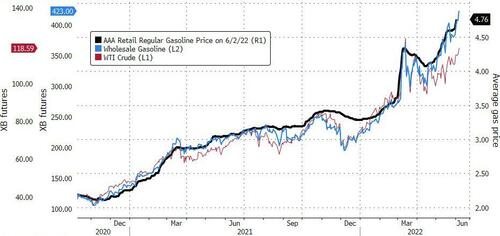

Oil prices exploded higher this week as OPEC+ didn’t break up as so many hoped and production increases don’t cover Russia’s shortfall, tightening supply in the face of China demand re-igniting as lockdowns are lifted…

That pushed WTI up to $119 – its highest since the post-Putin peak…

Finally, retail gas price are at their highest ever… and judging by wholesale gasoline prices, things are set to get considerably worse…

Source: Bloomberg

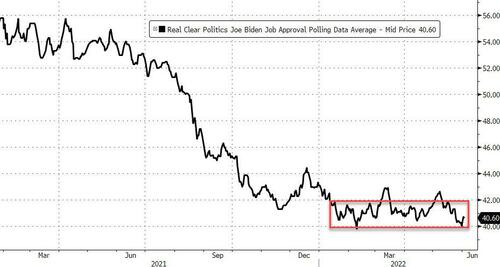

And nothing is helping Biden’s approval rating…

Source: Bloomberg

Time for some blaming and shaming?

Tyler Durden

Fri, 06/03/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.