Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Stocks Go Nowhere In May, USD Sinks Amid Worst Macro-Meltdown Since Lehman

Tl;dr: May… 30Y Bond unch-ish, S&P unch-ish, Gold unch-ish, Oil way-up, Crypto way-down, USD down, US Macro data total collapse…

Source: Bloomberg

To put that in context, outside of the April 2020 crash (where the government basically shut down the entire economy), May 2020’s collapse in US Macro Surprise data was the worst since Oct 2008 (the immediate aftermath of the Lehman crisis and freezing of all capital markets).

The S&P, Dow, and Russell 2000 were basically unchanged on the month, thanks to the ramp of the last few days) but Nasdaq ended the month red (4th red month of last 5 for Nasdaq)…

Today was choppy with stocks erasing yesterday’s futures gains, then bouncing back, but Small Caps swinging from +1% to -1%. Everything pushed lower in the last few minutes leaving all the majors red on the day (from Friday’s cash close)…

The ‘most shorted’ stock squeeze stalled today…

Source: Bloomberg

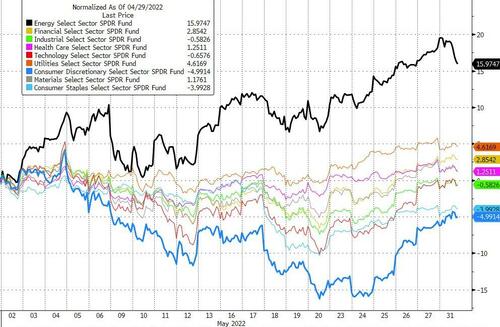

Energy stocks handily outperformed on the month and despite the recent ramp, Consumer Discretionary stocks suffered the most…

Source: Bloomberg

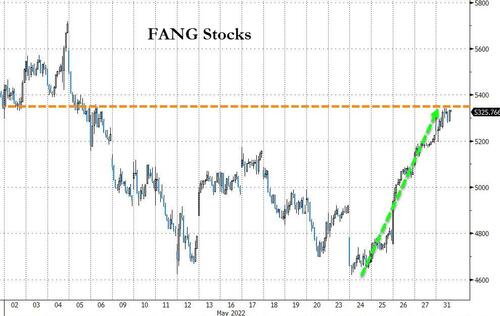

The ramp of the last few days has been led by mega-cap tech (AMZN +5% today!), which has managed to scramble back to ‘even’ on the month…

Source: Bloomberg

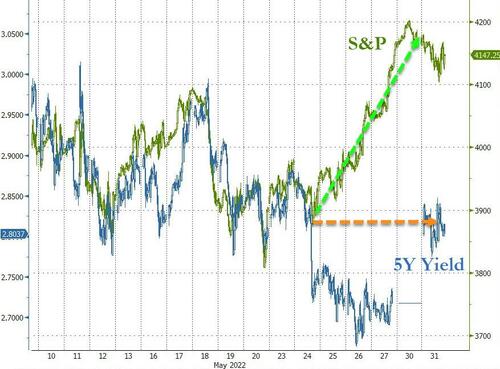

The last week has seen bonds go no where while stocks soared…

Source: Bloomberg

Bonds were mixed in May with most of the curve lower in yield (led by a 16bps compression in 2Y) but the long-end underperforming (30Y +6bps) thanks to today’s weakness…

Source: Bloomberg

The 30Y Yield kept finding support at 3.00% this month…

Source: Bloomberg

May saw the dollar suffer its worst month since May 2021…

Source: Bloomberg

Another ugly month for crypto, but the rebound of the last few days makes things appear a little better as bitcoin was the prettiest horse in the glue factory…

Source: Bloomberg

Bitcoin managed to get back aboved $32k today (and Ethereum topped $2,000)…

Source: Bloomberg

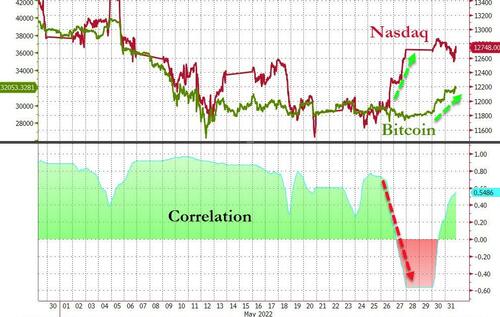

The decoupling between Big-Tech and Bitcoin is being unwound in the last few days as crypto catches up…

Source: Bloomberg

Commodities were mixed with oil prices soaring (hit today on the back of Russia/OPEC+ headlines), copper weaker and precious metals down for the month…

Source: Bloomberg

WTI ended the month above $115 ($10 a barrel above Biden’s SPR release plan levels)…

NatGas puked today but ended notably higher on the month amid European LNG demand and price convergence…

Gold was down on the month despite dollar weakness, closing back below $1900 and below pre-Putin levels…

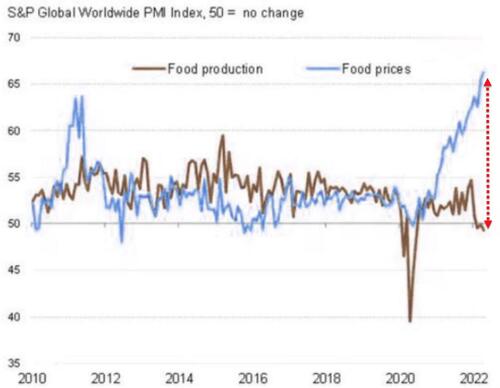

And finally, away from ‘market’-talk per se, this could be a real problem…

Famine is coming… and with it social unrest!

Tyler Durden

Tue, 05/31/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.