Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

“Shooting The Generals” – Nomura Says RIPieces To ‘Tactical Long’ In Stocks

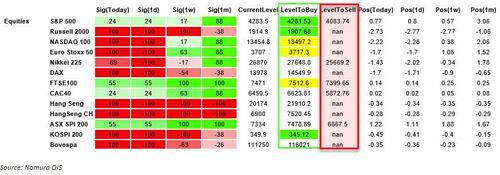

The Put Spread Collar that Nomura’s Charlie McElligott mentioned this morning was re-struck around 3pm – so the today-expiring 4270 Puts are deep in the money now, and Dealers have since had to sell ~$3B of futures since yesterday’s highs, as we’ve slipped and then accelerated lower, in order to stay hedged.

VIX lurched higher…

Well, as the Nomura strategist explains in a note shortly after the bell, the new trade is SPX 29Jul 3320 / 3940 / 4385 PS Collar 12,700 x’s (Put Spread over), so the customer bot 4k SPX today 4000 Calls to offset this immediate “negative Delta” impact of the June hedge. BUT…the Call settles into Cash on today’s close, so the Dealer needs to short ~$3B in futures on the bell to replace it (h/t J Pierce and H Homes).

When you add that to the projected ~$10.8B of Leveraged ETF flows for SALE we are currently estimated on their rebalancing into the close, we are talking pound-town.

The flows were ugly everywhere: Major + Sector ETF for sale: -$10,806.4

-

Major -$8,641.4

-

SPX -$2,228.7

-

NDX -$5,637.2

-

RTY -$449.9

-

INDU -$294.4

-

-

Sector -$2,165.0

-

Financial (incl. Bank) -$495.0

-

Tech (incl. Semicon, FANG+) -$1,486.8

-

Health Care (incl. Biotech) -$12.5

-

Not surprisingly then, the current netted-out MoC as of 350pm EST is ~$7.5B for sale.

And look, these mechancial flows matter…but as far as helping to get the macro ball rolling, there is no doubt in my mind too that:

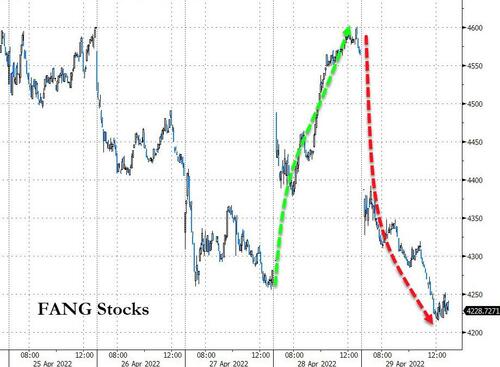

1) US Equities market “shooting the Generals” of mega-cap FANG+ lore (AMZN shocker -15%, and mind-you, a top 5 “placeholder Long” position for the entire Global Equities manager universe)…and the

2) “hawkish re-escalation” globally due to data in both US (Employment Cost Index signaling “wage / price spiral” concerns, plus the Personal Spending upside surprise = OVERHEAT) and EU (where Core Inflation jumped +3.5% and forces the ECB’s hand for July, fully priced-in now)

…is also partially behind this latest wave of deleveraging and “Tightening Tantrum” – where this data is so dicey with both CB’s being viewed as “even further behind the curve” that we now see Fed Funds Futs ascribing ~40% odds of a Fed 75bps June (was actually 44% earlier before the Equities total meltdown)…all of this is part of this story today.

Seriously – Nasdaq 5 day rVol is 60 right now, as the mega-cap Tech “generals” are being executed 1-by-1:

And hilariously, after yet another massive “high to low” reversal in US Equities today, the CTA Trend potential “buy / cover” triggers that were in reach, which we spoke about this morning?

Well, we are now a non-zero chance of seeing the S&P 500 position go from the current “+25% Long” signal to FLIPPING “-100% Short” on a close under 4083 in ES today, which would ~$16B estimated for sale.

RIPieces to my “Tactical Long” in Equities.

Tyler Durden

Fri, 04/29/2022 – 16:40

Continue reading at ZeroHedge.com, Click Here.

.png?itok=GN6D86cY)