Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Big-Tech & Bitcoin Shrug Off Beijing Bloodbath; Bond Yields, Bullion, & Black Gold Battered

Chinese stocks were Johnny-Depp’d overnight amid extended lockdowns, record COVID cases and deaths (worst month since 2016)…

Source: Bloomberg

No signs of The National Team at all (even as China cuts FX reserve ratio).

But US equities held it all together until the cash open when everything puked (except Nasdaq). That drop in stocks caught a bid as Europe closed (surprise surprise) and rallied back to unch (Nasdaq outperformed) and the TWTR news seemed to spur stocks even higher with everything turning green and Nasdaq leading the charge…

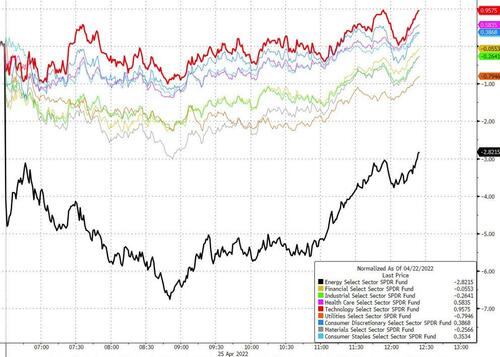

Tech outperformed as Energy lagged…

Source: Bloomberg

Small Caps dropped to their lowest since Dec 2020 (down over 22% from the highs)…

Source: Bloomberg

But don’t worry, Cramer says “the bear market is over”…

“I think the bear market is over.”@jimcramer makes a bold call in tonight’s Talk of the Tape. pic.twitter.com/hTwYWzbON6

— CNBCOvertime (@CNBCOvertime) March 25, 2022

Before we leave equity land, the Twitter board confirms it has accepted Musk’s offer to take the firm private for $54.20 ($44 billion)…

Bonds were bid with the belly of the curve outperforming (and the wings worst)…

Source: Bloomberg

The dollar rallied once again…

Source: Bloomberg

…as Yuan faded further…

Source: Bloomberg

Ruble soared to its strongest relative to the Euro in 2 years…

Source: Bloomberg

Bitcoin dumped and pumped on the day, plunging down to a low $38k handle before ripping back above $40k…

Source: Bloomberg

Ethereum also surged, topping $3000…

Source: Bloomberg

Oil prices plunged as China lockdown anxiety trumped geopolitical risk premia again with WTI down 5% and Brent back below $100. However, once Europe closed, WTI was bid and rallied back up near $100…

Gold was clubbed like a baby seal, once again testing $1900 (and once again rebounding higher back above it)…

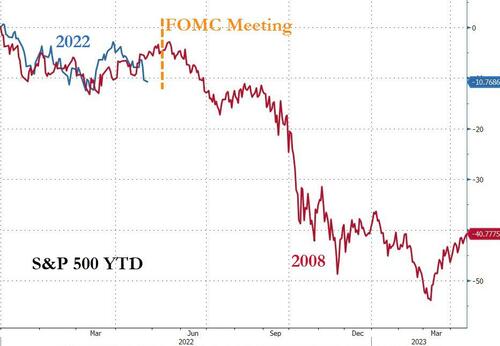

Finally, are we replaying 2008? Bounce into the May FOMC?

Source: Bloomberg

Interestingly…

As the hawkish bravado builds over the Fed, keep in mind that the only time in history that it started a tightening campaign with the stock market this weak (as in, all the major averages languishing below the 200-day trendlines) was in …1987 (ouch). Take your umbrella with you!

— David Rosenberg (@EconguyRosie) April 25, 2022

Deja vu all over again?

Tyler Durden

Mon, 04/25/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.