Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Tech Wrecks As Bond Bid Sparks Major Curve-Flattening

Major divergence in US equities today as Nasdaq puked (after NFLX collapsed) and the rest, led by The Dow and Small Caps, managed gains (with late-day weakness erasing S&P’s positive returns)…

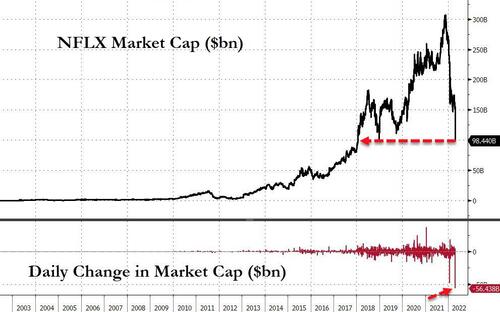

Of course everyone was focused on today’s carnage in NFLX (biggest volume since Oct 2013, 2nd worst daily loss since IPO – Oct 2004 previous) with over $56 billion in market cap being wiped away, leaving the company smaller than $100 bn total market cap…

Source: Bloomberg

Traditional ‘defensive’ stocks like Real Estate, Healthcare, and Consumer Staples, were today’s best performing sectors, while many of the sectors that outperformed throughout the pandemic – Tech, Consumer Discretionary – lagged today…

Source: Bloomberg

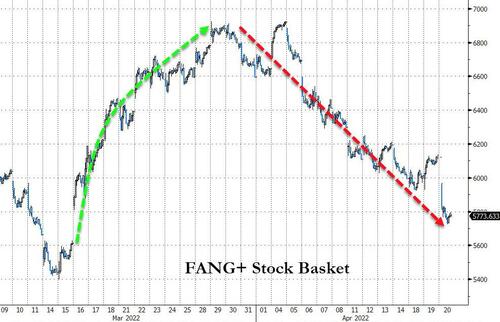

The FANG+ complex, which outperformed so much throughout the pandemic crashed today (with only MSFT ending green) with the biggest daily drop since March 2020. The FANG+ complex has basically erased all of the late-March meltup…

Source: Bloomberg

“Most Shorted” stocks whipsawed back lower today…so back up we squeeze tomorrow?

Source: Bloomberg

Treasuries were bid across the curve with the long-end dramatically outperforming (30Y -11bps, 2Y -1bps) helped lower in yield after a very strong 20Y auction. This pushed 30Y (and 10Y) lower in yield on the week, while the short-end remains notably higher on the week(2Y +13bps)…

Source: Bloomberg

The yield curve (2s30s) has plunged almost 30bps in 2 days after steepening back into the March FOMC range…

Source: Bloomberg

The dollar fell back today finding support at unchanged on the week…

Source: Bloomberg

The Ruble rebounded to pre-invasion levels today, back below 77/USD…

Source: Bloomberg

Bitcoin ended the day basically unchanged after testing above $42k and below $41k…

Source: Bloomberg

Gold ended marginally lower, but seemed to hold $1950…

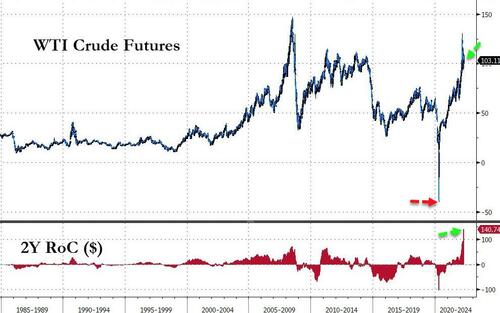

WTI ended the day modestly higher after finding support at the $100 handle…

Finally, today is the 2 year anniversary of WTI futures closing negative for the first time in history. Since that day, WTI is up a stunning $140 per barrel… the largest surge in absolute price ever…

Source: Bloomberg

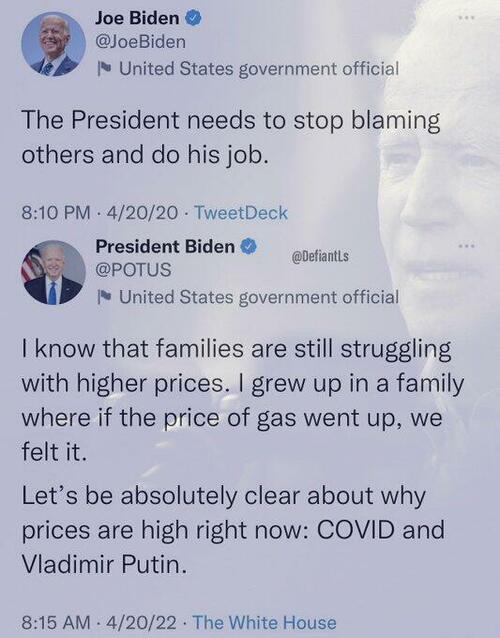

It’s also another anniversary… of President Biden saying this…

And gas prices are up quite a bit since he took over…

Source: Bloomberg

‘probably nothing’ right?

Tyler Durden

Wed, 04/20/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.