Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Tech Rout Leads To Record 34% Loss At Tiger Global’s Hedge Fund

Back in December, when stocks were still trading at all time highs and few traders were concerned about selling, we waved goodbye to liquidity and wrote that “one of the main reasons sophisticated, wealthy investors would pick hedge funds over private equity firms to manage their wealth – despite variances in fee schedules of course – is access to near immediate liquidity: unlike PE funds which lock up capital for years, hedge funds provide clients with the option to cash out just days or weeks after sending in their redemption request – after all, the money is in “public” equities which can be sold with the flick of a switch. However, as a result of the unprecedented bifurcation of the hedge fund market, where the vast majority of hedge funds continue to underperform their benchmarks and are bleeding AUM while a handful of giant multi-strat funds are swimming in profits, have long lines of willing investors and can therefore change the rules at will without fear of losing clients, access to liquidity at the best performing hedge funds is about to become a thing of the past.”

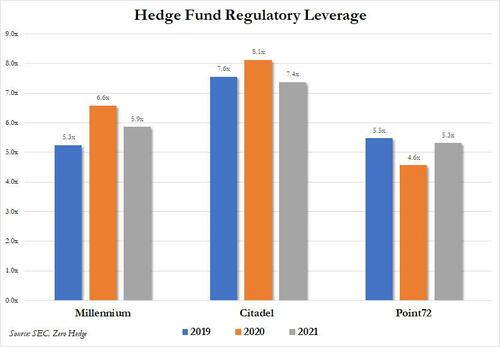

We were referencing the recent quiet transitions taking place among some of the world’s best performing, and most levered hedge funds…

… such as Millennium and Citadel, which are gradually transitioning away from a conventional redemption schedule toward draconian, PE-like lock ups as long as 5 years. That means that if you send in your redemption notice now, you may get your money some time in 2027, if you are lucky.

Millennium and Citadel were not the only ones that can impose whatever terms they want on their naive clients, who are willing to accept never again seeing their money because if there is a crash and either of these funds is impaired or worse, has an LTCM moment, the probability that the money will be there in 5 years is nil. According to Bloomberg, at least four other large multi-manager funds have changed their terms or started new share classes this year, all extending the time it takes for investors to get out.

But while it is obvious why funds would seek such long lock ups, why are clients agreeing to this format? Well, as Bloomberg explained at the time, investors are complying because, in an industry where many funds have underperformed, these managers produce the steadiest returns and to the winner go the spoils.

“Part of it is just because they can,” said Rishabh Bhandari, a senior portfolio manager at Capstone Investment Advisors, which runs multi-strategy funds as part of its $9.4 billion portfolio. Bhandari added that investments on average have become riskier and less liquid.

* * *

Well, just four months later, following the most brutal bear market in tech names since the covid crash, it has become all too clear why hedge funds are seeking to lock clients in for as long as possible: take one of the world’s most prominent tech investors, Chase Coleman’s Tiger Global, where things have gone from bad to worse very, very fast.

According to Bloomberg, Tiger’s flagship hedge fund fell nearly 34% in the first quarter, due to poor-performing stocks and markdowns of private holdings. But mostly due to poor-performing stocks, i.e., the tech crash.

The hedge fund tumbled more than 13% in March, according to a person familiar with the matter, capping three straight losing months and a tough 2021. The decline was 7% last year, its first annual drop since 2016.

Tiger Global’s long-only fund sank about 36% in the first quarter, while its Crossover fund, which invests in public and private companies, fell about 21%, according to the letter.

“Stock declines in our focus areas have been steeper, faster, and longer lasting than in prior drawdowns,” the firm said in Friday’s letter, signed by the investing team. While Tiger Global’s shorts generated gains, “they have not kept pace with the decline in our longs.”

Considering that the hedge funds held more than $50 billion in tech names, the dismal Q1 performance is actually surprisingly good. A quick look at Tiger’s 13F shows why a 34% drop is actually surprisingly low for a hedge funds who only holdings are some of the highest beta names, both in the US and in China.

All of Tiger Global’s biggest stock holdings at year-end, including JD.com and Microsoft, have declined this year and most fell by double digits, with many sliding into a bear market if not far worse.

In addition to the public mauling, Tiger also “adjusted valuations down” for its private investments to account for pressure on their public-market peers, the firm said in the letter, although it is unlikely that the firm applied nearly the right haircuts on its private investments. The hedge fund owns shares of private companies including ByteDance, Stripe, Checkout, and Databricks.

“In hindsight, we should have sold more shares across our portfolio in 2021 than we did,” the firm said. “We are reassessing and refining our models using all the inputs available to us.”

Yes, Tiger, in hindsight you should have been selling more shares starting as far back as July when we first reported that Goldman had been doing just that as it was quietly liquidating a quarter of its prop equity investments, or a net of $4 billion…

… a number which more than doubled by year-end, at which point Goldman indicated a net $11 billion in “dispositions.”

But nobody cared, and the party continued. Then everything crashed, and suddenly everyone cares, and the fingerpointing begins.

“In this moment, we are humbled, but steady in our conviction and confident about the go-forward opportunity,” the firm wrote.

The question is whether the firm’s clients share this view and whether Tiger’s latest catastrophic performance will lead to a reassessment of capital allocations. The good news is that the firm manages $35 billion across its hedge, long-only and crossover funds, while the rest of the assets are in its rapidly expanding venture-capital unit. Tiger also said it recently closed its PIP 15 venture fund with $12.7 billion. The bad news is that after losing more than third of their assets in one quarter, LPs won’t be happy and many of them will see to redeem what money they have left especially with the Fed facing down at least 9 more rate hikes which will crippled tech stocks.

Luckily for Tiger, we are confident that it, along with Millennium and Citadel, has locked its clients in for a long time. If not, however, brace for impact as the waterfall of redemptions will lead to relentless selling among the formerly best performing tech stocks for the foreseeable future, leading to a feedback loop where more redemptions lead to more selling, leading to more redemptions and so on.

Tyler Durden

Sat, 04/02/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.