Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Banks Battered & Trannies Trounced Amid Yield Curve & Commodity Carnage

After a big start to the week, Weds, Thurs, and Fri all saw significant selling pressure across month-, quarter-end with The Dow and S&P the laggards, with only a last-minute panic bid taking Nasdaq and Small Caps green and dragging Dow and S&P up to unch briefly….

Transports had the worst week since Jan 2021…

Source: Bloomberg

Why did stocks sink this week? Who knows. But one reason is ‘because the curve was inverted’…

Financials were the hardest hit sector as Utes outperformed…

Source: Bloomberg

As they chased the yield curve flatter…

Source: Bloomberg

Trucking stocks stood out this week as the jobs data signaled the first Trucking sector job losses (and threats of a recession loom)…

Source: Bloomberg

All Major US equity markets lost key technical levels. S&P back below its 100-DMA, Dow broke back down through its 100- and 200-DMA, Nasdaq failed at its 100-DMA, as did Russell 2000…

Massive divergence in bond markets this week as the short-end yields rose significantly as the long-end rallied hard…

Source: Bloomberg

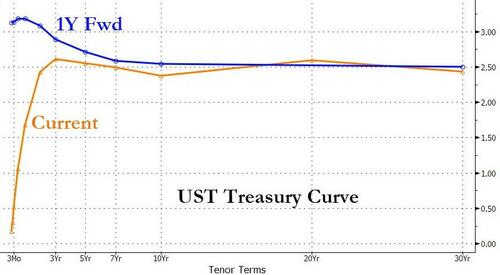

The big story of the week, however, is likely to be the carnage in the yield curve with everything from 2Y out now inverted…

Source: Bloomberg

2s10s, 2s30s, 3s5s, 3s7s, 3s10s, 3s20s, 3s30s, 5s7s, 5s10s, 5s30s, 7s10s, 7s30s, and 20s30s are now all inverted on the US Treasury curve… and one year out things get even more inverted (inverted from 1Y maturity all the way out to 30Y)…

Source: Bloomberg

The forward curve is pricing in an almost unprecedented amount of inversion – The Fed’s biggest policy error ever?

Source: Bloomberg

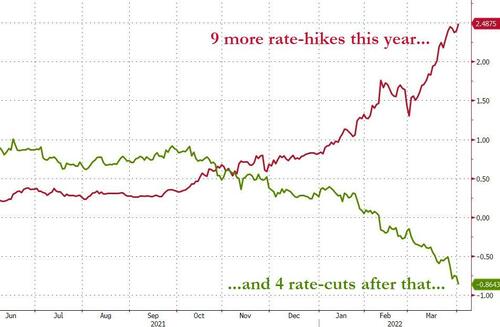

The market is now pricing in 9 more rate-hikes this year… and then almost 4 rate-cuts

Source: Bloomberg

Let’s just hope that the yield curve’s premonition is not a reflection of where stocks should be…

Source: Bloomberg

Crypto rallied today as the threat of more QE (post-recession) began to leak into traders’ minds with Bitcoin back in the green for the year, and back above $46000…

Source: Bloomberg

Commodities traded broadly lower this week with crude leading the way down. This was the worst week for commodities since March 2020…

Source: Bloomberg

WTI dropped back below $100 after Biden’s SPR news (but more likely driven by Shanghai’s ongoing lockdowns sparking demand fears), but is still above the $90 level that was pre-Putin…

Gold held above $1900 but was lower on the week…

Finally, diamonds are not just a girls’ best friend, they are an inflation hedgers’ pal too, as BofA notes that since 1950, Diamonds have had an extremely high correlation to CPI (higher than US farmland, real assets, and gold)…

Source: Bloomberg

Diamonds are forever after all… Not just til the midterms.

Tyler Durden

Fri, 04/01/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.