Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Following Global Outrage, Shell Says It Only Bought Russian Oil After “Intense Talks With Governments”

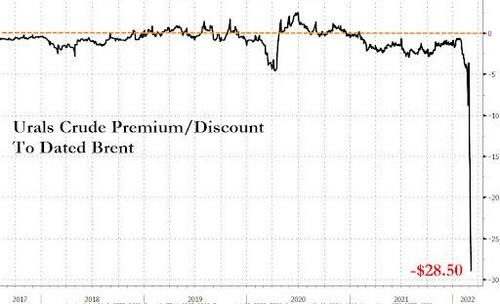

Yesterday, we reported that after a week of “no bid” markets for Russian seaborne oil where the discount for Urals widened more and more from spot with each passing day (while in the process making the market for non-Russian oil almost offerless and helping Brent close near $120), finally on Friday one company stepped up, and with the Russian crude discount hitting a record $28.50 below dated Brent…

… Shell purchased the Russian black gold from oil merchant Trafigura Group, which had originally bought the cargo originally from Russia (the cargo was bought on a delivered basis, meaning Shell won’t need to sort out transportation).

Discussing the transaction, we said yesterday that the deal not only underscores the deep discount Russia is going to have to sell its oil at – which amounts to roughly 25% below spot – but more importantly, it is also the first clear reminder that there is a clearing price for everything, and that Russia will still find willing buyers in companies that are reliant on Urals crude if the discount is low enough.

We also said that “now that Shell has shown the rest of the world world it can be done, we expect most if not all western companies to scramble and bid for Russian oil, especially when considering that regular spot Brent is trading around $115 on its way to $200, and with that the Russian discount to spot will slowly but surely drift back to zero.”

What we didn’t say is that Shell would get a flood of pushback and outrage for its decision by Western moralizers, who still refuse to grasp that without Russian oil in the market, the clearing price of crude could soon hit $200 (as many banks have warned) leading to a historic global recession, with outcomes not that different from what happened after oil hit $140 in the summer of 2008 (as discussed first here two months ago).

So on Saturday, about a day after the details of the Shell purchase first emerged, and following the anticipated barrage of criticism for buying Russian oil, Europe’s largest oil company pushed back, saying in a tweet that “without an uninterrupted supply of crude oil to refineries, the energy industry cannot assure continued provision of essential products to people across Europe over the weeks ahead” – which of course, is precisely the core pillar behind Putin’s gambit – and, more importantly, adding that Shell has been “in intense talks with governments and continue to follow their guidance around the issue of security of supply” even as it is “acutely aware we have to navigate this dilemma with the utmost care.”

“We will continue to choose alternatives to Russian oil wherever possible, but this cannot happen overnight because of how significant Russia is to global supply,” Shell added in the statement.

Read Shell’s statement. pic.twitter.com/6mN7KVTiGc

— Shell (@Shell) March 5, 2022

The London-based Shell didn’t specify which governments it had been speaking to, and as Bloomberg notes, a U.K. government official didn’t immediately comment.

As we said yesterday, and as Bloomberg today confirms, “Shell’s purchase is a signal that major buyers will likely continue to make purchases of Russia’s energy products despite its increasingly deadly war against Ukraine.”

The deal also underlined the stark situation facing European and world energy buyers. They need to work out how to deal with the potential loss of one of the market’s top suppliers, as a raft self-sanctioning effectively removes Russian product as an option.

Shell’s purchase sparked a barrage of global criticism; Ukraine’s Minister for Foreign Affairs Dmytro Kuleba took to Twitter to ask the company whether Russian oil smelt like “Ukrainian blood for you?” and called on all “conscious [sic] people around the globe to demand multinational companies to cut all business ties with Russia.”

I am told that Shell discretely bought some Russian oil yesterday. One question to @Shell: doesn’t Russian oil smell Ukrainian blood for you? I call on all conscious people around the globe to demand multinational companies to cut all business ties with Russia.

— Dmytro Kuleba (@DmytroKuleba) March 5, 2022

He has also pressed his twitter followers and Western nations to “stop buying Russian oil” however as even Shell writes, such an action would be tantamount to economic suicide by Western nations.

Stop Putin. Stop buying Russian oil. Act now. pic.twitter.com/W9OxGqbuBU

— Dmytro Kuleba (@DmytroKuleba) March 5, 2022

In hopes of quieting its critics, Shell, which last weekend also announced it would divest its stake in the Sakhalin-2 LNG project, also said it will donate profits from its Russian business to humanitarian aid agencies.

Tyler Durden

Sat, 03/05/2022 – 14:51

Continue reading at ZeroHedge.com, Click Here.