Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

The Fed “Made Their Bed” – Nomura Warns Dip-Buyers Not To Expect 2018/19 Fed-Flip-Flop Redux

Prices should continue to be unstable.

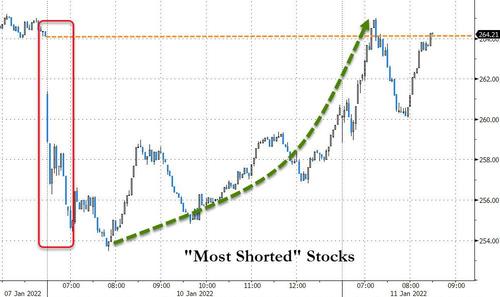

That’s the message from many in the market as while talking-heads want to proclaim yesterday as a fundamentally-driven buying spree confirming how ‘cheap’ hyper-growth has become, SpotGamma points out that is was actually a “short cover rally” fueled by delta (puts closed/rolled) and vanna (implied volatility crush).

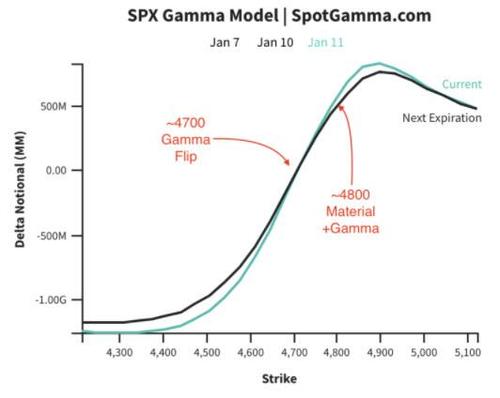

Additionally, SpotGamma’s models continue to suggest high volatility until the 4700 strike is recovered – and it is not until 4800 that we would see significant dealer based support.

But, as Nomura’s Charlie McElligott notes, the largely “mechanical” flows in the options-space that helped turn the tide of what was set to be an ugly selloff yday into sentiment-stabilizing power rally have shifted both Gamma- and Delta- to a much less “extreme short” and rapidly pushing towards a more stable footing.

And with regard to that “stability”, the Nomura strategist has a tactical (less bearish) and strategic (hyper-growth ain’t coming back) perspective…

It is my feeling that tactically, relative to positioning and what’s already priced, that in the absence of fresh “upside surprises” in either Inflation- or Jobs- data (still a significant “IF”), it will be increasingly difficult for much more incremental bearishness to be priced-into USTs / Rates without some new “accelerant” catalyst…so there very well may be additional / local relief for Tech as the bond selloff stabilizes and consolidates without a new reason for “bearish” Rates / USTs flow.

BUT as I have been saying MEDIUM / LONGER-TERM (outside of the next few weeks- and months- worth of high freq data), I am not sure that investors are going to fully “plow back into” the “expensive” / “hyper-Growth” stuff again beyond these counter-trend rallies, and will instead continue preferring “Value” at this juncture in the Cycle, largely because “sticky” higher inflation continues as a bipartisan POLITICAL issue at this point for the Fed.

And that double-whammy of mechanical QT catalyst leading to “tighter” financial conditions (and the “less cash, more collateral to digest” dynamic it creates) is where the risk then pivots, felt across the “risk-premia” space despite seeming diversification, with “carry,” “momentum” / “trend,” “crowding,” “growth,” “value” which had been accumulated and leveraged into during the “suppressed Vol” era of Fed policy—but then reset on the paradigm shift “from QE to QT,”… thus resumption of concerns for “rolling Vol Events” and / or “bleed” ahead, similar to the 2018 scenarios highlighted below:

Cross-Asset Momentum – Jan18 through Jan19

Multi-Asset Risk Premia (w Vol) – Jan18 through Jan19

US Equities Growth Factor – Jan18 through Jan19

US Equities Cyclical Value Factor – Jan18 through Jan19

But, this time is different from 2018/19 when The Fed flip-flopped back and rescued the world.

McElligott reminds us that this time, the Fed has increasingly “made their bed” with committed signaling and language on their pivot, and they have now assumed a position to reverse the prior regime of “easy” financial conditions through both an aggressive liftoff path (mkt pricing now greater than 3.5 hikes in ’22, while many see scope now for 4+ hikes – with Bostic this morning stating that every meeting is “live”) as well as simultaneous balance-sheet runoff by mid-year…and critically, this time around occuring AT A FASTER PACE. Nomura’s House view from Rob Dent:

“In terms of our Fed call in 2022, we continue to expect four rate hikes this year (Mar, Jun, Sep, Dec) and a balance sheet runoff announcement in July, effective August. We think monthly caps on Treasury and MBS runoff will start at $12bn and $8bn before scaling up to $60bn and $40bn, respectively, by December. We think the Fed will slow to a pace of two hikes per year in 2023 and 2024 before hitting a terminal rate of 2.00-2.25%. Our latest thoughts on the Fed’s debate regarding runoff and rate hikes are here”

It seems very clear now that as the FOMC has continued to iterate both 1) the shift to “inflation fighters” (Jerome Powell comments last night–*POWELL: FED WILL STOP HIGHER INFLATION FROM GETTING ENTRENCHED), as well as 2) increase their “at or near” full-employment rhetoric which we have been seeing more of…it likely makes this a case of data “show me” requiring a sustained downtick in US economic releases first, before the Fed would be able to make yet-another policy reversal and keep things “easy”.

In other words, Brace!

Tyler Durden

Tue, 01/11/2022 – 15:30

Continue reading at ZeroHedge.com, Click Here.

.png?itok=Qg0FGENA)

.png?itok=_md3BAcz)

.png?itok=8XxJQJjn)

.png?itok=cFtA2jIL)

.png?itok=eNqFL3JW)