Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

US Fed to Start QE Tapering, Crypto Market Remains Bullish — Analysis, 8 Nov

US Fed to Start QE Tapering, Crypto Market Remains Bullish — Analysis, 8 Nov

One of the main events of this past week was the U.S. Fed announcement of the beginning of the Quantitative Easing (QE) tapering. On Wednesday, November 3rd, the central bank decided to reduce the monthly amount of buying assets by $15 billion at its monetary policy meeting:

QE, a process of injecting liquidity by the Fed or — as many call it “printing money out of thin air” — has been one of the major drivers for the price increases in the financial markets for the last ten years. And, now, when the U.S. central bank is starting to taper this process, many experts think that the pace of increase of the prices of the financial assets may stop to decrease.

Nevertheless, the crypto community doesn’t believe that the Fed will stop using its ‘printing machine.’ For example, Jameson Lopp, a famous Bitcoin enthusiast, said that: “It is easier for a camel to pass through the eye of a needle than for central banks to quit printing money.” And, Hashcash inventor, Dr. Adam Back agreed with him:

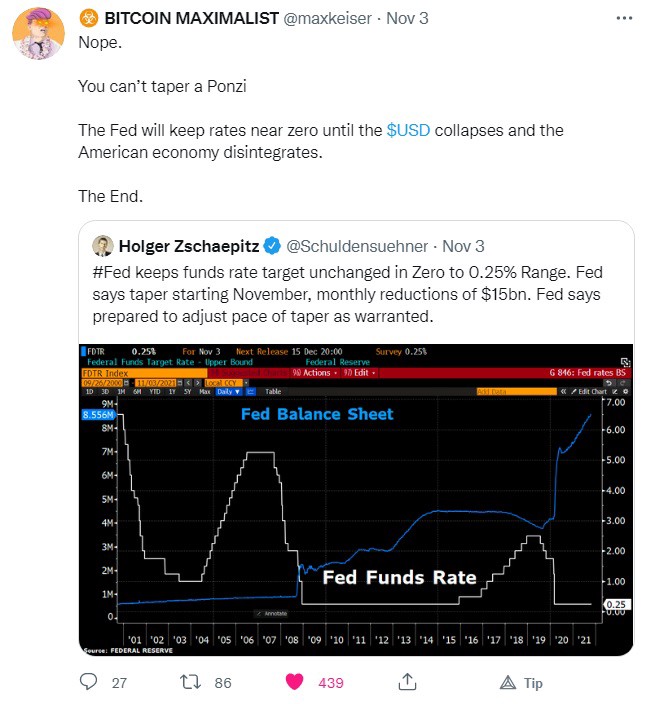

Bitcoin maximalist Max Keiser expressed even a more extreme point of view on the Fed’s tapering process. He compared the central bank’s QE with a Ponzi scheme:

Keiser expects the Fed to continue its loose monetary policy until the dollar collapses and the U.S. economy disintegrates.

Michael Saylor is another famous Bitcoin bull who expects a continuation of the loose monetary policy that, in the end, will destroy the U.S. dollar. In a recent interview on CNBC, the MicroStrategy CEO underlined that ‘Bitcoin will go up forever’ because fiat money is depreciating.

Because the trust in fiat money is declining, the New York City Mayor announced that he is willing to receive his three first paychecks in Bitcoin and wants to transform New York into a crypto hub:

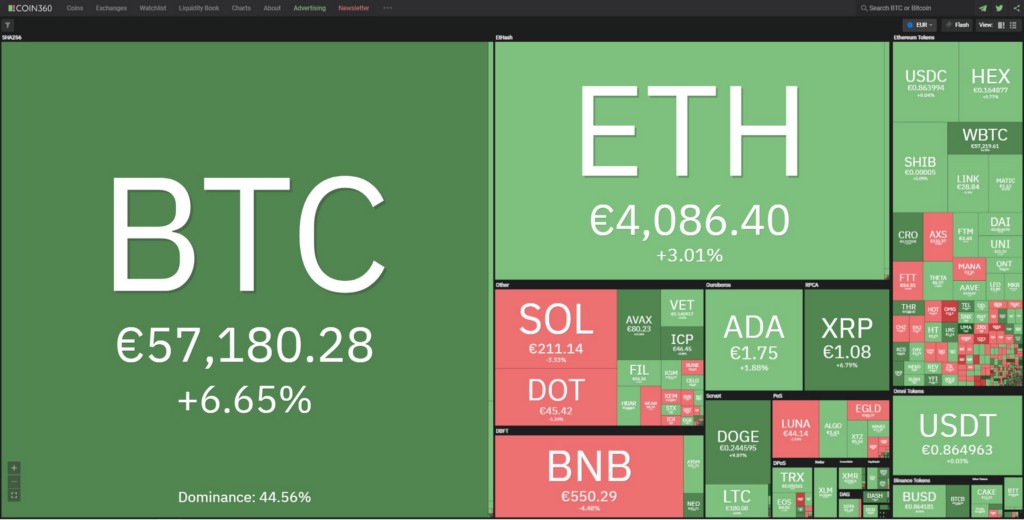

Last week, full of interesting events and news, the crypto market retained the bullish sentiment. Now, the Monday market starts on a positive footing as well. According to Coin360.com, one Bitcoin costs €57,180.28 (+6.65%), one Ethereum — €4,086.40 (+3.01%), one DOGE — €0.2445 (+9.57%), and one UNI — €22.23 (+1.68%):

Now, let us analyze the price charts of the top cryptocurrencies against the euro in the most noteworthy time frames.

BTC/EUR

In the weekly chart (1W), BTC/EUR recorded a small bullish candlestick after the two Dojis:

Interestingly, the body of this bullish candlestick has exited the consolidation range formed by the two Dojis. That is a small initial bullish signal confirming the uptrend renewal.

In the 4-hour chart (4H), BTC/EUR has already surpassed the level of the last local high from the Bullish Flag:

As we mentioned in our previous analysis, we view this as a confirmation of the buy signal.

ETH/EUR

In the weekly time frame (1W), ETH/EUR has recorded another bullish candlestick with a local high above the previous one and a local low above the previous one:

Therefore, the sequence of bullish candlesticks with ascending local highs and local lows continues. It is a clear signal that the bullish sentiment remains in place.

It is worth remembering once again that, in the weekly chart (1W), ETH/EUR has formed a Cup and Handle technical pattern (C&H) — a typical bullish pattern:

Because the uptrend continues, ETH/EUR will probably reach the level of approximately €5,045. This price target results from applying the full height of the Cup to the exit point of the C&H.

DOGE/EUR

In the weekly time frame (1W), DOGE/EUR has formed a small bearish candlestick after the Long-legged Doji:

These candlesticks confirm that the price of Dogecoin continues to consolidate.

Nevertheless, we see the light at the end of the tunnel. In the 1-hour time frame (1H), DOGE/EUR is starting to draw an Ascending channel (uptrend):

If this uptrend continues, the consolidation in the weekly chart may end, and the bull market may resume.

UNI/EUR

In the weekly chart (1W), UNI/EUR formed another Spinning Top sequence indicating that the market is in a phase of indecision:

The sequence of Spinning Tops is a clear signal that the sideways movement remains in place. Once again, we would like to remind you that as long as the price of Uniswap remains range-bound, we will abstain from entering the market.

Stay updated on everything Bitcoin-related with Bitvalex. Bitvalex is a licensed digital wallet and cryptocurrency exchange; learn more about us and blockchain technology and sign up to use our services.

The analysis is purely informational and does not constitute investment, financial, trading, or any other sort of advice and you should not treat any of Bitvalex’s content as such. Bitvalex does not recommend that any cryptocurrency should be bought, sold, or held by you. You are solely responsible to conduct your own due diligence and consult an advisor before making any investment decisions.

Originally published at https://bitvalex.com.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

US Fed to Start QE Tapering, Crypto Market Remains Bullish — Analysis, 8 Nov was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.