Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

The quest of STABLECOINS — seeking stability in the volatility of the crypto market

The quest of STABLECOINS — seeking stability in the volatility of the crypto market

Pt 1 — Security in the ocean of volatility — Blockchain 101

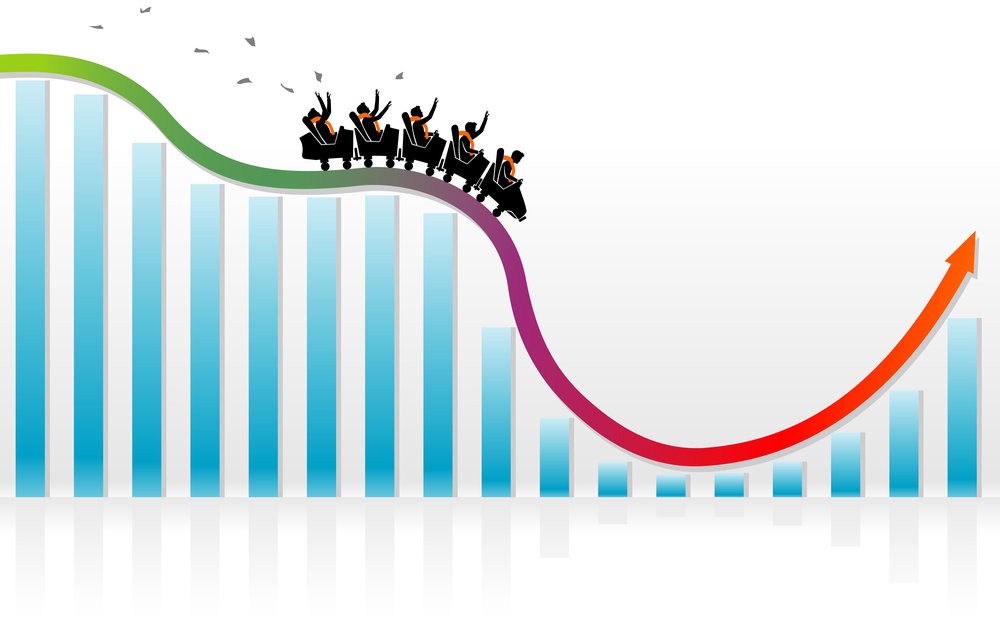

While cryptocurrencies spread over the world and start participating to some extent in regular business transactions, they remain highly volatile in value. Not stable value limits use of cryptocurrencies and actually prevents them to take main functions of money: being the store of value, mean of exchange and unit of account.

Facing this rather peculiar issue, the crypto ecosystem bases itself on a few cryptocurrencies which are able to ‘stabilize’ the price of the traded assets.

We obviously talk about STABLECOINS.

Stablecoins is a group of cryptocurrencies which try to fulfill these three functions of money more effectively using different price stabilization mechanisms.

If we consider a stablecoin as a substitute for traditional fiat money in the digital space, the best way to see the advantages and disadvantages of existing solutions is to analyze how each of them fulfills three main functions of money.

A brief view of FIAT money

The dollar was once basically a stablecoin tied to gold, and that worked well as the greenback was establishing itself as an asset.

The US left the gold standard in 1971 — Richard Nixon suspended dollar redemptions with gold. Though the process took a few more years to play out, this effectively ended the gold standard and the fixed Bretton Woods exchange system that relied on it. basically depegging the US dollar $ from its equivalent value in gold — making a defacto FIAT currency:

a currency backed by an unshakeable faith in the government and state.

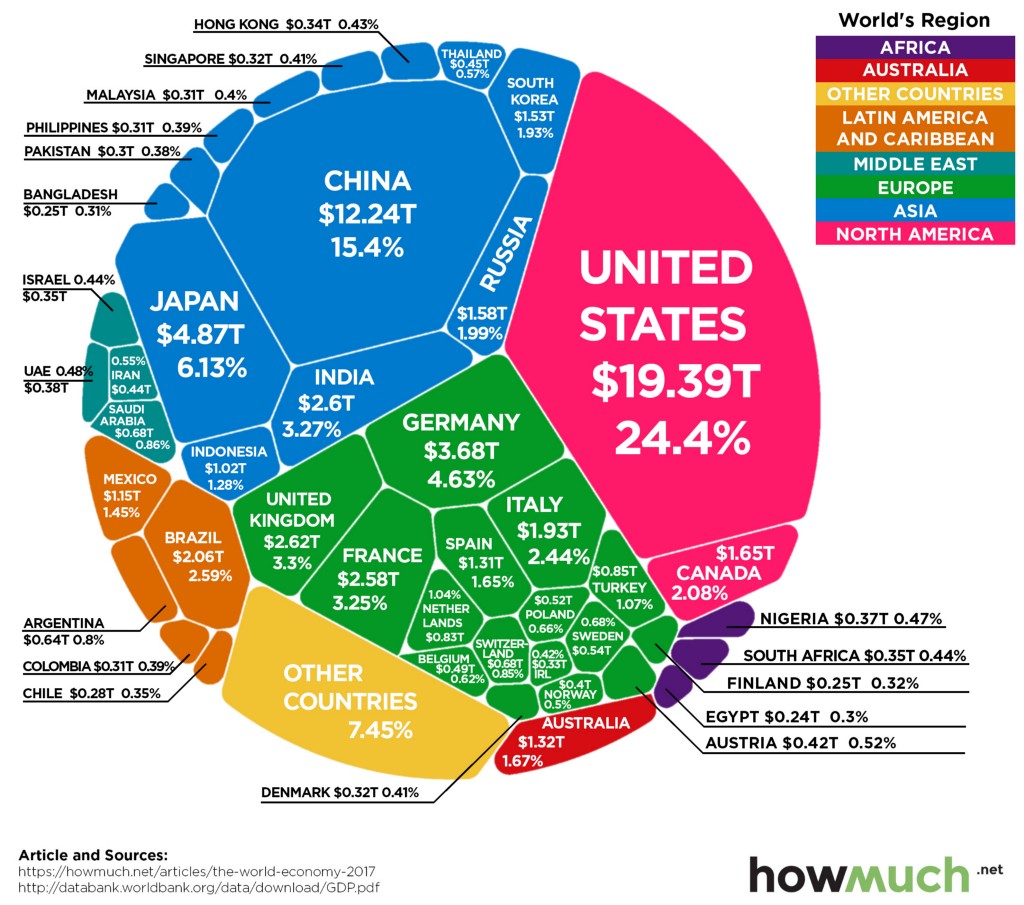

The abandonment of the ‘Gold Standard’ did not work in the long run because the economy has indeed expanded faster than the amount of materials available; that and the raising concerns (and real-life sentiment) of post-pandemic inflation have reignited worries about the dollar’s declining reserve status, but it’s a much longer-term trend: In May, the dollar’s share of central bank reserves fell to a 25-year low of 59%.

US Dollar Share of Global Foreign Exchange Reserves Drops to 25-Year Low

More about FIAT currencies on my article: “So You Think You Know Money?”

https://medium.com/the-capital/so-you-think-you-know-money-c03c46265c84

The 3 Functions of STABLECOINS

1 — Stablecoins from store of value perspective

The ability of a stablecoin to store value means that its purchasing power, in the long term, remains stable compared to goods or assets it can buy.

As far as prices for most goods and assets in the modern global economy are nominated in $USD, the ability to store value in our case means the ability to hold peg to $USD in the long run.

Stablecoins use different mechanisms to store value, some of them are quite reliable, others are rather questionable. Let’s outline several main mechanisms which are used to protect the value of a stablecoin via collateralization:

a. By fiat currency

b. By cryptocurrencies and tokenized assets

c. By real assets or mixed

1.1. Collateralization

Collateralization is the most obvious and straightforward approach to stabilize currency value. Some form of collateral exists in almost every stablecoin project, but its mechanics and quality widely vary.

a. Stablecoins collateralized by fiat currencies

Using fiat currency as collateral to create stablecoin is a method that currently has the largest practical implementation. We believe the reason for it is that this approach is technically simple and quite straightforward to explain to users. It also enables to ensure a quite tight peg to the US dollar, which makes these stablecoins quite good as a substitute of a dollar for trading in the digital space.

However, this method also has serious drawbacks: such stablecoin is not decentralized and always controlled by some people or entities.

Value of this currency can be questioned by many trust issues such as solvency and honesty of a token issuer, reliability of intermediaries holding assets, transparency of the collateral, risk of seizure of these assets by third parties (including governments).

In the long term, we also suppose that all stablecoins collateralized by USD or other major currencies will be regulated as strictly as fiat currencies, thus, they won’t be very different from USD on your bank account.

This also means such stablecoin won’t be attractive to users who want to be protected from political risks.

Nevertheless, these drawbacks don’t prevent such currencies to be effectively used for settlement operations or trading.

b. Stablecoins collateralized by cryptocurrencies and tokenized assets

A quite promising way to issue stable and, at the same time, truly decentralized cryptocurrency is to create a coin that is backed by some other valuable digital assets or services.

In this optic, stablecoins collateralized by digital assets can solve many issues which stablecoins backed by fiat currencies can’t:

- it remains fully digital in nature and trustless as cryptocurrency concept itself to a large extent;

- its collateral is stored in a digital wallet(s) and easily observable by anyone;

- its issuance and redemption can be made in the most transparent way in exchange for provided collateral, this process can be managed by a smart contract in a trustless way;

- it always has some fair value and can be exchanged on it;

- the digital wallet(s) with collateral is controlled by no one except smart contract itself and can be effectively protected from theft, confiscation, or seizure of any type.

The most important problem of such stablecoins is that value of digital collateral is likely to be not stable and highly volatile. For that reason, some mechanism is required, which guarantees that collateral exists in necessary amounts.

Currently, we see two major ways to create a mechanism that enables to provide enough collateral in volatile digital assets to a stablecoin.

The first is direct collateralization which is very similar to collateralized bank loans. This scheme is implemented in such projects as Maker DAO(Dai), Alchemint, and Sweetbridge. Direct mechanism assumes that there is a group of players who takes loans in a stable coin (thus issuing them to the market) and provide some valuable collateral which level they pledge to support.

If collateral value goes below some minimal requirements, then, exactly like for a bank loan, borrower must add more collateral, or his collateral will be liquidated on the market.

We can see that this approach is quite promising if stablecoin designer finds enough incentives for borrowers to come to the system, pledge their assets and take system risks. In other words, the whole community of people ready to take stable coin risks needs to be created to make this approach scalable. Supporting the necessary level of collateral also requires creating quite a sophisticated risk management system which looks like a difficult but doable task.

1.2. Support from internal system revenues

Each stablecoin is based on a quite complex economic system that can generate income for its issuer or for the overall stablecoin system. If this income can be used to sustain a stablecoin value, this drastically increases its chance to survive in the long run, even when other stability mechanisms (like collateralization) fail.

We distinguish three main sources of such income:

- Transaction fees, paid by stablecoin holders for transactions;

- Operating income — income derived from different services, provided using stablecoin benefits;

- Investment income — e.g. collateral can generate some investment income or interest rate.

There is a number of projects which use, explicitly or implicitly, internal system revenues to support stablecoin value.

The starkest example is Tether. Despite one may believe that Tether is a collateralized stablecoin and its value is backed by USD dollar reserve, we would argue that Tether is not a collateralized stablecoin and its stability is derived from revenues Tether generates for its creators.

Tether is not collateralized in the commonly used sense because:

- there is no legal or smart contract obligation of Tether issuer to exchange USDT back to USD;

- collateral existence, sufficiency, and safety is not clear

Hence, the only reason for Tether to be stable is the willingness of its masters to support it. At the same time, Tether creators and supporters are closely related to several major cryptocurrency exchanges, and Tether is likely to generate decent profits for them. This means that Tether’s stability is directly related to the ability of its developers to derive profits from it.

1.3. Money supply regulation

The money supply regulation mechanism is based on the Quantity Theory of Money, which basically states the value of a currency depends on the quantity of this currency in circulation (supply) and the demand on it from those who want to hold or use this currency.

Quantity Theory of Money – Explained

Hence, to achieve the needed price peg for a stablecoin, we need to increase or decrease its quantity in circulation, corresponding to an increase or decrease in demand for it.

This theory is quite popular in government monetary policy, and central banks widely use this concept to regulate the price of national currencies relative to others.

Some stablecoin projects plan to regulate and stabilize stablecoin value by controlling the number of coins circulating on the market, similar to the central bank money supply policy. In such a case, no collateral or other backup is required to make a coin stable. The main reason why this approach must work is the fact that all major fiat currencies (including the US dollar), currently are not collateralized by anything from the legal point of view but, at the same time, some of them remain very stable only because of smart money supply regulation.

This approach seems very attractive because, if it worked, the production of a stablecoin wouldn’t require any serious efforts and, at the same time, would be infinitely scalable.

Such stable fiat currencies as the US dollar are collateralized by the power of economies that issue them and grant exclusive rights to be the only legal currency on that territory.

In other words, if somebody holds a US dollar, he is guaranteed that in foreseeable future, he can buy with it a can of Coca-Cola or other goods produced by the US economy. At the same time, the US government guarantees that the only legal tender of payment in the US economy is the US dollar, which generates needed demand for dollars. This is the main source of US dollar stable value, and Fed’s smart money supply policy only helps to fine-tune it.

Any private currency doesn’t have exclusive rights and competes with many others, hence, the is no reason why the demand for it cannot drop substantially at some moment and never recover after. This means that holders of this currency will suffer losses in value that will never be compensated.

In other words, a stable coin that relies only on supply regulation mechanism can be stable only in the case of stable or growing demand for it, which in the long run can’t be always true.

2-Stablecoins as a unit of account

Unit of account is an important function of money which allows them to be the universal benchmark of nominating value of goods and services.

National currencies are the unit of account inside national economies, while the US dollar is commonly used as a unit of account for international trade. Choosing a unit of account is a matter of habit or tradition, as well as the network effect. An international trader would likely price his goods or services in US dollars just because everybody else is doing the same, and the US dollar is accepted almost everywhere.

If we consider for now only USD-pegged stablecoins, what makes one coin better than the other as a unit of account?

Obviously, if a stablecoin aims to substitute the US dollar for pricing purposes, its price should be tightly pegged to the US dollar even in the short run. Hence, a good unit of account is a coin which price regulation mechanism allows to provide very small stablecoin volatility (<1%) around US dollar price.

Let’s now analyze which methods or regulating short-term value are available for different coins.

2.1. Market — making / Interventions

To provide short-term stability, almost every stablecoin project would employ a market-making mechanism where a dedicated market-maker having some capital will hold the price of the coin to certain limits.

For projects implementing coin supply regulation, market-making will be coincided with interventions (issuing more coins to circulation to increase demand or selling kind of bonds/stocks for coins to reduce demand). Obviously, market-making can be a good stabilization tool for small price moves but has very limited power.

Price interventions that try to curb coin price growth by issuing more coins will work perfectly, but only in the case when coin price is going up.

This mechanism leaves a big question mark for the case when coin demand and price go down. In this case, the intervention mechanism must sell something (bonds, stocks, whatever) in exchange for coins to reduce coin supply and, hence, stabilize the price. Demand for such bonds is likely to be volatile, moreover, supply reduction itself doesn’t guarantee immediate price recovery.

2.2. Stimulating issuance and redemption

This mechanism is likely to work for loan-type collateralized stablecoins, which mechanism doesn’t assume immediate access to collateral for anybody who holds the coin (e.g. Dai).

What is Dai, and how does it work?

In such systems, when the price of a stablecoin goes below the price peg, borrowers have an incentive to repay loans, and vice-versa, when the price is too high, borrowers may like to borrow more.

The problem with this approach is that relatively small price variations (say, 2–3%) can be not enough to incentivize borrowers to act. This means such a mechanism, effective in the long run, may fail to ensure a tight peg in the short run, which is still quite bad for a coin that is used as a US dollar substitute for pricing and trading purposes.

2.3. Collateral redemption / Risk-free arbitrage

Risk-free arbitrage is the mechanism that guarantees the tightest peg of a stablecoin.

This mechanism is possible when collateral is liquid, easily, and quickly redeemable, which means that everybody may exchange a coin for underlying collateral or backward even when only a small price distortion exists.

The downside is though that even small variations around price peg (1% or even less) may force arbitrageurs to act, making price peg very tight.

Stablecoins implementing such stabilization mechanisms can be considered ideal candidates as units of account.

3-Stablecoins as a mean of payment

To analyze stablecoins from a mean of payment perspective, we should consider two main factors: transfer speed/costs and control/privacy issues.

3.1. Transfer speed and costs

High transfer speed is important for real-time payment applications and may strongly limit a coin’s proliferation. Most popular stablecoin — Tether mostly uses Bitcoin (Omni) blockchain and, probably, is the slowest and the most expensive to transfer stablecoin.

At the same time, it is still much more attractive than traditional banking transfers. Other stablecoin projects use either Ethereum blockchain (Dai, True USD) or develop their own blockchains, which claim to be even faster and cheaper.

Need to mention that new generation blockchains can potentially enable almost instant transfers with little or ‘close to zero’ fees for the users, and they could be a quite attractive proposition for stablecoin users.

3.2 Control/Privacy issues

Cryptocurrencies have been invented with a spirit of freedom, meaning that only private key holders may decide how and where to use their money.

Meanwhile, many stablecoin projects set some constraints on users (strict KYC procedures) and operations or have a potential to do so in the future.

This especially relates to all projects which use fiat as collateral. Given that governments have full access to such collateral and regulations, in general, become more strict, we may assume that most stablecoins which are fiat-based will be regulated as tough as regular banking accounts in the future.

Officials: Stablecoin issuers should be regulated like banks, call on Congress to take action

This means that holders of such coins may face problems similar to what they experience now in banks: tough and long KYC, potential limits on transfers, requirements to explain some operations, and all other things which inspired the creation of cryptocurrencies.

We also know that all regulatory burden is always transferred to the client, which means that fiat-based coins can be more difficult and expensive to use in general.

Stablecoins that don’t have fiat collateral (especially in USD) have a smaller risk of being regulated or restricted, which should be attractive to their holders.

End of Part 1

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

The quest of STABLECOINS — seeking stability in the volatility of the crypto market was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.