Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Intel Plunges After Sales Miss, Profit Forecast Disappoints

In its preview of Intel’s Q3 earnings, Bloomberg writes that against a background of a 10-year high in personal computer shipments and surging demand for chips in general, Intel’s growth has dried up in 2021, causing concern it’s giving up market share. Rival Advanced Micro Devices Inc. grew 45% in 2020 and is on course to post a revenue expansion of more than 60% this year, according to estimates. Nvidia which has overtaken Intel to become the largest U.S. chipmaker by market capitalization, will expand more than 50% for its second consecutive year.

Commenting ahead of earnings, Matt Bryson of Wedbush Securities said “Our concerns regarding Intel remain the same in the intermediate term. Specifically, we believe Intel will continue to bleed share to AMD as well as former customers (e.g., Apple, Amazon, etc.) until it resolves its manufacturing disadvantage. And while it’s struggling competitively, increased capex will weigh on gross margins. Net, while Intel is doing the right thing in reinvesting in the company, we don’t see the combination of higher expenses and market share headwinds as creating a positive outcome for shareholders for some time to come.”

Amid the gloomy sentiment, Intel shares have trailed the Philadelphia Stock Exchange Semiconductor Index this year, with a 12% advance versus the index’s 22% climb.

So can/will Intel finally prove the skeptics wrong?

Unfortunately, the answer is a resounding no because moments ago the giant chipmaker not only missed revenue expectations but it also provided a lackluster forecast for the current period, fueling concerns that the cost of new CEO Pat Gelsinger’s turnaround will weigh on the company’s profits.

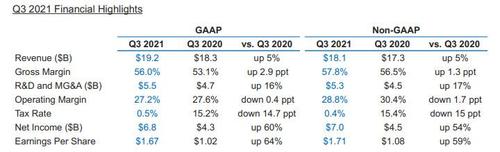

This is what Intel reported moments ago for the just concluded third quarter:

- Adj Rev $18.1B, missing est. $18.24B

- Rev. $19.2B, +4.9% Y/Y

- Adj EPS $1.71, beating est. $1.11

- Adjusted gross margin 57.8% vs. 54.8% y/y, beating estimate 55.0%

The EPS beat was in no small part driven by a plunge in the effective tax rate which collapsed to just 0.5% from 15.2% Y/Y.

Breaking down the revenue components reveals a mixed picture, with Client Computing Beating but Data Center Group revenue missing estimates::

- Client Computing Group Revenue $9.7 billion, -2% just barely but beating estimates of $9.64 billion

- Data Center Group Revenue $6.50 billion, +10% y/y, missing estimate $6.65 billion

- Internet of Things revenue $1.37 billion, +50% y/y, beating estimate $979.5 million

- Mobileye revenue $326 million, +39% y/y, missing estimate $362.5 million

- Non-Volatility Memory Solutions revenue $1.11 billion, -4.2% y/y, beating estimate $1.02 billion

- Programmable Solutions revenue $478 million, +16% y/y, missing estimate $493.4 million

Despite the mixed picture, Intel said Q3 revenue was driven by return to normalcy in the IOT and data center groups. Intel also said its Q3 numbers for IOT, Data Center, and MobileEye groups are all-time records.

Commenting on the results, CEO Pat Gelsinger said “we are still in the early stages of our journey, but I see the enormous opportunity ahead, and I couldn’t be prouder of the progress we are making towards that opportunity.”

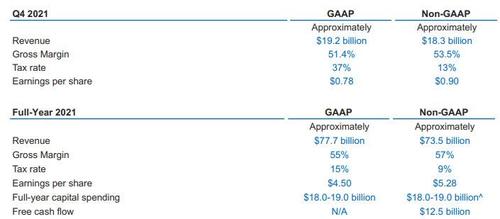

Looking ahead, Intel boosted its full year adjusted EPS forecast and is now expecting GAAP EPS of $4.50, non-GAAP EPS of $5.28, GAAP gross margin of 55% and non-GAAP gross margin of 57%, even if Q4 EPS came in below consensus estimates; The company also guided to slightly higher revenue than consensus.

- Intel Sees 4Q Adj EPS 90c, Est. $1.02

- Intel Sees 4Q Adj Rev About $18.3B, Est. $18.26B

- Intel Sees FY Adj EPS $5.28, Saw About $4.80

- Intel Sees FY Rev. $77.7B, Saw $77.6B

Intel also hiked its gross margin guidance, and now expected 53.5% non-GAAP gross margin for Q4 and 57% for the full year 2021.

Visually:

Not helping matters, Intel CFO George Davis announced plans to retire in May 2022. Davis is a holdover from Gelsinger’s predecessor and one of the relatively few top executives that the CEO hasn’t replaced.

Commenting on the results, Bloomberg’s Ian King writes that “the key takeaway is the cost of Gelsinger’s attempts to make Intel more competitive is hurting profitability. Investors like what he’s said and the actions he’s promising, but the interim hit to the financial performance of the company is the problem.”

King also writes that “investors are focused on whether Gelsinger can improve Intel’s products quickly enough to halt market-share losses to rivals and defections by customers who are beginning to design their own components. Intel’s predictions add to concern that his efforts to make the chipmaker’s products and manufacturing more competitive will suppress its profitability.”

Sure enough, the stock is tumbling after hours, and was down more than 6% at last check. This is the fourth time in a row that the stock has dropped more than 5% following an earnings announcement. Maybe it’s time for another new CEO?

Adding insult to injury, key competitor Advanced Micro Devices is now rising in extended trading, up about 1%, potentially on Intel’s boosted full-year profit view.

The company’s earnings presentation is below:

Tyler Durden

Thu, 10/21/2021 – 16:22

Continue reading at ZeroHedge.com, Click Here.