Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Working-Poor Still Use Food Banks As Millions Had Their Savings Wiped Out During COVID

Eighteen months since the virus pandemic began, hunger and food insecurity continue to plague millions of households across the country. Some of these folks have had their life savings drained with no financial safety net for the next crisis.

Compound food insecurity and deterioration of financial conditions of households, and it appears the working-poor have barely recovered from the pandemic downturn. What’s likely to happen is the Biden administration will continue handing out free money to these folks to prevent social upheaval. An example of this was when Biden increased SNAP allowances by a quarter a few months ago.

First, let’s talk about food banks and their current state. Katie Fitzgerald, COO of Feeding America, a nonprofit organization that oversees a nationwide network of 200 food banks feeding more than 46 million people, told AP News that despite the decreasing numbers of households reliant on food banks. Today’s numbers remain 55% above pre-pandemic levels “We’re worried (food insecurity) could increase all over again if too many shoes drop,” she said.

The next is a new NPR poll that finds almost 20% of U.S. households had their savings wiped out during the pandemic. The share of respondents who made $50k or less was about 30%.

Avenel Joseph, a vice president at the Robert Wood Johnson Foundation, said many used their savings to cover basic expenses and survive as tens of millions were laid off during the pandemic. “When crisis hits, or anything goes out of the norm—your child is sick, for example—you are sacrificing wages,” she said. About 66% of households earning $50k or less had difficulty pay rent, feeding their family, and covering medical bills.

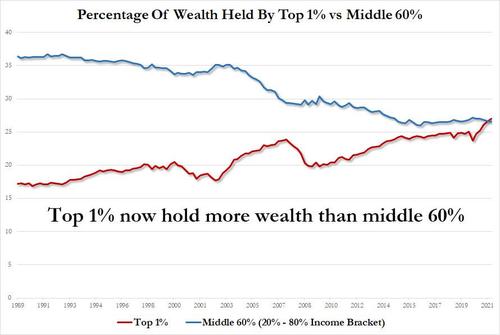

Countless times we have described the disparity between the people who hold assets and those who don’t. The gap in wealth inequality surged even wider, already at emergency levels before the pandemic, after the Federal Reserve pumped trillions of dollars in liquidity into financial markets to boost asset prices higher, such as stocks, bonds, homes, art, classic cars, wine, and crypto. Those who owned nothing were the worst off.

The age-old question for the Biden administration: How will they elevate those stuck in poverty? Keep handing out free money and disincentivizing people not to work?

Tyler Durden

Sat, 10/16/2021 – 15:00

Continue reading at ZeroHedge.com, Click Here.