Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Levels to Watch to Ride the Bitcoin and Litecoin Bull Market

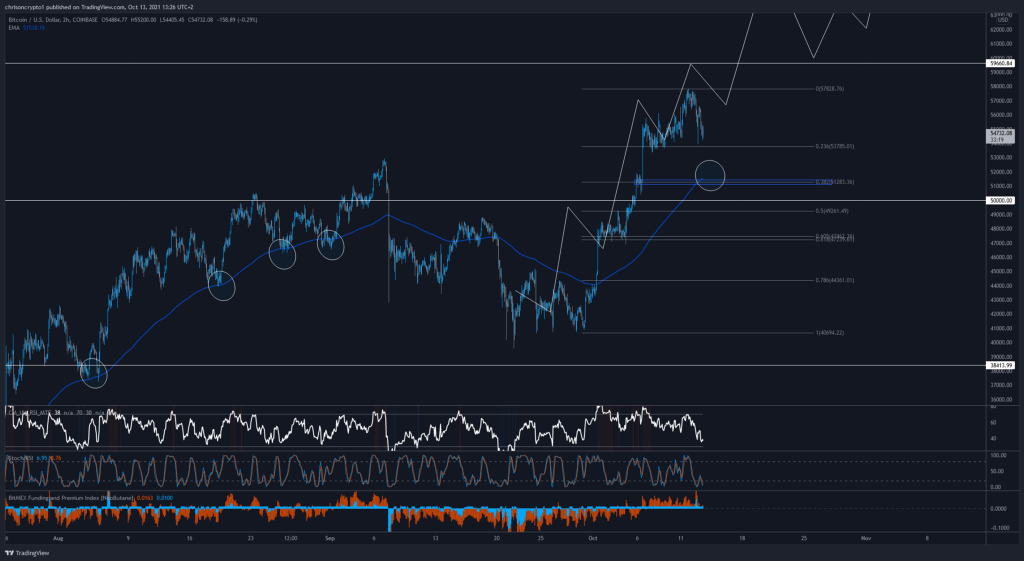

Bitcoin reached $57,800 before pulling back to 0.236 fib level, where it currently trades. If prices continue south, where should investors look for the perfect entry to ride the bull market?

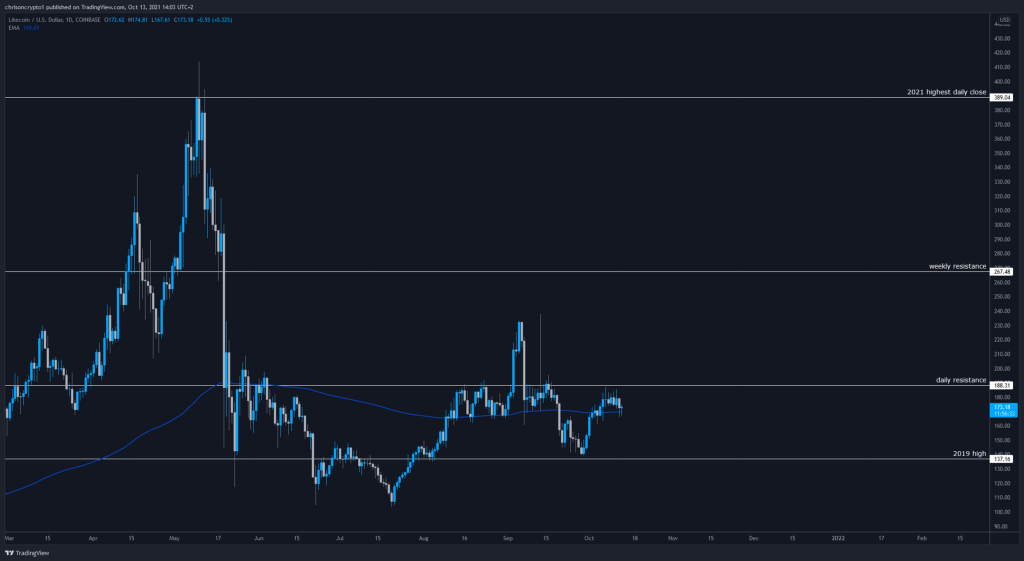

Meanwhile, Litecoin is gearing up for a mammoth Q4 as address activity overtakes that of Ethereum for the third time this year.

Let’s dig in.

Charlie Lee Talks Litecoin As the Crypto Reaches its 10-year Milestone

Creator of Litecoin Charlie Lee, aka Stoshilite on Twitter, exalted the crypto’s launch and ongoing development as the ‘digital silver‘ cryptocurrency turns ten.

Lee specified the exact time of the birth of the asset, which ultimately came to be one of the most successful cryptocurrencies to date.

Check out the full article here!

Bitcoin pulled back after reaching $57,800, potentially entering into a low time-frame ABC correction. The modest retreat saw the coin retrace by 6.8% from the local high to the 0.0236 Fibonacci level.

Technically, BTC/USD has not set a lower local low, which leaves the door open for bulls to reclaim the lost ground and continue the trend posthaste.

Still, Bitcoin could consolidate further before resuming the trend, which would have the benefit of providing structure to price-action, which has been relatively vertical since the start of October.

In the immediate short term, $55,900 is overhead resistance. Unless it’s reclaimed, then bulls will look to defend the .382 Fib level at $51,200. Further confluence is provided by the 200-EMA (2hr), which has provided ample support since the bottom in July.

As noted previously, provided $49,000 is not lost on a daily closing basis, then the high time frame picture remains bullish. Basically, dips are there to be bought until proven otherwise.

On the flipside, once $55,900 is captured, then BTC/USD would have cleared the last of the overhead resistance — bearing in mind that prices have already reached $57,000 in the current uptrend. The more often resistance levels are tested, the less likely they are to hold, especially when BTC is just 18% away from setting new highs at the time of publishing.

Traders and investors need to ask themselves one thing as bitcoin chops around: is it worth risking having less BTC to potentially buy a couple of percentage points lower?

The Litecoin Trade

Litecoin often gets a bad rap due to the prevalence of arbitrary and unintelligible word salads levied against it. But the fact of the matter is that the crypto has withstood the test of time. Unlike virtually all cryptocurrencies besides bitcoin, Litecoin’s ten-year history is firmly in its favour. There was no pre-mine, the launch was verifiably fair, and developers are working on new updates, MimbleWimble being the most anticipated one this year. In other words, the fundamentals are rock solid, and there’s no reason to discuss its survivability since that question has been answered time and again.

From a technical perspective, there is two noteworthy medium to long-term resistance levels: $188, and $267; both of which were pivotal in either direction, historically speaking. Taking out $188 would set the premise for all-time highs by the end of the year. As things stand, bulls must work harder to overcome the unfounded FUD that causes novice investors to panic sell an asset that quite literally has everything going for it (liquidity, fair distribution, decentralisation, ongoing development, massive upside potential relative to market cap, etc.)

On the flip side, losing the 2019 all-time high ($137) would probably mean revisiting the 2-digit mark. But unless Bitcoin enters a bear market (which is not likely unless global warfare breaks out), then Litecoin won’t see $137 ever again.

Notably, the LTC blockchain just flipped Ethereum in terms of address activity for the third time this year, according to data from analytics firm Santiment. Back in September, I pointed out how Litecoin address creation is going parabolic — this trend has not changed either.

From an investment perspective, Litecoin is probably the most underrated, wrongfully derided, and undervalued project in the market for what it is.

Catch you later.

p.s. This is my opinion. You can have your own opinion.

Join the Telegram channel for live updates & setups!

Follow me on Twitter & Gab and my social portals below.

Read More: Bitcoin Settlement Volume Reached Record Daily High

You can also support me in Bitcoin!

BTC address: 3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Best regards,

Christopher Attard

Founder of Chris on Crypto

Contributor to www.cityam.com

Connect directly on: Telegram

Originally published at https://mailchi.mp.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Levels to Watch to Ride the Bitcoin and Litecoin Bull Market was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.