Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Morgan Stanley: Countries Will Transition Toward Acceptance Of COVID As An Endemic Problem They Must Live With

By Chetan Ahya, Chief Economist and Global Head of Economics at Morgan Stanley

Getting Back to Growth Outperformance

The tone in my recent meetings with investors in Asia has been all too familiar. Our constructive views – both cyclically and structurally – are greeted with cautiousness. Earlier in the summer, investors were sceptical about the region’s vaccination efforts. Now, continuing or even tighter restrictions in parts of the region have left them concerned that these measures may not be fully relaxed even as vaccinations reach high levels.

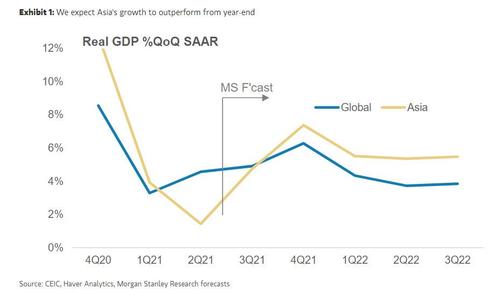

I do understand why investors are cautious – Asia’s growth outperformance in the initial stages of the pandemic has given way to underperformance. Asia was the earliest region to stage a V-shaped recovery. Led by China, GDP climbed back quickly to pre-Covid levels by 3Q20, driven by a sharp rebound in exports and private investment. Aggressive lockdowns kept outbreaks under control, and factories reopened just ahead of the global surge in demand. Asia’s export growth engine powered ahead, with real exports recovering faster than in previous cycles, reaching 5% above their pre-Covid path. As ever, the exports recovery had strong spillover effects into Asia’s capex cycle, and Asia’s investment has already moved to 2% above its pre-Covid trajectory.

However, growth momentum in Asia has slowed in the last two quarters. The emergence of variants, a delay in the start of Asia’s vaccination drive and continued stringent measures to contain Covid outbreaks in several large economies have led to tighter restrictions on mobility from time to time. Consumption has been constrained and is the only component of GDP which remains below its pre-pandemic path.

Recognizing the challenge, policy-makers have accelerated vaccination efforts. Over the last three months, vaccination rates have jumped from 21% to 63% of Asia’s adult population. At the current pace and with vaccine supply continuing to stream in, we expect that 10 out of 12 economies will have achieved 80%+ vaccination rates for the adult population by end-2021. Policy-makers in Asia have set a high bar for vaccination rates before reopening, and we believe that they will meet it.

At that point, we expect a number of countries to modify their Covid management strategies and begin transitioning towards the acceptance of Covid as an endemic problem that they must live with. Authorities in Singapore, Korea and Australia have laid out such roadmaps. The pressure to move away from strict containment measures stems from the fact that they have constrained activity in labor-intensive sectors, weighing on employment.

We therefore expect a broad-based recovery to take hold starting early next year, as policy-makers – comfortable with progress on vaccinations by 4Q21 – start moving towards a full reopening that reaccelerates consumption growth. Meanwhile, the strength we have seen in exports should continue, which bodes well for the region’s capex cycle. Although consumption in the US will shift towards services, the strongest US capex cycle since the 1940s should help to support Asia’s exports. Moreover, the pick-up in euro area domestic demand with reopening should provide an added boost to Asia’s exports. With growth firing on all cylinders, GDP should exceed its pre-Covid path meaningfully towards year-end, and Asia would once again be a growth outperformer.

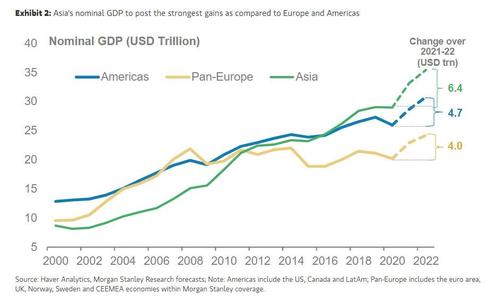

We also see good reasons to be bullish on Asia over the medium term. When exports growth languished between 2010 and 2016, policy-makers had to rely on leverage to drive growth, giving rise to macro-stability concerns. This time, we believe that Asia’s growth engine will be propelled by the right kind of fuel. The virtuous feedback loop of strong external demand and positive spillover effects to capex can engender a self-sustaining cycle. In some ways, Asia’s growth story in this cycle will resemble 2003-07, with productivity playing a larger role while leverage takes a back seat.

In truth, this dynamic was already emerging towards the end of 2016, as Asia had effectively adjusted after the misallocation following the global financial crisis. Strong growth during 2017 and into 1H18 was interrupted by the onset of trade tensions from 2H18, followed by the pandemic. We think that once the Covid cloud lifts, the structural story where productivity takes the lead will be evident.

Tyler Durden

Sun, 09/12/2021 – 15:30

Continue reading at ZeroHedge.com, Click Here.